- Every income tax notice has a different meaning

- Avoid overspending on credit cards

- The notice will come directly to your mail

Income Tax Notices: If you hid your income while filing ITR or did not provide proof of investment, overspend on credit cards or submitted financial transactions that do not match the existing records, you will definitely be issued a notice by the Income Tax. Many people get confused because they don’t know the purpose of income tax notice. It is mandatory for the customer to file ITR if his annual income is taxable; Otherwise, a notice is sent by the Income Tax Department.

But, one thing consumers should note is that Income Tax Department notices are meant to identify deficiencies in returns or seek clarifications. If the taxpayer has not provided proof of tax-saving investments or has made large bank transactions or overspent on credit cards, they receive a fixed notice. Sometimes you may get a notice if they find other financial transactions that don’t match the department’s records.

Difference between Section 139(9) and Section 133(6).

There will be some errors or omissions in your ITR when the Section 139(9) notice is sent. It will be treated as defective return and then Section 139(9) notice will be sent by Income Tax Department.

However, Section 133(6) notice is sent if your income exceeds the basic exemption limit or you have not filed ITR. Similarly, the Income Tax Department can issue a notice if the income is not properly reported in your ITR or if the expenses are more than your income.

Difference between Section 142(1) and Section 143(1).

Income Tax Section 142(1) notice is sent when the department requires additional information relating to the return to support the claim made by the taxpayer in the income tax return. Also, notice is sent even if the customer has not filed ITR.

Notice under section 143(1) is sent to see whether the computation returns with the income of the department. This is also called assessment.

Section 143(2) and Section 148

Income Tax Department sends Section 143(2) notice, after Section 143(2) and Section 143(1). This notice is sent to a taxpayer if he does not reply to section 143(1). Section 148 notice is sent when it is noticed that part of the income has been concealed. Income tax department sends a 156 notice if the amount of tax, interest or penalty is outstanding.

-

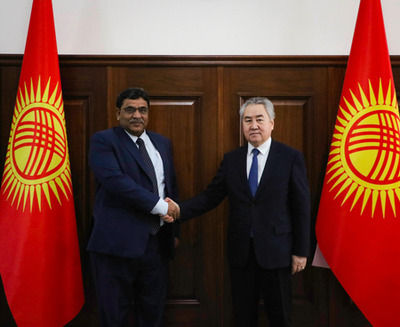

Bishkek: Indian envoy, Kyrgyzstan's Foreign Minister discuss bilateral ties

-

GB News grinds to sudden halt for breaking Andrew Mountbatten-Windsor alert

-

Historic Victory for Indian Blind Women's Cricket Team in T20 World Cup

-

Rani Kapur accuses daughter-in-law Priya Kapur of grabbing control of Sunjay Kapur's assets immediately after his death

-

Andrew Mountbatten-Windsor 'told Epstein victim: I know he's inappropriate'