Tokyo: Japan is in the spotlight again, but not for matcha lattes or cherry blossoms, this time, the headlines are about its record-high debt. Understanding the roots of this situation requires a closer look at the country’s economic history, starting with the collapse of the late 1980s asset bubble.

During the late 1980s, the country experienced an unprecedented rise in asset values fueled by easy credit, aggressive lending and speculative investments. Real estate prices and stock valuations surged, with the Nikkei 225 index tripling between 1985 and 1989.

Expectations of sustained growth and low interest rates drove institutional and individual investors. However, by mid-1992, the bubble had burst, erasing most gains and triggering a long period of economic stagnation.

Add Zee News as a Preferred Source

Skyrocketing asset prices in real estate and stocks collapsed almost overnight, leaving banks, corporations and households reeling. Even as inflation began to return in recent years, its legacy continues to influence household and corporate behaviour.

Faced with stagnation, both individuals and companies prioritized savings and debt repayment over consumption. Tax revenues declined. Instead of raising taxes, the government turned to borrowing to finance its operations.

With an aim to further stimulate spending and keep borrowing costs low, the Bank of Japan cut interest rates drastically, at times even pushing them into negative territory. Combined with an aging population and rising pension and healthcare costs, these measures created a cycle of stimulus triggering more debt, which in turn reinforced weak growth.

Low domestic interest rates encouraged investors to seek returns abroad. This led to the emergence of the yen carry trade, a strategy in which investors borrow yen at low cost to invest in higher-yielding markets. For years, this flow of Japanese capital kept global borrowing costs suppressed and provided easy liquidity to international markets. Today, with Japanese yields rising, the era of easy carry-trade profits is coming to an end.

Despite a gross debt-to-GDP ratio of roughly 250%, Japan’s net debt sits at about 140%, providing a more balanced perspective. Comparatively, the United States carries a gross debt of 120% and net debt near 96%.

Nearly 90% of Japanese government debt is held domestically, and long bond maturities of nine years or more limit immediate exposure to rising rates. Rating agencies continue to view Japan as a safe investment destination, maintaining A-level ratings.

Japanese investors hold substantial foreign assets, including US Treasuries, but these are long-term investments rather than speculative bets. As a result, sudden large-scale sell-offs are unlikely, and the transition away from ultra-low domestic yields is expected to be gradual.

Japan’s massive debt is the product of decades of policy decisions, structural challenges and demographic pressures. It has influenced global markets through the yen carry trade and long-term lending patterns, keeping borrowing costs low worldwide.

While the current rise in yields represents a change, the situation is manageable. The country’s approach to debt and investment continues to affect economies far beyond its borders.

-

Weather today: Cyclone Ditwah to bring more rainfall in Chennai, Andhra Pradesh? Here's what IMD said in its latest bulletin

-

Horoscope today, 1st December, 2025: Fresh Starts, New Projects & Healing Vibes

-

US sees progress after talks in Florida with Ukraine, but more work needed to reach deal

-

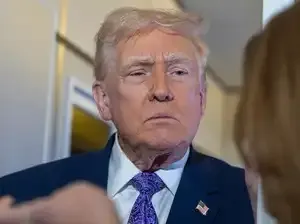

Trump says he’ll share MRI findings, unsure what was scanned— but confident it wasn't the brain

-

China's November factory activity swings back to decline, private PMI shows