On 4 December 2025 investments in the Sovereign Gold Bond (SGB) 2017-18 Series-X - issued on 4 December 2017 - will mature and the Reserve Bank of India (RBI) has announced a redemption price of ₹12820 per unit. How was the Redemption Price Determined? As stated in the SGB guidelines the redemption amount is determined as the simple average of the closing price of 999-purity gold published by the India Bullion and Jewellers Association (IBJA) during the three business days preceding the date of redemption. In the case of Series-X this means that RBI took the closing gold prices on 1 December 2025 2 December 2025 and 3 December 2025 into account. Returns - Very good all-round! Series-X was issued in December 2017 at an issue price of around ₹2964 per gram (₹2914 for subscribers on the primary electronic platform). With a redemption price of ₹12820 per unit this implies a capital appreciation of ~₹9856–₹9906 per unit (exact number depends on the issue price). This amounts to a total return of approximately 332%–340% in eight years excluding the periodic interest payments. To put this into perspective some recently matured tranches of SGB have produced similar total returns: Series-IX (Redeemed 27 November 2025) received ₹12484 per unit - a return of over 320%. Series-VII (Matured 13 November 2025) got ₹12350 per unit at redemption. The numbers show how investing in SGBs for the long-term can multiply the initial capital several times without the hassles that go with holding physical gold. What Investors need to do to receive redemption proceeds? Investors holding Series-X do not need to do anything extra. On maturity redemption proceeds are automatically credited to the bank account linked with the SGB (or to the demat account in case it is held in electronic form). Also capital gains on redemption (ie the gain resulting from the difference between the issue price and the redemption price) are tax-free if the bonds are held until maturity. However the periodic interest of 2.5% p.a. received during the holding period is taxable as per the investor’s income-tax slab. What this Means for Investors and Gold Lovers? The maturity of Series-X is welcome news for investors who continued to believe in gold-linked instruments over physical gold or market-linked funds. SGBs - issued by the government - have the backing of the state and are a safe storage-free and purity-assured alternative to physical gold. With the current redemption price investors have more than tripled their money in eight years making SGB 2017–18 one of the best performers in recent years. For investors averse to market risks or for those who want to protect their capital from erosion or inflation or currency fluctuations SGBs reaffirm their position as a long-term capital preservation and growth tool.

-

Tourists slam UK Christmas market with 'no atmosphere' and crowds 'packed like sardines'

-

OpenAI ordered to share ChatGPT logs in NYT copyright case

-

83 pc India's small biz leaders say AI is critical for growth: Report

-

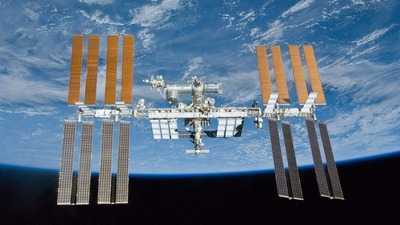

ISS sets record with 8 spacecraft docked at once

-

Over 157 lakh passengers benefit from 3.27 lakh UDAN flights: Minister