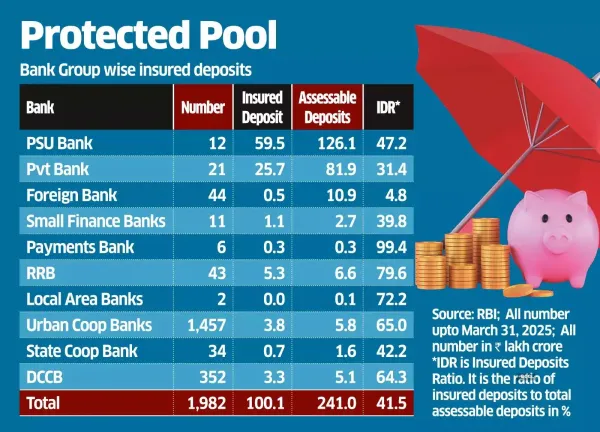

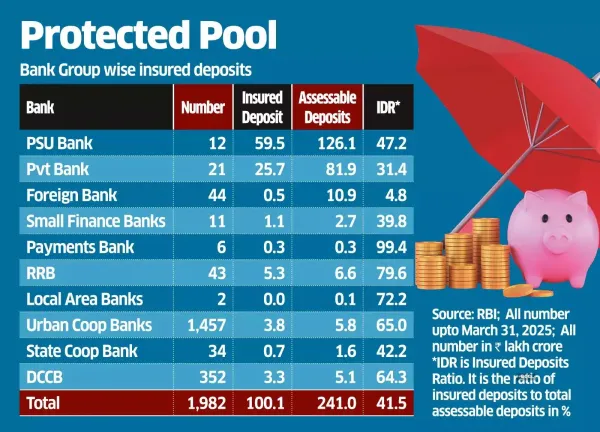

Mumbai: Nearly 41.5% of total deposits by value and 97.6% by number of accounts at commercial and cooperative banks were insured by Deposit Insurance and Credit Guarantee Corporation (DICGC) as of March 2025, according to latest data released by the Reserve Bank of India.

DICGC provides insurance cover up to ₹5 lakh per depositor.

Of the ₹241.08 lakh crore deposits with banks until end March 2025, ₹100.12 lakh crore were insured. In the previous year, 43.1%, or ₹94.12 lakh crore, of deposits were covered by DICGC.

In FY25, DICGC settled ₹476 crore of claims through the fund and made a total recovery of claims amounting to ₹1,309 crore. The balance in the deposit insurance fund was ₹2.29 lakh crore as of end March 2025, up 15.2% y-o-y. Insured deposits rose 6.4%.

Since its inception in 1961, DICGC has levied a flat rate premium on banks to fund the deposit insurance scheme. It charges a premium of 12 paise per ₹100 of assessable deposits.

In December 2025, the Reserve Bank approved a risk-based deposit insurance framework for banks to incentivise sound risk management and promote financial stability.

Almost all deposits parked with payment banks are insured since they can accept only up to ₹2 lakh deposit per person.

As of March 31, 2025, DICGC extended deposit insurance to 1,982 banks-139 commercial banks and 1,843 co-operative banks.

DICGC provides insurance cover up to ₹5 lakh per depositor.

Of the ₹241.08 lakh crore deposits with banks until end March 2025, ₹100.12 lakh crore were insured. In the previous year, 43.1%, or ₹94.12 lakh crore, of deposits were covered by DICGC.

In FY25, DICGC settled ₹476 crore of claims through the fund and made a total recovery of claims amounting to ₹1,309 crore. The balance in the deposit insurance fund was ₹2.29 lakh crore as of end March 2025, up 15.2% y-o-y. Insured deposits rose 6.4%.

Since its inception in 1961, DICGC has levied a flat rate premium on banks to fund the deposit insurance scheme. It charges a premium of 12 paise per ₹100 of assessable deposits.

Stronger Buffer RBI division DICGC provides insurance cover up to ₹5 lakh per depositor, levying a flat premium from banks

In December 2025, the Reserve Bank approved a risk-based deposit insurance framework for banks to incentivise sound risk management and promote financial stability.

Almost all deposits parked with payment banks are insured since they can accept only up to ₹2 lakh deposit per person.

As of March 31, 2025, DICGC extended deposit insurance to 1,982 banks-139 commercial banks and 1,843 co-operative banks.