EPFO: There is only one question in the mind of every employee working in the private sector regarding retirement, will the pension received in old age be sufficient? Considering the speed at which inflation is increasing at present, the current pension amount of EPFO seems quite low. But, now a ray of hope is visible for crores of employed people across the country. The Supreme Court has directed the Central Government and EPFO to increase the wage limit. If this change is implemented, there may be a huge jump in the pension of private employees.

Why does your pension remain less?

First of all, it is important to understand why you are getting less pension in your hands now. According to the rules of EPFO, at present the salary limit for pension is fixed at Rs 15,000. This means that whether your basic salary is Rs 50 thousand or Rs 1 lakh, it is considered only Rs 15,000 for calculating pension.

When your company deposits money in your PF account, a part of it goes to EPS i.e. Employee Pension Scheme. Due to the fixed limit of Rs 15,000, the contribution towards EPS also gets limited. This is the reason why the amount of pension received after retirement is much less than expected. At present, under this rule, any employee can get a maximum monthly pension of Rs 7,500 and minimum Rs 1,000.

The entire pension math will change

Now let's talk about the change for which everyone is waiting. There is discussion that the wage limit can be increased from Rs 15,000 to Rs 30,000. If this happens, the entire mathematics of pension calculation will change. There is a direct formula to calculate pension: (Pensionable salary × years of service) / 70.

Now if we calculate at Rs 15,000, then for a maximum of 35 years of service, the pension becomes Rs 7,500. But, as soon as this base becomes Rs 30,000, this figure will directly double. In this formula, 'pensionable salary' is the average basic salary of the last 60 months. The direct effect of increasing the limit will be that the amount deposited every month in your EPS account will increase, which will increase your monthly pension.

Monthly pension can be doubled directly

The biggest benefit of this decision will be to those employees who have been in private jobs for a long time. In case the wage limit is Rs 30,000, if an employee completes maximum 35 years of service, the maximum pension he will receive will directly increase from Rs 7,500 to Rs 15,000. There will be a big increase not only in the maximum but also in the minimum pension. According to the current data, if this limit is increased, employees can get a pension of at least Rs 4,285, which is currently only Rs 1,000.

-

5 Struggles Of Adults Raised By Parents Who Didn’t Show Affection

-

5 Zodiac Signs Have Great Horoscopes On Thursday, March 5, 2026

-

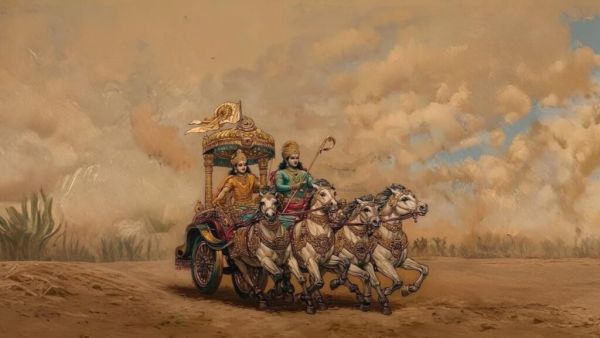

Do you know? Shalya was the charioteer of Yudhishthir, there is a big secret hidden in this unheard story of Mahabharata.

-

200,000-year-old DNA from horse slaughtered by Neanderthals found in Germany where it should not have survived |

-

A Spring Spectacle of Moss Phlox and Mt. Fuji