SBI has discontinued the mCASH facility, which was an outdated method for transferring money. Now, use secure and modern digital payment options like UPI, IMPS, NEFT, and RTGS.

India's largest bank, State Bank of India (SBI), announced on November 30, 2025, that it will completely discontinue the M-Cash service. From December 1, 2025, sending money through mCASH will no longer be possible on the OnlineSBI platform and the YONO Lite app. The bank has advised account holders to use secure digital payment methods like UPI, IMPS, NEFT, or RTGS to transfer money to any person or account.

What was the mCASH service and how did it work?

mCASH was a money transfer facility offered by SBI that allowed you to send money using just a mobile number or email ID and an mPIN code. The receiver received a link or code, which they claimed through an app or link. After claiming, the money was transferred directly to their bank account.

Why was the mCASH service discontinued?

SBI described mCASH as an outdated and less secure process. Secure digital payment methods like UPI, IMPS, NEFT, and RTGS are now widely used in the country. These are fast, secure, and reliable. Therefore, the bank removed mCASH and advised account holders to use modern digital payment platforms.

What are the ways people can make transactions now?

Unified Payments Interface (UPI)

UPI has become India's fastest and most reliable digital payment platform. It doesn't require the beneficiary's bank account number or IFSC code. You can send money instantly with just a mobile number or UPI ID. It is used everywhere from street vendors to large hotels. For UPI, you can use BHIM, Google Pay, PhonePe, or SBI's own BHIM SBI Pay / YONO app.

IMPS, or Immediate Payment Service, is a fast banking service that allows you to send money instantly, day or night, weekend or holiday. It's especially useful when you need to transfer money to someone's account immediately, as the money is deducted from your account and credited to the beneficiary's account instantly. SBI customers can easily use it through net banking or the YONO app. All you need to complete the transaction is the beneficiary's account number, bank name, IFSC code, and sometimes even a mobile number. This is why IMPS is considered the most reliable digital payment option for urgent needs.

-

Gen Alpha Says These Outdated Slang Words Make You Sound Old

-

4 Zodiac Signs Attract Abundance & Luck On Monday, January 19, 2026

-

Chandni Chowk’s Digambar Jain temple, where the glass broke due to the explosion, what is its history?

-

State Admits ‘Sober DUI’ Arrests Are Far More Common Than Claimed

-

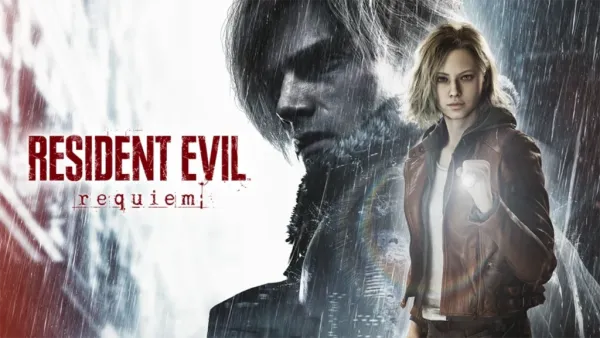

What Fans Can Expect From Capcom’s New Game in 2026