Preity Zinta

The income of the country's famous actress Preity Zinta is not in crores of rupees. Rather his wealth is only Rs 46 lakh. We are not saying this. He himself has informed the Income Tax Department. Yes, on June 26, 2016, he filed his Income Tax Return (ITR) as a non-resident individual working in the film industry, in which his income was declared as Rs 46 lakh. But, after getting information about large deposits and withdrawals in his bank account from the internal system of the tax department, his case was reopened under section 147. He was served a notice by the tax department. He appealed against this in the Mumbai court, from where he has now got relief.

What is the matter?

On March 31, 2022, the Income Tax Officer issued a draft assessment order, proposing to modify his declared income to a total income of Rs 11 crore (11,30,48,040). In response to this draft order, they filed an objection before the Dispute Resolution Panel (DRP), which, in its order dated December 31, 2022, upheld the increase suggested by the tax officer. Following these instructions, the tax officer issued the final assessment order on January 23, 2023 based on the opinion of the DRP.

Appeal in ITAT Mumbai

Preity Zinta appealed against the income tax notice in Mumbai Court (ITAT). A bench of ITAT Mumbai set aside the earlier order and said that the tax officer and the DRP will have to resolve the issue related to the legality of initiating the reassessment process. The tax officer was asked to reiterate the findings given in the final order dated January 23, 2023 and decide on the main issues of the case.

The reality is that the Investigation Wing's investigation revealed that he had made transactions worth Rs 13.10 crore, which included deposits of Rs 13 crore and withdrawals of Rs 13 crore. After this transaction, only Rs 10,300 was left in his newly opened savings account in Corporation Bank. He opened this account on January 25, 2016. The Income Tax Department admitted that these large deposits and withdrawals did not match their income. The tax officer did not consider the source of the amount of Rs 13 crore to be clear, due to which action was taken under section 148. As a result, Rs 10 crore was added as incomprehension cash amount under section 68.

court decision

ITAT Mumbai said that all the three units of the merchant group responded to the notices issued by the AO and submitted complete information and documents, which were also accepted by the AO itself. Preity Zinta also presented evidence of all transactions, bank entries and fund movements. Despite the existence of a complete trail of transactions, the AO made an adverse finding merely terming the fund movement as suspicious. The Tribunal held that the AO did not deal with the available evidence and as per the detailed explanation and documents, there was no basis for making any addition to the income.

-

Patanjali Disputes Test Results On Cow Ghee, Says Appeal To Be Filed In Tribunal

-

Mrunal Thakur Reacts To Dating Rumours With Shreyas Iyer: 'They Talk, We...'

-

What Is FOFO? How Is It Putting Your Physical Health At Risk?

-

Shubman Gill Injury Update: India Captain Takes 4 Flights In 8 Days Despite Neck Injury, Could Miss IND Vs SA T20Is; Report

-

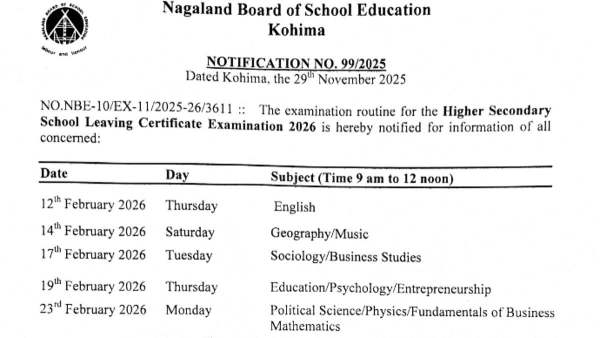

NBSE Releases 2026 HSLC, HSSLC Exam Dates; Nagaland Board Class 10 & 12 Papers Begin In February; Check Full Schedule Here