US equities extended losses on Monday after the latest ISM Manufacturing PMI came in weaker than expected, signalling further contraction in factory activity and weighing on investor sentiment across Wall Street.

The closely watched ISM Manufacturing PMI fell to 48.2 in November, below forecasts of 48.6 and marking another month under the expansion threshold of 50. The employment sub-index also dipped sharply to 44.0 from 46.0indicating labour softness in the US manufacturing sector. The disappointing data triggered a broad market decline across major indices.

Major US Indices React

The three key US benchmarks slipped through the session:

-

Nasdaq: 23,258.58down 0.46%

-

S&P 500: 6,821.53down 0.40%

-

Dow 30: 47,521.57down 0.41%

The weaker-than-expected PMI reinforced concerns that industrial activity remains under pressure, limiting hopes of a stronger year-end economic rebound.

Broader Market Overview

Across the Americas, most indices were in the red, with only Brazil’s Bovespa showing marginal gains.

-

VIX: 17.32 (+5.93%) — volatility index spiked as risk sentiment cooled

-

IBOVESPA (Brazil): 159,116.81 (+0.03%)

-

S&P/TSX (Canada): 31,281.69 (-0.32%)

-

US Dollar Index: 99.14 (-0.32%)

-

Russell 2000: 2,485.40 (-0.60%)

The increase in the VIX highlights increased caution among investors, while small-cap stocks tracked by the Russell 2000 saw the steepest decline among major US indices.

With manufacturing employment and new orders showing weakness, traders will now look ahead to labour data later this week for further cues on the economic trajectory.

-

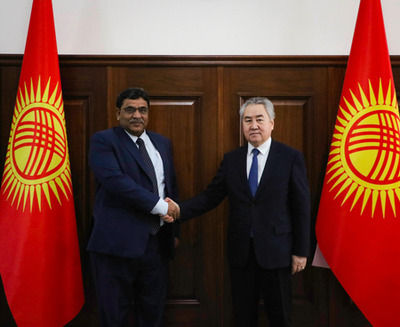

Bishkek: Indian envoy, Kyrgyzstan's Foreign Minister discuss bilateral ties

-

GB News grinds to sudden halt for breaking Andrew Mountbatten-Windsor alert

-

Historic Victory for Indian Blind Women's Cricket Team in T20 World Cup

-

Rani Kapur accuses daughter-in-law Priya Kapur of grabbing control of Sunjay Kapur's assets immediately after his death

-

Andrew Mountbatten-Windsor 'told Epstein victim: I know he's inappropriate'