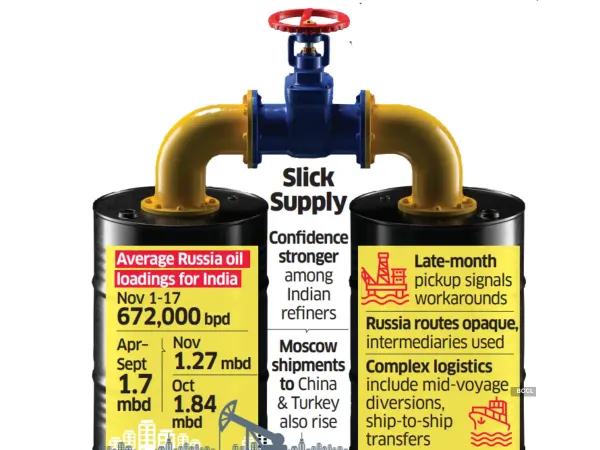

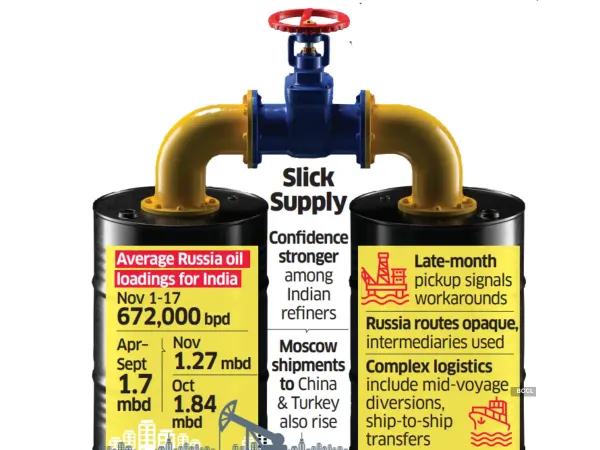

New Delhi: Russia’s oil shipments to India rebounded sharply after plunging in the first half of November, indicating increasing workarounds by Russian suppliers and renewed confidence among Indian refiners.

Loadings on to India-bound tankers from Russian ports averaged 1.27 million barrels per day (mbd) in November, almost double the 672,000 barrels per day (bpd) recorded in the first 17 days of the month, according to Kpler, a global real-time data and analytics provider.

November loadings nonetheless remained below October’s 1.84 mbd, when companies rushed cargoes ahead of the November 21 US sanctions deadline. “This still reflects notable resilience and the emergence of new supply chains and trading patterns involving additional intermediaries,” said Sumit Ritolia, lead research analyst, refining and modelling, at Kpler.

November volume was also well below the April-September average of 1.7 mbd, but the dramatic increase in the second half of the month signalled a shift from the immediate aftermath of US sanctions on Russian companies Rosneft and Lukoil, when Indian refiners turned highly cautious. The US slapped sanctions on the duo in a bid to cripple Moscow’s ability to fund the Ukraine war. “As long as broader secondary sanctions aren’t applied, India is likely to continue importing Russian crude,” said Ritolia.

Arrivals Also Rise

Arrivals Also Rise

Ritolia said it will just be “through more indirect and less transparent routes”. “On the Russian side, the response has been highly adaptive, involving ship-to-ship transfers near Mumbai, mid-voyage diversions and more complex logistics to keep barrels moving and increase discounts.”

Arrivals of Russian cargoes at Indian ports climbed to 1.83 mbd in November, from 1.62 mbd in October, as refiners, mainly state-run, stocked up ahead of sanctions. Kpler expects December arrivals of around 1 mbd.

Shipments to China and Türkiye also increased, though remaining below October levels. China averaged 887,000 bpd in November, up from 624,000 bpd in the first 17 days. Türkiye averaged 143,000 bpd for the month, more than a threefold surge from 43,000 bpd in the first 17 days.

In the first 17 days of November, tankers with undeclared destinations accounted for half of Russian cargoes. The proportion for the full month fell to 27%, signalling increasing confidence among buyers in India, China and Türkiye. Sanctions kicked in from October 23, allowing a one-month wind-down period for trade and payments. Oil prices are broadly unchanged from pre-sanctions levels, as markets expect most Russian flows to continue through workarounds.

Rosneft, Russia’s top oil exporter, aggregates crude from multiple producers, and industry executives expect non-Rosneft Russian oil to keep flowing through alternative exporters.

The US sanctions aim to push Russia toward a negotiated solution to the Ukraine war. Washington has also presented Kyiv with a peace plan and has been pressing India for months to curb Russian oil imports. Indian exporters continue to face a 25% additional US tariff as penalty for oil purchases from Russia.

Loadings on to India-bound tankers from Russian ports averaged 1.27 million barrels per day (mbd) in November, almost double the 672,000 barrels per day (bpd) recorded in the first 17 days of the month, according to Kpler, a global real-time data and analytics provider.

November loadings nonetheless remained below October’s 1.84 mbd, when companies rushed cargoes ahead of the November 21 US sanctions deadline. “This still reflects notable resilience and the emergence of new supply chains and trading patterns involving additional intermediaries,” said Sumit Ritolia, lead research analyst, refining and modelling, at Kpler.

November volume was also well below the April-September average of 1.7 mbd, but the dramatic increase in the second half of the month signalled a shift from the immediate aftermath of US sanctions on Russian companies Rosneft and Lukoil, when Indian refiners turned highly cautious. The US slapped sanctions on the duo in a bid to cripple Moscow’s ability to fund the Ukraine war. “As long as broader secondary sanctions aren’t applied, India is likely to continue importing Russian crude,” said Ritolia.

Ritolia said it will just be “through more indirect and less transparent routes”. “On the Russian side, the response has been highly adaptive, involving ship-to-ship transfers near Mumbai, mid-voyage diversions and more complex logistics to keep barrels moving and increase discounts.”

Arrivals of Russian cargoes at Indian ports climbed to 1.83 mbd in November, from 1.62 mbd in October, as refiners, mainly state-run, stocked up ahead of sanctions. Kpler expects December arrivals of around 1 mbd.

Shipments to China and Türkiye also increased, though remaining below October levels. China averaged 887,000 bpd in November, up from 624,000 bpd in the first 17 days. Türkiye averaged 143,000 bpd for the month, more than a threefold surge from 43,000 bpd in the first 17 days.

In the first 17 days of November, tankers with undeclared destinations accounted for half of Russian cargoes. The proportion for the full month fell to 27%, signalling increasing confidence among buyers in India, China and Türkiye. Sanctions kicked in from October 23, allowing a one-month wind-down period for trade and payments. Oil prices are broadly unchanged from pre-sanctions levels, as markets expect most Russian flows to continue through workarounds.

Rosneft, Russia’s top oil exporter, aggregates crude from multiple producers, and industry executives expect non-Rosneft Russian oil to keep flowing through alternative exporters.

The US sanctions aim to push Russia toward a negotiated solution to the Ukraine war. Washington has also presented Kyiv with a peace plan and has been pressing India for months to curb Russian oil imports. Indian exporters continue to face a 25% additional US tariff as penalty for oil purchases from Russia.