Due to increasing market volatility, constantly changing interest rate expectations, and global uncertainty, investors are once again turning to safe-haven investment instruments like gold and silver. People consider these metals to be strong options for stabilizing and protecting portfolios over the long term.

A recent Motilal Oswal report also indicates that gold will remain a positive asset for medium- and long-term portfolios in the future. Factors such as inflation hedges and geopolitical tensions are the main reasons behind this.

Before investing, it's crucial to understand the different natures of gold and silver. Gold is considered a more stable asset, while silver's price fluctuations are more rapid. Therefore, if you're planning to invest in these two metals, be sure to understand these five important points.

1. If you already own gold, hold on to it.

The Motilal Oswal report clearly states that those who already own gold should hold on to it. Gold doesn't offer sudden, large returns, but it provides stability to a portfolio over time. New investors are better off adding gold gradually rather than investing a lump sum all at once. Investing through SIPs, or staggered investments, reduces market timing risk and reduces the impact of price fluctuations.

2. Small SIPs build a substantial corpus over the long term

Experts believe that small SIPs in gold are very beneficial. If someone buys gold for a period of 5–7 years or more, they can build a substantial corpus. This corpus can help fund future major expenses like buying jewelry or children's weddings.

3. Silver has potential, but it's highly volatile

Silver may look as shiny as gold, but its behavior in the investment world is completely different. Motilal Oswal says that silver should only be considered by investors with a high risk appetite. Silver prices are influenced by global industrial demand, supply changes, economic sentiment, and other unpredictable factors. This makes it a much more volatile asset than gold.

If you're an investor who gets worried by sudden price fluctuations, silver isn't the right choice for you. However, if you have a good understanding and the ability to take long-term risks, you can invest in it gradually.

4. Limiting Silver Exposure is Important

Drawdowns in silver can be very large. This means its price can fall suddenly and sharply. Therefore, even investors who are willing to take risks should limit their exposure. Gold and silver combined should not constitute a large portion of their portfolio.

5. Keep only 10% of your portfolio in gold and silver.

The role of gold and silver is to diversify the portfolio and protect against inflation. They are not core components of the portfolio. Therefore, it is not wise to have more than a 10% allocation to both gold and silver combined. This maintains portfolio balance and preserves the benefits of metals without increasing instability in returns.

Today's Gold Prices

The price of 22-carat gold in India today is ₹11,676 per gram. The price of 24-carat gold is ₹12,738 per gram. Gold prices fluctuate daily based on global cues, demand-supply, and rupee-dollar movements. Therefore, it is important to monitor daily prices before investing.

Disclaimer: This content has been sourced and edited from Zee Business. While we have made modifications for clarity and presentation, the original content belongs to its respective authors and website. We do not claim ownership of the content.

-

Silver futures hit record high on weak dollar, Fed rate cut hopes

-

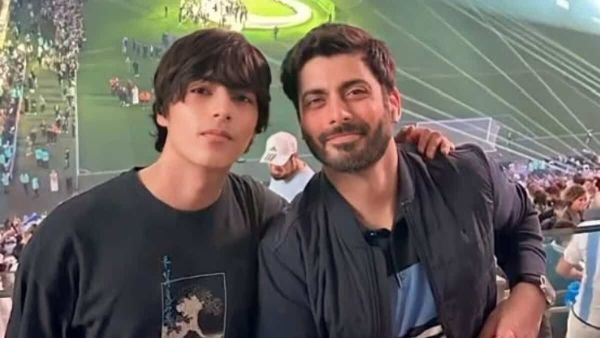

Video of Fawad Khan’s son goes viral, fans compare him to Aryan Khan

-

‘Beef’ in buffet triggers row at UP wedding; samples sent for forensic test

-

Woman ‘marries’ partner’s corpse after family kills him over caste

-

Man murders estranged wife, posts selfie as WhatsApp status