If you've never invested in the stock market before and now want to, but are worried about incurring losses due to market fluctuations, put that fear aside. There's a fund in the stock market that can keep you largely stress-free even amid risk. We're talking about an index fund because in this fund, your money is divided among stocks that represent the entire market (or a broad index). This means you don't rely on individual companies, but instead participate in the overall market performance. Learn more about it here.

What is an index fund?

An index fund is a mutual fund that follows a specific index (such as the Nifty 50 or Sensex). This means that if the Nifty 50 contains 50 companies, the index fund will invest in those companies in the same proportion. The fund manager doesn't select stocks, but simply copies the index. That's why it's called a passive fund.

Why is investing in an index fund beneficial?

1. Lower Risk

Index funds invest in the country's top companies, so the risk is lower.

2. Lower Expense Ratio

Index funds have significantly lower management costs than active mutual funds, resulting in higher returns.

3. Better Long-Term Returns

The Nifty 50 has delivered an average CAGR of 11%–14% over the past 20 years.

Index Fund Return Calculation

If you invest ₹5,000 every month in an Index Fund and assume an average CAGR of 12%:

Term Investment Amount Estimated Value

5 years ₹3,00,000 ₹4,05,518

10 years ₹6,00,000 ₹11,20,179

15 years ₹9,00,000 ₹23,79,657

20 years ₹12,00,000 ₹45,99,287

Types of Index Funds

Who will suit this type?

Nifty 50 Index Fund: New investors

Sensex Index Fund: Low-risk investors

Nifty Next 50: Those seeking high growth

Nifty 500 Index Fund: Those seeking diversified exposure

Keep in mind that with Index Funds, it's not the timing that matters, but the time-in, i.e., the investment. It's important to hold for a long time.

Best for whom?

Those who are intimidated by the market

Those who want to invest without complicated strategies

Those who want to build long-term wealth

Salaried individuals who want to invest in SIPs

Disclaimer: This content has been sourced and edited from Zee Business. While we have made modifications for clarity and presentation, the original content belongs to its respective authors and website. We do not claim ownership of the content.

-

Silver futures hit record high on weak dollar, Fed rate cut hopes

-

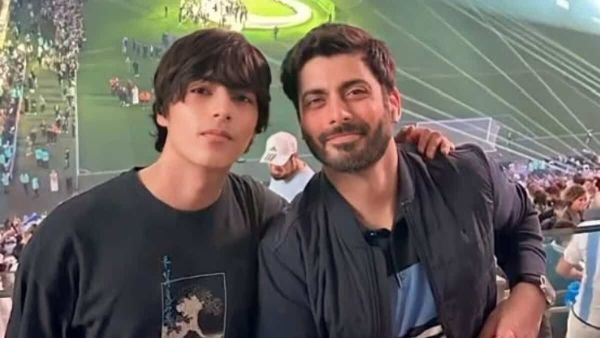

Video of Fawad Khan’s son goes viral, fans compare him to Aryan Khan

-

‘Beef’ in buffet triggers row at UP wedding; samples sent for forensic test

-

Woman ‘marries’ partner’s corpse after family kills him over caste

-

Man murders estranged wife, posts selfie as WhatsApp status