From artificial intelligence to cloud computing and consumer electronics, the “Magnificent Seven” sit at the center of some of the world’s most powerful industries.

- The term was coined by Bank of America’s equity research analyst Michael Hartnett in 2023 to refer to the large-cap stocks that dominated the market.

- These stocks made up for roughly one-third of the S&P 500’s total market capitalization at the end of 2024.

- Investors can buy individual stocks or ETFs tracking broader markets to gain exposure.

Seven companies now move the U.S. stock market more than entire sectors once did. Dubbed the “Magnificent Seven,” these trillion-dollar giants dominate everything from AI to cloud computing and often shape investor sentiment on Wall Street.

In 2023 and 2024, these seven companies accounted for more than half of the S&P 500's total returns.

Which Companies Are Part Of The Group?

Google parent Alphabet, Amazon, Apple, Instagram-parent Meta Platforms, Microsoft, chipmaker Nvidia, and Tesla make up the group. As per Fidelity Investments, these stocks made up for roughly one-third of the S&P 500’s total market capitalization at the end of 2024. All of the companies had market capitalizations exceeding $1 trillion, with Nvidia briefly reaching $5 trillion on Oct. 29, 2025.

The term was coined by Bank of America’s equity research analyst Michael Hartnett in 2023 to refer to the large-cap stocks that dominated the market. The name was a reference to the 1960 Western film of the same name, starring Steve McQueen, Yul Brynner, and Charles Bronson.

How Did These Companies Perform Over The Past Decade?

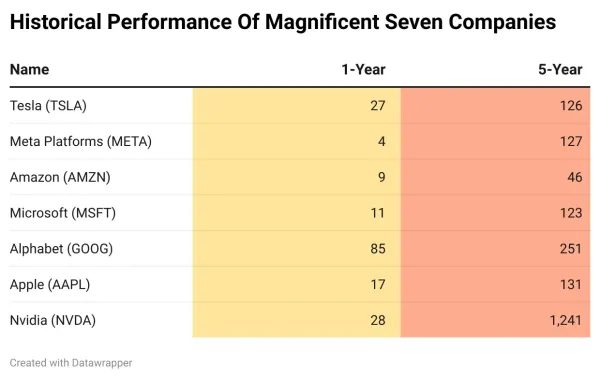

This graphic represents the 1-year and 5-year performance (%) of the magnificent seven stocks, as of Dec. 3, 2025.

Nvidia has led the gains with an astronomical 1,241% rise over the past five years. Barring Amazon, the rest have more than doubled since the COVID-19 pandemic.

How Can I Trade In Them?

In addition to owning individual stocks, investors can buy exchange-traded funds, such as the MAGS Magnificent Seven ETF by Roundhill Investments, to add them to their portfolios. Additionally, investors can gain exposure to the magnificent stocks by investing in ETFs that track broader markets, such as the S&P 500.

Risk Vs Reward

According to Fidelity, the Magnificent Seven companies have historically had robust operating resources, a track record of revenue growth, and typically strong earnings, which have contributed to their strong share performance.

These companies, with significant customer bases, are present across the globe, helping them diversify their revenue streams. It has also enabled them to reap the benefits of international growth, especially in developing markets that may be growing faster than the U.S. economy.

However, on the flip side, because of these companies' large market capitalization and high price-to-earnings ratios, they might not offer the same growth as a smaller firm. Most of these firms are also betting billions on AI, and concerns about their future profitability have made them susceptible to volatility, as seen in 2025.

Despite the concerns, the group’s enormous market capitalization and earning potential have made it hard to ignore, and the companies are expected to stay among the market’s most closely watched names.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

-

Ashes 2nd Test: Joe Root shines in Brisbane, England cross 300 as star batter hits first Test century in Australia

-

Palak Muchhal breaks her silence after Smriti Mandhana–Palaash Muchhal wedding put on hold, says, ‘Families have been…’

-

Ultraviolette raises $45 Million from Zoho, Ferrari-backer Lingotto to boost EV motorcycle lineu

-

Hyderabad’s closest Cruise destination, just three hours away

-

Rachakonda, Cyberabad police websites hacked for a week; restored