If you have been scrolling through social media or checking your inbox lately, you have probably seen talk about the IRS $1800 Stimulus Check. With the cost of living rising, energy bills going up, and groceries more expensive than ever, many Americans are holding out hope for some end-of-year relief. Headlines and viral posts are teasing a December 2025 payout, sparking a lot of buzz and curiosity.

But here is the truth: the IRS $1800 Stimulus Check is not exactly what it seems. It is not a brand-new government handout. Instead, it is a mix of unclaimed past credits, especially from the 2021 Recovery Rebate Credit, and new state rebate programs that, when combined, can add up to around $1,800 for some people. In this article, we will break down what is real, what is rumor, who qualifies, and how to get your share before it is too late.

IRS $1800 Stimulus Check: Everything You Need to Know

Let us set the record straight. There is no new federal stimulus check officially approved for December 2025. The so-called IRS $1800 Stimulus Check is actually a combination of unclaimed federal Recovery Rebate Credits from 2021 and active state-level rebates. The federal government is not sending out $1,800 to everyone, but if you missed out on earlier payments or qualify for certain state relief programs, you could still be eligible for that amount or more.

What makes this topic even more confusing is how it is spreading online. Posts are claiming that payments are automatic, especially for seniors and low-income families. But in reality, eligibility is based on specific tax filings, income thresholds, and in many cases, whether you have taken action to file your taxes. So, let us go deeper into what you can actually expect and how to avoid being misled.

Overview Table: IRS $1800 Stimulus Check Details at a Glance

| Key Point | Details |

| Federal Check Status | No new federal stimulus approved |

| Origin of $1800 Amount | Combo of 2021 Recovery Rebate Credit and recent state rebates |

| Max Federal RRC Amount | $1,400 per person from 2021 stimulus |

| Final Deadline to Claim RRC | April 15, 2026 |

| State Programs Adding to Total | Alaska, Colorado, Georgia, California, New Mexico |

| State Payment Ranges | $250 to $1,702 depending on location and income |

| Who Can Still Qualify | Non-filers, low-income earners, those who missed 2021 credits |

| Ineligibility Factors | Already claimed full RRC, high income, non-residents, incarcerated people |

| Scam Warnings | No IRS quizzes or paid sign-ups, scams are rising |

| How to Claim | File 2021 taxes, use IRS refund tracker, check state sites |

Understanding the IRS $1800 Stimulus Check Rumor in 2025

The buzz around the IRS $1800 Stimulus Check exploded from viral social media posts claiming automatic payments were coming under a fake “American Family Relief Act.” These posts suggest that people receiving SSI, SSDI, or VA benefits would see checks hit their accounts in June 2025. But the truth is, no such law exists, and the IRS has not announced any such program.

The $1,800 number mostly comes from two main sources. First is the federal Recovery Rebate Credit for 2021. Many Americans never claimed this benefit, especially non-filers or those with low incomes. In late 2024 and early 2025, the IRS issued auto-payments to over a million of those eligible. Second, several states launched their own rebate programs, giving residents extra money during the holiday season. Combined, these payments can add up to roughly $1,800, but only if you qualify.

Shocking Eligibility Rules: Who’s Actually Getting Paid in 2025?

Eligibility for the IRS $1800 Stimulus Check is not as simple as it looks. It really depends on both federal and state programs. If you missed the 2021 Recovery Rebate Credit, you still have time to file for it by using your 2025 tax return. This credit gives $1,400 per person if you meet the income and residency requirements.

Income is key. Full credits are available for those making up to $75,000 as individuals or $150,000 for married couples. Partial credits apply for those earning slightly more. Families with dependents could see up to $5,600 if they have not already received the funds. States like Alaska, Colorado, and California are offering additional payments ranging from $250 to $1,702, but each has its own rules. Non-residents, prisoners, and anyone who already received their full RRC do not qualify again.

State Rebate Programs Offering Real Payments

State rebates are a major reason why people think the IRS $1800 Stimulus Check is real. In truth, these programs are separate from the IRS, but they do offer meaningful financial help. For example, Alaska issued a $1,702 Permanent Fund Dividend to all qualifying residents in October 2025. Colorado offered a TABOR refund of $800 to individuals earning under $50,000, with payments arriving in December.

Georgia has announced payments of $250 to $350 depending on income and filing status, which are set to go out by December 20, 2025. California completed most of its Middle Class Tax Refunds by November 30, paying between $200 and $1,050. New Mexico offered $500 rebates earlier in November. These state-level checks, when combined with unclaimed RRCs, can add up to the much-discussed $1,800 figure.

Current Status: Auto-Payments Wrapped, Claims Open Till 2026

There are no new automatic IRS $1800 Stimulus Check payments scheduled. The federal payments made in December 2024 and January 2025 were the last round of auto-issued RRCs. If you did not receive yours, you can still claim it through your 2025 tax return, but you need to act before April 15, 2026.

On the state side, most of the year-end rebates are being processed throughout November and December 2025. You should check your state’s official tax or revenue department site to track the status. Do not rely on email or social media messages, and do not pay anyone who claims they can get your check faster. The real information is free and available from government sources.

Economic Impacts: Relief Without the Hype

Even though the IRS $1800 Stimulus Check is not officially real, the combined impact of RRCs and state rebates can still be powerful. These payments have helped pump billions into the economy. In fact, in 2021 alone, stimulus checks lifted more than one million Americans above the poverty line. Similar effects could be seen this year if more people file for their unclaimed credits.

Experts argue that giving money directly to low-income households helps with both personal needs and economic growth. Unlike ongoing benefits, the Recovery Rebate Credit is not taxed and does not reduce your eligibility for programs like SNAP or SSI. That makes it especially helpful for gig workers, the unemployed, and retirees living on fixed incomes.

How to Prepare for Any Real $1800 Stimulus or Rebate in 2025

To stay ahead, you need to take a few key steps. First, use the IRS refund tool to check whether you received your 2021 Recovery Rebate Credit. If you have not filed for it yet, use Free File services to submit your 2021 tax return and claim your credit. This can bring in up to $1,400 per person and will be processed within 21 days if e-filed.

Next, visit your state’s tax department website. States like Colorado, California, and Georgia have clear instructions and timelines for payments. Update your bank information and ensure your mailing address is correct. Lastly, be smart. Scammers are targeting people looking for stimulus money. The IRS does not ask for payment or personal info through email or text. Report anything suspicious directly to the FTC.

FAQs

Is the IRS sending a new $1800 stimulus check in December 2025?

No, the IRS has not announced any new stimulus for December 2025. The $1,800 figure comes from old credits and state rebates.

How do I know if I qualify for the 2021 Recovery Rebate Credit?

If you did not receive the full third stimulus check in 2021, you may qualify. You must file a 2021 tax return to claim it.

When is the deadline to file for the 2021 RRC?

The deadline to claim your Recovery Rebate Credit is April 15, 2026.

What states are still giving rebate checks in December 2025?

Georgia, Colorado, and possibly others are still issuing payments. Check your state’s revenue website for updates.

Are these payments taxable?

The federal Recovery Rebate Credit is not taxable. State rebates may vary depending on your local tax laws.

The post IRS $1800 Stimulus Check 2025 In December 2025: Eligibility Secrets & Payment Timeline appeared first on unitedrow.org.

-

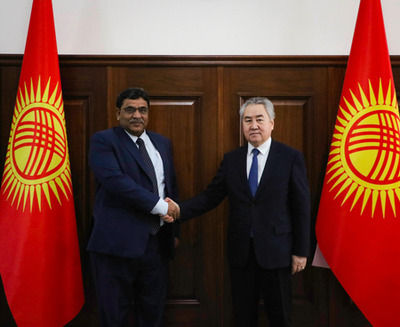

Bishkek: Indian envoy, Kyrgyzstan's Foreign Minister discuss bilateral ties

-

GB News grinds to sudden halt for breaking Andrew Mountbatten-Windsor alert

-

Historic Victory for Indian Blind Women's Cricket Team in T20 World Cup

-

Rani Kapur accuses daughter-in-law Priya Kapur of grabbing control of Sunjay Kapur's assets immediately after his death

-

Andrew Mountbatten-Windsor 'told Epstein victim: I know he's inappropriate'