Inflation eased, and yields fell, lifting stocks, but stretched valuations and cautious retail sentiment temper optimism.

- Markets extended a strong multi-year bull run, with the S&P 500 posting solid double-digit gains and leadership concentrated in tech and communication services.

- Retail traders remain divided, with roughly 40% expecting flat or negative year-end returns despite the market’s recent rebound.

- Strategists see earnings growth, AI adoption, and resilient economic growth supporting 2026 upside.

The futures market is yet to react significantly to the inflation reading. The CME FedWatch Tool, based on futures traders' expectations, still shows more than 75% odds of a pause at the January meeting. Economists, though positive about the Federal Reserve lowering rates further next year, were divided on whether a reduction will materialize in January.

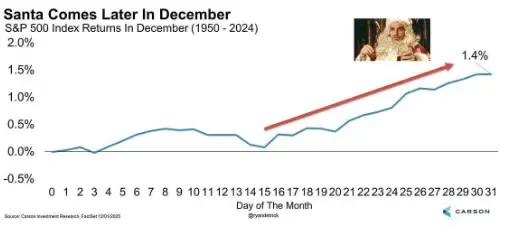

Where does this all leave the market, which is now in its fourth year of a bull run? Will Santa arrive on Wall Street on time to give the market the typical year-end lift? Will 2026 prove to be another bumper year for stocks?

For the unversed, a Santa rally is a calendar effect in the stock market that drives sustained upside in the final five sessions of a year and the first two sessions of the following year. So, it starts on the 24th of this month, an abbreviated session ahead of the Dec. 25 Christmas holiday, and runs through Jan. 5.

Historical trends prove that:

Source: Sevens Report via Investing.com<

Market Check-In

After the 2022 inflation-driven economic uncertainty drove the market into bear territory, it hit a bottom in October before bouncing back strongly.

S&P 500 Returns

| Year | Annual Returns |

| 2025 (YTD) | +15.2% |

| 2024 | +23.3% |

| 2023 | +24.2% |

| 2022 | -19.4% |

Among the 11 S&P 500 sectors, communication services and IT have outperformed this year, with gains of more than 20%.

S&P 500 Sectors’ YTD Returns

| Sectors | Returns |

| Communication Services | +30.0% |

| IT | +20.6% |

| Industrials | +16.9% |

| Utilities | +13.2% |

| Financials | +12.5% |

| Healthcare | +11.4% |

| Materials | +7.4% |

| Consumer Discretionary | +7.2% |

| Consumer Staples | +2.6% |

| Energy | +2.5% |

| Real Estate | -0.9% |

Indices, representing different market class categories, have had a solid run this year, although the broader tech sector and the narrower non-financial tech categories have been outperforming slightly.

Source: Koyfin<

Retail Hopes But Stays Skeptic

Not all retail traders are convinced that Santa will work his magic on Wall Street.

An ongoing Stocktwits poll asking users about their expectations for the S&P 500's potential return in the second half of December showed that nearly 40% of retail traders are bracing for either a flat or negative performance. A little over 60% expect the market to end the year with a gain.

It is worth noting that many of the votes were cast before the November inflation report was released on Thursday. On the polls timeline, a bearish user wrote, “The market is way overvalued.”

His views aligned with those of NYSU Stern School of Business Finance and Economics Professor Aswath Damodaran, famously known as the “Dean of Valuation”. In an interview with CNBC last week, Damodaran said:

“I’m not sure the remaining 493 [of the S&P 500 stocks] are bargains relative to the Mag-7. They looked richly priced to me as well.”

Inflation Adds Spring To Santa’s Steps

The November inflation report showed a cool-off in the annual inflation rate to 2.7% from 3.1% in October. The yearly rate of core inflation also slowed to 2.6% from 3%. But economists do not see a smooth downward trend in inflation.

Commenting on the inflation data, Northlight Asset Management Chief Investment Officer Chris Zaccarelli said the November data was only one month’s figure and will likely fluctuate in the coming months.

“But the main concern of Fed officials who are reluctant to keep cutting is that inflation is persistently high and won’t come down if they keep lowering interest rates, and at this point, that doesn’t look like it’s the case.”

LPL Financial Chief Economist Jeffrey Roach also expects bumpy inflation readings in the next few months but expects it to drop to 2.5% by the year-end, allowing the Federal Reserve to cut rates a few times next year.

Fund manager Louis Navellier hoped the Santa rally had begun, with nine trading days left in the year.

“Expectations for an up market in the new year are the highest in 4 years. Ending the year at new highs is back on the table, as investors position themselves for a strong start to 2026.”

Rate Cuts, AI Surge Likely To Be Market Theme

The fears of the length of the bull market are ill-founded. According to a graphic shared by First Trust, the average bull market lasts 4.3 years and returns 151.4%. By this historical norm, the current market is still young: it is only a little over three years old, and the gain has been 89%.

Source: First Trust<

Strategists pin their hopes on strong profit growth and a resilient economy to support continued market gains next year. Zaccarelli sees further gains:

“While next year will undoubtedly bring new challenges, heading into the end of the year, there should be room for the market to move higher as corporate profits are increasing, the GDP is growing and inflation (for now) remains in check.”

In its 2026 outlook report, Morgan Stanley said it is overweight on U.S. equities due to resilient growth. The firm prefers U.S. large-caps despite market talk of the tech rally broadening as interest rates drop. It also looks for selective exposure to mid-cap stocks.

“Economic conditions and market performance in 2026 may prove to be more U-shaped than K. The trough likely occurred in 2025, partially masked by stronger equity performance, with notably narrow leadership.”

Despite the doom-and-gloom talk about artificial intelligence (AI), the technology is expected to boost the economy through increased spending and productivity gains.

Retail sentiment toward the SPDR S&P 500 ETF (SPY), an exchange-traded fund that tracks the S&P 500 Index, and the Invesco QQQ Trust (QQQ) ETF, which tracks the Nasdaq 100 Index, was ‘bearish’ as of early Friday. The SPDR Dow Jones Industrial Average ETF Trust (DIA) also elicited a ‘bearish’ sentiment, while retail traders were ‘extremely bearish’ on the iShares Russell 2000 ETF (IWM).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

-

HPSC Exams 2026: Eight recruitment exams in Haryana will be held by March; see the schedule for each exam..

-

AIIMS Vacancy 2025: Recruitment is underway in 41 departments of AIIMS for medical professionals..

-

RBI Vacancy 2025: The RBI is offering a chance to get a job without an exam; applications have started for these positions..

-

Minor PAN Card: When is a PAN card needed for children, and how is it made?

-

Investment: What should your investment strategy be from youth to old age? Understand this...