The cost-of-living crisis shows no sign of easing, with Christmas only adding to struggling households' strained budgets, charity workers have said. Chancellor Rachel Reeves vowed to improve living standards at the Budget last month, including by hiking the minimum wage, freezing rail fares and scrapping the two-child benefit cap.

But for those on the frontline of the cost-of-living crisis, the pressure on families is no easier now than in the 2010s as some face even bigger debts and the prospect of spiralling further into debt to pay for Christmas. The grim picture painted by those helping Britain's debt-laden families comes as the charity Christians Against Poverty (CAP) warns over five million Brits admit to feeling Christmas adds to their financial woes. One in three children will face Christmas in poverty this year, according to CAP.

Jon Taylor is a debt centre manager at the Beacon CAP Partnership, a group of churches in south London working with CAP to help people get control of their debts. Mr Taylor told the Daily Express he has seen no tangible improvement in the cost-of-living crisis over the 10 years he has been helping people.

He said: "I'm as busy as I ever was. I don't have any sense of coming out of these difficulties anytime soon...So many clients I see now - it's not sustainable, their outgoings aren't matching their income. I don't recall it being as bad as that 10 years ago."

Polling commissioned by CAP and carried out by Opinium, shared exclusively with the Daily Express, shows around 5.3 million people in Britain feel Christmas adds extra financial pressure on them when they are already struggling.

In total, 12.5 million (23%) UK adults say they, a family member or a friend has received help from a local church or Christian organisation within the last five years, according to CAP's study.

The charity warns this Christmas millions are being forced to choose between keeping warm and feeding their children. It has launched a £300,000 Christmas appeal to help families cope.

While Mr Taylor suggested things have gotten worse for some households, he hailed the support church groups and CAP offer people.

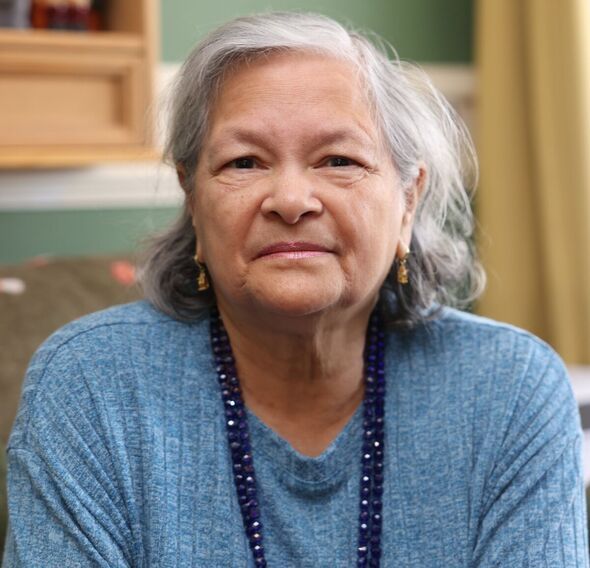

This includes Beverley Charlie, 74, from Streatham, south London, who last Christmas was told she owed £5,000 in unpaid council tax. This was despite a lifetime of keeping on top of all her bills and payments. Ms Charlie challenged the debt, but was eventually forced to settle it.

The retired hotel manager said: "I was really panicked. It was frightening. I was crying at the drop of a hat. I kept thinking I would lose my home. I was unwell and kept having angina attacks. I was absolutely petrified."

Ms Charlie, who was recovering from cancer at the time, described how she worried whenever there was a knock on her front door, fearing it would be bailiffs coming to take her furniture away.

Unable to pay the debt, an anxious Ms Charlie declared herself bankrupt, with help and advice from CAP, Mr Taylor and his colleagues during what was a deeply stressful time.

Ms Charlie, who is almost blind, said things have now returned to normal, adding: "I feel a lot of relief now. I worked my whole life and that was the first debt I ever had.

"I'm one of those people who doesn't like to buy something unless they can afford to. I never buy on the never-never."

Jade, 26, who asked not to be named in full, fell into debt in 2022 along with her former partner. The mum-of-three from Barnstaple said she and her ex's efforts to keep up the appearance of having money caused them to fall behind on rent payments and bills.

She said: "It was a dark and horrible life, not going anywhere or getting anywhere. Just living in a state of poverty."

The young mum said she would often go without food so her children could eat and would end up asking her mother for help.

Debts kept piling up to the point where she owed in excess of £6,000. Her electricity provider alone wanted £200 per month in debt repayments, which was more than Jade could afford.

Jade said Christmas was a particular nightmare.

She said: "You have this picture in your mind of what Christmas should be like, and you want to please everybody and everyone to be having something and be excited.

"And when it's not like that, which is the reality, because what you see on TV isn't Christmas, it doesn't feel like Christmas. I just dreaded it - I would try to play happy families, but I was actually just living in pure fear."

Jade decided enough was enough when her relationship ended and she received a letter threatening a visit from the bailiffs.

She contacted her local council who put her in touch with CAP. The charity teamed her up with Ben Warrender, a debt centre manager at Trinity Church in Barnstaple.

With help, Jade managed to secure a debt relief order which cleared her debts.

Jade said: "Things now are really good. I'm married now. I don't feel like I'm stuck anymore. My life has been transformed."

Where the financial cost of Christmas used to be a worry, it is now a time to celebrate.

Jade said: "It's a much better feeling than it was before."

On being in debt, she added: "There's nothing wrong with getting help. Everyone tries to keep up a façade everything is okay. Debt is not something to be ashamed of."

Mr Warrender told the Daily Express everyone has a different reason for falling into debt. It might be caused by loss of a job, a relationship ending or other changes in circumstances.

He said: "We see a lot around rent arrears, gas, electric, water bills and council tax. A trend we see is for more primary debt, things that will affect your home such as rent and mortgage debt."

So far this year, Mr Warrender and his colleagues have helped 23 households become debt free. He said debts nowadays are bigger than he has seen in the past, pointing to an average of £14,330.

He said: "It's a worrying trend. Debts are bigger and more complex. I've been in homes where there's nothing in the fridge except for a sandwich, where parents feed their children but aren't eating themselves."

Asked how bad the cost-of-living crisis is, Mr Warrender said: "It's still a challenging time. It's still difficult."

-

NID DAT 2026 Application Correction Window Closes Today At admissions.nid.edu, Check Direct Link To Apply

-

Corporate FDs vs. Bank FDs & Analyse the Trade-Off Between Higher Interest Rates and Safety

-

EAM Jaishankar Warns West will be "Net Losers" if Skilled Immigration is Restricted

-

Ukraine's NATO Membership "key Question" of Discussion with US Delegation: Kremlin Aide

-

Cheetah Veera, Her Cubs To Be Released In Wild At Kuno National Park On International Cheetah Day Today