Many people are surprised when a new credit card from a bank suddenly arrives at their doorstep, even though they never applied for it. The RBI has called such cards "Unsolicited Credit Cards." According to the RBI, issuing cards without the customer's consent is now completely prohibited.

If a credit card has been issued in your name without your knowledge or permission, there's no need to panic. RBI regulations provide complete protection. The bank must immediately block your card, and you won't have to pay any charges. You can also file a complaint directly with the RBI Ombudsman.

What is an Unsolicited Credit Card, and why does the RBI block it?

An Unsolicited Credit Card is a card that was issued in the customer's name without their request. The RBI states that this is an unfair practice and increases the risk of fraud, incorrect billing, and data misuse. Therefore, the bank needs to obtain explicit permission from the customer before issuing a card.

What should you do first if a card arrives without permission?

The RBI has made it clear that customers should not activate the card or provide any authorization via OTP or any other means. You should do these three things immediately:

Do not activate the card

Do not click on any OTP or link

Inform the bank in writing that you did not request the card

RBI's strict rule: Banks must close the card within 7 days

If the customer has not approved the card, the bank must close the card within 7 working days. What should the bank do:

Close the card account within 7 days

Inform the customer via text/email that the card has been closed

Do not charge the customer any fees

Advise the customer to destroy the card

If the bank does not close the card within 7 days, you will have to pay a penalty of ₹500 per day.

No charges will be levied on the customer.

The RBI has clearly stated that sending the card without a request is the bank's fault, not the customer's. Therefore, annual fees, card charges, taxes, fuel charges, and processing fees cannot be charged to the customer.

What to do after the card is closed?

When the bank confirms that the card account has been closed, the customer should destroy it. The safest method is to cut the card diagonally along with the chip, cut the magnetic strip into separate pieces, and then discard it.

What to do if the bank doesn't hear your complaint?

This is the most important part for customers. Under the RBI's Integrated Ombudsman Scheme, a customer can file a complaint in the following three situations:

The bank does not respond for 30 days.

The bank partially or completely rejects the complaint.

The customer is not satisfied with the bank's resolution.

How to file a complaint with the RBI Ombudsman?

1. Online Complaint

The easiest way is to file a complaint online by visiting https://cms.rbi.org.in.

2. Written Complaint

Send your complaint to: Centralized Receipt and Processing Centre, 4th Floor, Reserve Bank of India, Sector-17, Central Vista, Chandigarh- 160017

3. What documents will be required?

Your complaint was sent to the bank.

Bank's response (if received)

Photo of the unwanted card

Proof of your identity and address

Why are RBI rules important for customers?

Credit card fraud has increased in the last few years. Banks often send cards under the guise of marketing. This:

Harms credit scores

Unwanted charges are levied

Customer data is compromised

The RBI has tightened these rules to prevent these problems.

If a credit card has been issued in your name without permission, there's no need to panic. Under the new RBI rules, the bank must close the card within 7 days, and no charges can be levied on the customer. If necessary, you can take the matter directly to the RBI Ombudsman. This rule is a major step in protecting consumers from the misuse of financial products.

Disclaimer: This content has been sourced and edited from Zee Business. While we have made modifications for clarity and presentation, the original content belongs to its respective authors and website. We do not claim ownership of the content.

-

Silver futures hit record high on weak dollar, Fed rate cut hopes

-

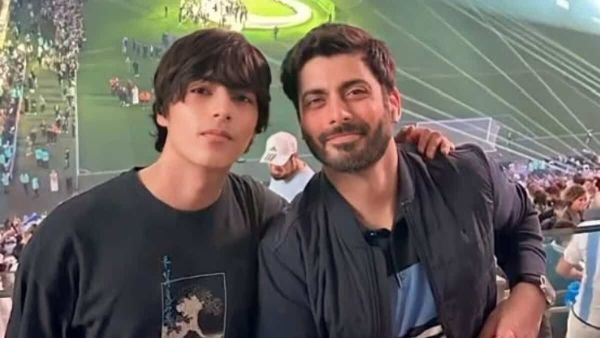

Video of Fawad Khan’s son goes viral, fans compare him to Aryan Khan

-

‘Beef’ in buffet triggers row at UP wedding; samples sent for forensic test

-

Woman ‘marries’ partner’s corpse after family kills him over caste

-

Man murders estranged wife, posts selfie as WhatsApp status