Wipro Q3 Results: PAT Declines 7% YoY To Rs 3,119 Crore; Declares Rs 6

Sanjeev Kumar | January 17, 2026 12:22 PM CST

Azim Premji's tech giant Wipro registered a 7% decline in consolidated net profit to Rs 3,119 crore during the third quarter of FY26. However, Q3 PAT dropped by nearly 9% sequentially.

In terms of top-line, Wipro posted revenue of Rs 23,556 crore, registering an upside of 5.5% yoy and 3.8% qoq.

In the constant currency, the IT services segment revenue stood at $2,635.4 million, increase of 1.2% QoQ and 0.2% YoY. Non-GAAP constant currency IT Services segment revenue increased 1.4% QoQ and decreased 1.2% YoY.

During the quarter, Wipro witnessed total bookings of $3,335 million, which was down 5.7% YoY in constant currency. Meanwhile, the company's large deal bookings stood at $871 million, which also dropped by 8.4% YoY in constant currency.

Further, IT services operating margin for Q3FY26 was 17.6%, expansion of 0.9% QoQ and 0.1% on YoY basis.

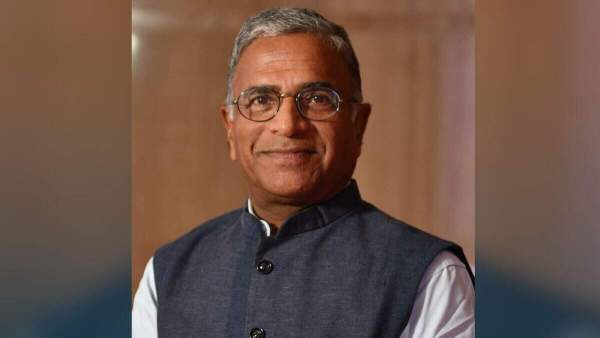

Talking about the performance, Srini Pallia, CEO and Managing Director, said "In Q3, we delivered broad-based growth in line with our expectations. As AI becomes a strategic imperative, Wipro Intelligence is emerging as a

differentiator and contributed to several wins this quarter. We saw greater adoption of our AI-enabled platforms and solutions, scaled AI-led delivery through WINGS and WEGA, and expanded our innovation network across global locations."

Also, Aparna Iyer, Chief Financial Officer, said "Our IT services operating margins at 17.6% expanded both sequentially and on a year-on-year basis. This is our best margin performance in last few years. Our continued focus on execution rigour also reflects in our strong operating cash flow of 135% of net income in Q3. We are also pleased to share that the Board has declared an interim dividend of Rs 6 per share which will take the total payout for the year to $1.3 billion."

Wipro's operating cash flow stood at Rs 42.6 billion, up by 25.7% sequentially but down by 13.6% YoY.

Also, the company's voluntary attrition rate is at 14.2% on a trailing 12-month basis.

For FY26, Wipro expects revenue from IT Services business segment to be in the range of $2,635 million to $2,688 million. This translates to sequential guidance of 0% to 2.0% in constant currency terms.

Wipro Interim Dividend:

The company's board has approved interim dividend of Rs 6 per share with a face value of Rs 2 each. For this, the record date is fixed on January 27, and the payment date is set on or before February 14, 2026.

READ NEXT

-

Kanpur man strangles wife to death over infidelity doubts; surrenders

-

Forgetting history erodes society: Rajya Sabha Deputy Chairman

-

US slaps 10 pc tariff on 8 European countries opposing Greenland takeover

-

Kangana Ranaut Slams AR Rahman As ‘Prejudiced, Hateful’ Over Bollywood Remarks

-

India A ‘Dominant Country’ Driving Talent And Investment, Says US Congressman