The government has recently launched the Credit Assessment Model (CAM) to make it easier and faster for Micro, Small and Medium Enterprises (MSMEs) to get loans. "The model leverages the digitally fetched and verifiable data available in the ecosystem and devises automated journeys for MSME loan appraisal using objective decisioning for all loan applications and model-based limit assessment for both Existing to Bank (ETB) as well as New to Bank (NTB) MSME borrowers," the Ministry of Finance said in a release on Tuesday.

According to the press release, CAM is designed to provide a uniform, efficient way to evaluate MSME creditworthiness using digital tools. By leveraging existing data in the digital ecosystem, such as payment history and business records, the system aims to reduce delays and human errors in loan processing.

The government said the move is part of a broader plan to strengthen India's digital financial network. Over the past few years, the Government, Reserve Bank of India (RBI) and National Payments Corporation of India (NPCI) have introduced several steps to encourage cashless payments.

These include incentive schemes to promote RuPay Debit Cards and small-value BHIM-UPI transactions, as well as the Payments Infrastructure Development Fund (PIDF), which supports the deployment of digital payment tools such as POS terminals and QR codes in remote and underserved areas. The digital initiatives are also tied to ongoing schemes that help small entrepreneurs. One such effort is the Pradhan Mantri Street Vendor's AtmaNirbhar Nidhi (PM SVANidhi), which was launched on June 1, 2020.

The government has now extended this scheme till March 31, 2030. It is jointly run by the Ministry of Housing and Urban Affairs (MoHUA) and the Department of Financial Services. Under PM SVANidhi, street vendors can take loans of Rs 15,000, Rs 25,000, and Rs 50,000 in three stages to support their small businesses.

The scheme also allows vendors to use UPI-linked RuPay Credit Cards with a credit limit of Rs 30,000, along with cashback benefits for digital payments. These features encourage more small traders to adopt cashless transactions and build a formal credit history, making them eligible for easier access to loans under the new Credit Assessment Model.

This information was given by Minister of State for Finance, Pankaj Chaudhary, in a written reply to a question in Rajya Sabha today, the release said.

-

Rupee depreciation against major world currencies good for economy: Rajiv Kumar

-

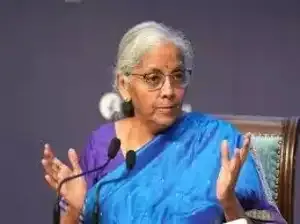

FM calls for global cooperation on digital-era tax transparency

-

GST rate rationalisation has largely fixed inverted duty structure, says Sitharaman

-

Apple to discuss Sanchar Saathi app order with govt, may not follow in its current form

-

Ahmedabad Airport to allow imports, exports of jewellery parcels through personal carriage