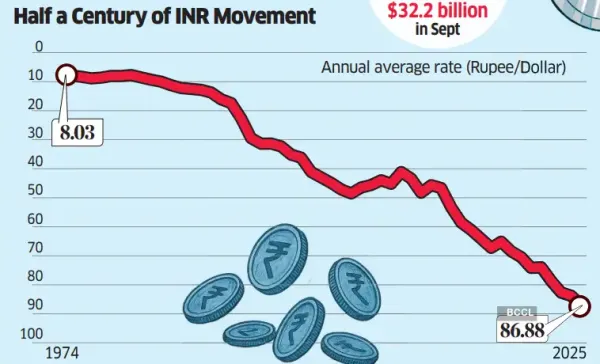

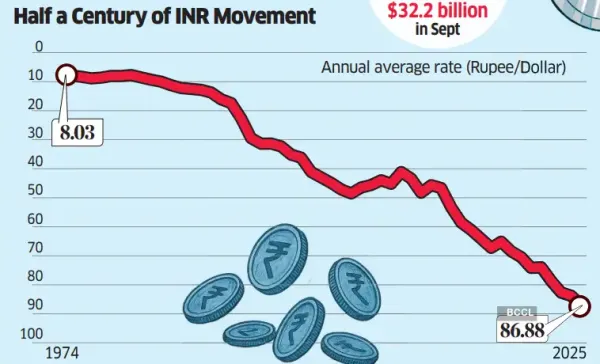

On Wednesday, the rupee tumbled to a historic low, breaching the psychological 90 to the dollar mark. While the currency’s quick recent descent stirs anxiety—raising the price of imported goods and injecting fresh turbulence into the stock markets—it isn’t a tale of unrelenting gloom, and the economy is well-placed to absorb the shock, with growth at a 6-quarter high and inflation at a record low. Anoushka Sawhney and Kirtika Suneja take a look at those at the receiving end of the slide and those who stand to gain.

PAIN & GAIN

Fuel imports will become costlier

India imports over 85% of its crude requirements, so a weaker rupee raises the landed cost of fuel. Other things being equal (global crude prices have softened recently), rupee depreciation will push up input costs for industries that rely on crude and its derivatives. With pump prices of petrol and diesel unlikely to be revised in the near term, higher import costs will squeeze the margins of oil marketing companies. Petroleum subsidy could increase too.

Rise in fertiliser import prices will increase subsidy burden

India relies heavily on imports to meet its fertiliser demand, making the sector especially vulnerable to currency swings. Because the government caps retail fertiliser prices through subsidies, any rise in import costs will swell the subsidy bill, which is currently budgeted at around Rs 1.68 lakh crore for FY26.

Overseas education would cost more

The same dollar cost of overseas education would require more rupee funds because of the depreciation. This would increase education loan amounts and EMIs.

Higher inflation

Costlier imports will lift inflation. However, that is not a worry as of now. Retail inflation hit a record low of 0.25% in October.

Increased stock market volatility

Depreciating the rupee would keep markets on edge as investors try to gauge the impact. Foreign investors may sit on the sidelines till the currency stabilises.

Costlier gold and silver

Silver prices are already at record high globally and gold is inching up towards the October highs. India meets most of its precious metal requirements through imports. Currency depreciation would exacerbate the effect, making jewellery costlier.

Airline operations will get costlier

Airlines have multiple foreign currency exposures, and rupee depreciation could impact them substantially. Fuel is a substantial part of their costs, along with aircraft lease rentals. Higher costs mean flying could get costlier.

Top-end cars and EVs costlier

Top-end cars have low localisation. A higher ratio of imported components would make them costlier because of the slide in the rupee. Similarly, electric vehicles also have high imported inputs and will see the cost of production rise.

Foreign borrowing costlier

The depreciation will increase the cost of foreign borrowing as servicing the loan will cost more rupee funds. Additionally, given the currency volatility, the hedging costs will also increase, making the overseas loans costlier. Those with already high foreign loans on their books will see interest costs rise. This may benefit Indian banks that could see higher demand for loans from those considering foreign funds.

SMARTPHONES AND ELECTRONICS MAY SEE PRICE RISE

Despite rising local production, smartphones and several white goods, such as televisions and ACs, have high import content. Their prices would feel the heat from rupee depreciation, negating the gains for the consumers from the cut in goods and services tax.

Boost for exports, cushion against high tariffs

The rupee depreciation would make India’s exports more competitive, negating some of the impact of the high US tariffs. The Real Effective Exchange Rate (REER) of the rupee has dropped to 97.47 in October 2025 from 107.27 a year ago, showing that the Indian currency has swung from overvalued to undervalued. It will benefit exports and dampen cheap Chinese imports. This is a much-needed adjustment to address the persistent trade imbalance.

IT and pharma industries big winners

IT industry, facing the heat from AI, has something to cheer. Since a high percentage of its earnings are in dollars, depreciation lifts rupee earnings. It also gives them a competitive cushion. Rupee depreciation has, in the past, lifted services exports. Likewise, pharma industry is a big exporter and stands to gain from the fall in the rupee.

Remittances may Get a Leg-up

The fall in the rupee may encourage the Indian diaspora to send money back home since dollar will now yield a larger amount in Indian currency. The country received highest-ever $135.5 billion in remittances in FY25, up from $118.7 billion a year earlier. These inflows, together with high services exports, provide a much-needed cushion against a high goods trade deficit.

PAIN & GAIN

Fuel imports will become costlier

India imports over 85% of its crude requirements, so a weaker rupee raises the landed cost of fuel. Other things being equal (global crude prices have softened recently), rupee depreciation will push up input costs for industries that rely on crude and its derivatives. With pump prices of petrol and diesel unlikely to be revised in the near term, higher import costs will squeeze the margins of oil marketing companies. Petroleum subsidy could increase too.

Rise in fertiliser import prices will increase subsidy burden

India relies heavily on imports to meet its fertiliser demand, making the sector especially vulnerable to currency swings. Because the government caps retail fertiliser prices through subsidies, any rise in import costs will swell the subsidy bill, which is currently budgeted at around Rs 1.68 lakh crore for FY26.

Overseas education would cost more

The same dollar cost of overseas education would require more rupee funds because of the depreciation. This would increase education loan amounts and EMIs.

Higher inflation

Costlier imports will lift inflation. However, that is not a worry as of now. Retail inflation hit a record low of 0.25% in October.

Increased stock market volatility

Depreciating the rupee would keep markets on edge as investors try to gauge the impact. Foreign investors may sit on the sidelines till the currency stabilises.

Costlier gold and silver

Silver prices are already at record high globally and gold is inching up towards the October highs. India meets most of its precious metal requirements through imports. Currency depreciation would exacerbate the effect, making jewellery costlier.

Airline operations will get costlier

Airlines have multiple foreign currency exposures, and rupee depreciation could impact them substantially. Fuel is a substantial part of their costs, along with aircraft lease rentals. Higher costs mean flying could get costlier.

Top-end cars and EVs costlier

Top-end cars have low localisation. A higher ratio of imported components would make them costlier because of the slide in the rupee. Similarly, electric vehicles also have high imported inputs and will see the cost of production rise.

Foreign borrowing costlier

The depreciation will increase the cost of foreign borrowing as servicing the loan will cost more rupee funds. Additionally, given the currency volatility, the hedging costs will also increase, making the overseas loans costlier. Those with already high foreign loans on their books will see interest costs rise. This may benefit Indian banks that could see higher demand for loans from those considering foreign funds.

SMARTPHONES AND ELECTRONICS MAY SEE PRICE RISE

Despite rising local production, smartphones and several white goods, such as televisions and ACs, have high import content. Their prices would feel the heat from rupee depreciation, negating the gains for the consumers from the cut in goods and services tax.

Boost for exports, cushion against high tariffs

The rupee depreciation would make India’s exports more competitive, negating some of the impact of the high US tariffs. The Real Effective Exchange Rate (REER) of the rupee has dropped to 97.47 in October 2025 from 107.27 a year ago, showing that the Indian currency has swung from overvalued to undervalued. It will benefit exports and dampen cheap Chinese imports. This is a much-needed adjustment to address the persistent trade imbalance.

IT and pharma industries big winners

IT industry, facing the heat from AI, has something to cheer. Since a high percentage of its earnings are in dollars, depreciation lifts rupee earnings. It also gives them a competitive cushion. Rupee depreciation has, in the past, lifted services exports. Likewise, pharma industry is a big exporter and stands to gain from the fall in the rupee.

Remittances may Get a Leg-up

The fall in the rupee may encourage the Indian diaspora to send money back home since dollar will now yield a larger amount in Indian currency. The country received highest-ever $135.5 billion in remittances in FY25, up from $118.7 billion a year earlier. These inflows, together with high services exports, provide a much-needed cushion against a high goods trade deficit.