Investors holding leveraged positions are at higher risk during a long squeeze, as leveraged trading amplifies both profits and losses.

- A long squeeze occurs when an asset’s price falls more than expected.

- When prices drop, buyers are often ‘squeezed’ out of their positions to limit any future losses.

- Equities, oil, and cryptocurrency markets have experienced prolonged squeezes.

Market squeezes occur when a security’s price changes sharply, forcing traders out of their positions. While retail traders are more familiar with short squeezes, it is not the only type of squeeze.

A short squeeze occurs when a heavily shorted security rises sharply, prompting short sellers to close their positions rapidly.

When Does A Long Squeeze Occur

A long squeeze occurs when an asset’s price falls more than expected. When prices drop, buyers are often ‘squeezed’ out of their positions to limit any future losses. According to IG analysts, the squeeze adds to the downward momentum as the balance between buyers and sellers shifts, potentially leading the bull market to reverse into a bear market.

Investors holding leveraged positions are at higher risk during a long squeeze, as leveraged trading amplifies both profits and losses.

When the float is small, the share price is influenced by a relatively small group of participants, making the stock more sensitive to shifts in supply and demand. In a tight market, even a mild spike in selling could affect prices much harder than usual.

Examples Of Long Squeeze

According to IG analysts, between April 9 and April 21, 2020, the WTI crude benchmark’s price dropped by about 46% suddenly, triggering a long squeeze. While the price rose slightly over the following days, on April 26, a 22% drop forced buyers to exit their positions to cover losses.

The squeeze came amid a rise in crude supply and concerns about elevated levels at oil storage facilities driven by the COVID-19 pandemic.

In October 2025, the cryptocurrency markets experienced the largest liquidation event in history after President Donald Trump threatened “massive” tariffs in response to Beijing’s rare-earth export curbs. Between October 10 and October 11, nearly $20 billion in leveraged trading positions were liquidated, affecting 1.6 million traders.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

-

December 2025 School Holidays: Check When Schools Will Close For Winter, Christmas Vacations Across States

-

Bigg Boss 19: Media personnel grills Tanya Mittal over her viral controversial remark, says, ‘Saree pehenne wali ladki…’

-

People continue to die in wars and conflicts, while arms manufacturing companies make huge profits; SIPRI’s shocking report

-

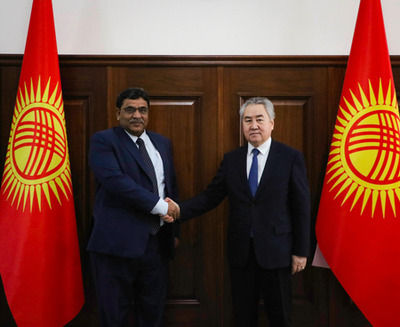

Bishkek: Indian envoy, Kyrgyzstan's Foreign Minister discuss bilateral ties

-

GB News grinds to sudden halt for breaking Andrew Mountbatten-Windsor alert