Rajya Sabha on Tuesday returned the Manipur Goods and Services Tax (2nd Amendment) Bill, 2025, to Lok Sabha after a brief discussion. Minister of State for Finance Pankaj Chaudhary had moved The Manipur Goods and Services Tax (2nd Amendment) Bill, 2025 in Rajya Sabha for consideration in the House and return to Lok Sabha.

The Bill was passed by the Lok Sabha on Monday, the first day of the Winter session of Parliament, amid din over the opposition parties' demand for discussion on Special Intensive Revision of electoral rolls.

As the bill was taken up, opposition members staged walkout from Rajya Sabha over their demand for immediate discussion on SIR.

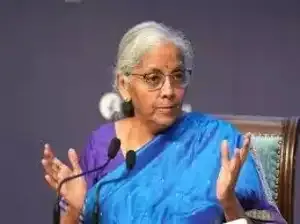

Replying to the debate, Union Finance Minister Nirmala Sitharaman said the government is committed to ease of doing business and avoid unnecessary disputes.She said businesses as well as enterprises will also benefit from this legislation.

Sitharaman accused opposition members of shedding "crocodile tears" for Manipur, saying they were not present in House during the debate on the bill. "Throughout 2024, we saw the Opposition shedding crocodile tears about Manipur for everything. They raised issues, they voiced their concerns, and shed crocodile tears. I have seen it earlier as well - when we brought the Bill for Manipur's budget, the Opposition did not participate in the debate. Even at that time, they didn't think about the welfare of the people of Manipur," she said.

"Even today, when we are trying to convert an ordinance into a regular Bill and get it passed here to become an Act, the Opposition is not here to participate. So, all the grievances that they voice about Manipur, accusing the Prime Minister and the Home Minister, is all just drama. I am ashamed and sorry to say this," she added.

Referring to the bill, she said it brings an important amendment. "Today's amendment will help in establishing the track and trace system. Once such a system is in place, it will become easier to prevent leakages. The rules for creating vouchers at the time of supply will become simpler."

The Minister also informed that the rules for generating vouchers at the time of supply of goods have been simplified. The Bill will amend the Manipur Goods and Services Tax Act, 2017. It will replace the Manipur Goods and Services Tax (Second Amendment) Ordinance, 2025 which was promulgated in October this year.

The Bill also aims to implement further decisions of the GST Council, including a plan to consolidate existing GST rates into two main slabs of 5 per cent and 18 per cent, in Manipur. The 56th GST Council, comprising members from the Centre and states, had decided to rationalise GST rates on about 375 items by merging the 5, 12, 18 and 28 per cent slabs into two slabs of 5 and 18 per cent.

She said rates of essential goods have reduced from per cent 12 to 5 per cent and only sin or demerits goods will be taxed 40 per cent, under the recent sweeping GST rates rationalization. No GST is levied on milk, she apprised the Upper House, responding to a query raised earlier by a member.

"Only UHT (ultra-high temperature) milk is heated at high temperature during the canning process and then packed. It does not need to be kept in the fridge before opening. It needs to be kept in the fridge only after opening the can. There used to be a tax on it earlier, but now it has become zero. Now no GST is levied on UHT milk," she said. She also added that the issue of inverted duty structure problem has been largely solved in the recent GST reforms.

Participating in the debate, nominated member of the Rajya Sabha, Harsh Vardhan Shringla said the government is working tirelessly to restore peace, rebuild confidence and revive normal life in Manipur. He said the bill is a major step towards strengthening the taxation system in the state and improving revenue structure. He said the government is focusing on security and economic reform to pave the way for the growth of Manipur.

Maharaja Sanajaoba Leishemba of BJP said the bill will ensure seamless continuity of tax administration in Manipur aligning with the Central GST Act. He said the new Bill will ensure administrative stability, as a pillar of peace at a time when Manipur is recovering from internal disturbances.

-

Rupee depreciation against major world currencies good for economy: Rajiv Kumar

-

FM calls for global cooperation on digital-era tax transparency

-

GST rate rationalisation has largely fixed inverted duty structure, says Sitharaman

-

Apple to discuss Sanchar Saathi app order with govt, may not follow in its current form

-

Ahmedabad Airport to allow imports, exports of jewellery parcels through personal carriage