UP Fintech posted a 73.3% growth in Q3 revenue to a record $175.2 million, while net income jumped nearly threefold to a record $57 million.

- The company’s Q3 revenue significantly beat analysts’ expectations of around $133 million.

- TIGR’s total client assets hit a new peak of $61 billion, up almost 50% from last year.

- The company added 31,500 new funded accounts during the quarter.

Shares of UP Fintech Holding (TIGR) shot up 9% in premarket trading on Thursday after it reported a record-breaking third quarter print.

TIGR was among the top-trending tickers on Stocktwits in the premarket session.

Q3 Results Shine

UP Fintech posted a 73.3% year-on-year growth in Q3 revenue to a record $175.2 million, significantly beating analysts’ estimates of $132.8 million, according to Stocktwits data. On a sequential basis, revenue increased 26.3%.

The company reported a record non-GAAP net income of $57 million, a nearly threefold increase from the prior-year period. Total client assets hit a new peak of $61 billion, up almost 50% from last year.

Client growth accelerated, with 31,500 new funded accounts added during the quarter. This brought the total funded clients to 1.22 million, an 18.5% increase from a year ago. Trading activity remained healthy, with total quarterly volume growing 28.5% to $209.4 billion.

“In Q3, market conditions continued to improve, and the Company once again achieved record-high revenue, profit and client assets. To date, we have already met our full-year target of adding 150,000 newly funded clients,” said UP Fintech's founder and CEO, Wu Tianhua.

“This quarter, the average net asset inflows per newly funded client in Singapore and Hong Kong reached $62,000 and $30,000, respectively, while client assets in these two markets grew approximately 20% and 60% QoQ, highlighting a steady improvement in overall user quality.”

How Did Stocktwits Users React?

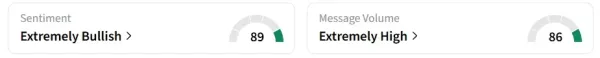

The results created quite a buzz on Stocktwits. Retail sentiment on the platform flipped to ‘extremely bullish’ from ‘neutral’ a day earlier, accompanied by ‘extremely high’ message volumes.

One user stated that the stock is undervalued.

Another user expects the stock to climb up to $15. It is currently at $9.4.

Year-to-date, TIGR stock has gained more than 35%.

Read also: Meta Faces Fresh EU Scrutiny: Regulators Reportedly Consider Interim Restrictions On AI Rollout

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

-

Harbhajan Singh’s bold remark fuels talk around Rohit Sharma and Virat Kohli, says…

-

After Elvish Yadav, singer Rahul Vaidya, slams IndiGo Airlines for its glitch, says, ‘One of the…’

-

Jaya Bachchan opens up on the emotional void she felt when…: ‘I just couldn’t stop…’

-

14-year-old shot dead by CISF officer for collecting money in Delhi wedding

-

Video: Woman in ghunghat playing guitar stirs debate on tradition