By the end of 2025, defence tech was no longer a fringe sector. The events of Operation Sindoor thrust the spotlight on Indian drones, anti-drone defence tech and AI-enabled smart weapons and defence systems.

And 2025 also highlighted India’s dependency on defence exports. Operation Sindoor, exposed a harsh reality: India needs indigenous defence tech, especially since the focus was squarely on sovereign tech all throughout the year.

“Before Op Sindoor, there was some movement toward improving tech sovereignty, particularly around cybersecurity, but it was fairly scattered and patchy. Today, the focus has clearly shifted toward indigenisation and tech sovereignty, especially after the challenges that emerged in the past six months,” says Sai Pattabiram, founder of Zuppa, a Chennai-based dronetech startup.

What followed was a surge in government demand for homegrown drone startups, along with growing interest from Indian VC firms. As per Inc42 data, of the approximately $78 Mn raised by defence tech startups over the last 10 years, $68 Mn was raised in 2025 alone.

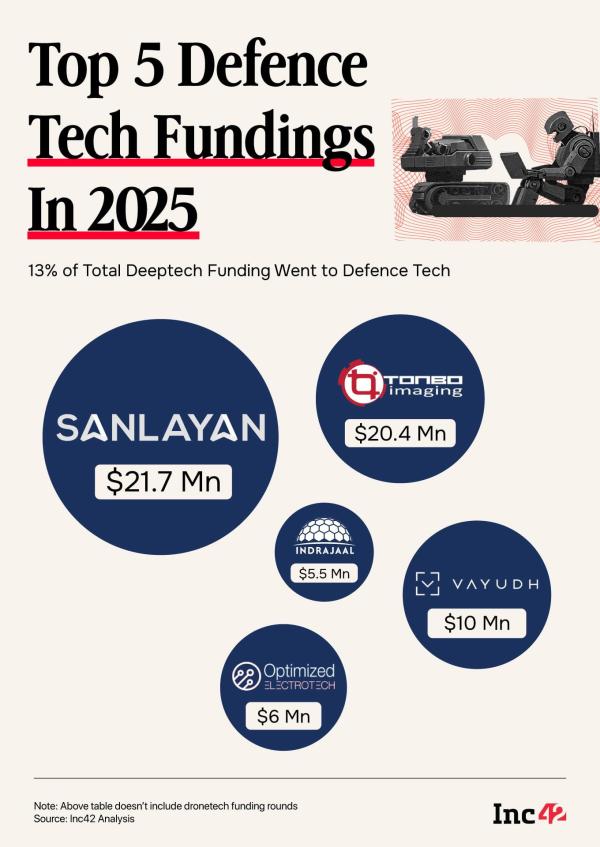

This accounted for about 13% of the total $533 Mn funding raised by all deeptech startups in India.

Pertinent to note that the above dataset includes only defence tech startups, and does not account for the entire drone tech ecosystem. That is a much broader sector spanning areas such as agriculture, healthcare, construction, and logistics, making it difficult to ascertain how much of the drone ecosystem caters to defence tech alone.

Still, dronetech accounts for a large part of the defence tech ecosystem. Some of the notable startups operating in the sector include Raphe mPhibr, IG Defence, ideaForge, Garuda Aerospace, among others. While a large portion of the overall capital deployed in the segment is concentrated towards the dronetech segments, other subsegments like ammunition, defence signals and AI-enabled systems have also started seeing increased traction in recent times.

So, what is driving this momentum? Let’s take a deeper look.

The State Of Defence Tech FundingFollowing recent geopolitical disruptions and supply-chain vulnerabilities, the Indian government has stepped up efforts to source defence equipment from domestic companies and startups.

In FY25 alone, the Defence Acquisition Council (DAC) cleared 193 capital procurement contracts worth INR 2.09 Lakh Cr. Of these, 177 contracts, valued at INR 1.7 Lakh Cr — around 81% of the total value — were awarded to Indian industry, signalling a decisive push towards indigenisation.

This shift is not limited to procurement. Over the past few years, the government has systematically lowered entry barriers for defence tech startups by absorbing much of the early technical and financial risk that once deterred private capital.

Startups now have access to subsidised land, shared infrastructure and common testing facilities, reducing the need for heavy upfront investment even before demand is validated.

Earlier, defence startups were often forced to raise private capital to build labs, testing facilities and pilot manufacturing lines at the ideation stage itself. That burden has increasingly shifted to the state now. Central schemes such as iDEX and Make-I/Make-II fund product development and prototyping, and offer a clearer route to procurement.

This is further reinforced by the Defence Testing Infrastructure Scheme and VC interest has definitely followed suit with the government policies.

VC Interest Ramps UpAs Bluehill.VC cofounder and managing partner Sridhar Parthasarathy told Inc42 India’s realignment towards domestic defence companies to plug capability gaps explains why defence tech and deeptech are attracting disproportionate attention from investors today.

“I think the biggest source of capital for deeptech today is the government. The government is really the fountainhead of funding in this space. For instance, SIDBI’s Fund of Funds now stands at INR 20,000 Cr, and in the next INR 10,000 Cr tranche, deeptech is a major focus,” Bluehill’s Parthasarathy noted.

This is expected to be complemented by the upcoming INR 1 Lakh Cr RDI fund, with significant capital routed into R&D through second-level fund managers. Together, these mechanisms are creating predictable revenue pathways, reducing R&D timelines and lowering operating costs for startups.

As a result, early-stage investors are also beginning to see liquidity through secondaries — historically rare in deeptech. In effect, government backing has not only catalysed India’s defence tech ecosystem but has reshaped how venture capital evaluates risk, returns and scale across the broader deeptech landscape.

As defence buyers have become more sophisticated in evaluating technology, investors have also begun to distinguish between surface-level products and companies building core, defensible IP. Patents, certifications and embedded systems are now central to investment decisions.

“Earlier, investors struggled to differentiate between companies because they didn’t fully understand what constituted core technology versus just the drone itself. Now, as customers have become more informed, the investor community has followed. They’re looking beyond the flying object and focussing on what’s inside it,” Zuppa’s Pattabiram shared.

Why 2026 Is A Big Year For Defence TechYourNest Venture Capital’s venture partner Ranjeet Shetye believes what has fundamentally changed is the certainty and scale of demand. He added that governments globally are now open to buying defence equipment from startups, with addressable markets spanning defence budgets in the US, China, India and Brazil.

Despite this, the real inflection point, Shetye argued, is the creation of a market with near-guaranteed capital. “Come to us with a strong technology, and we will fund it,” has effectively become the state’s proposition. This alters the risk-reward equation for deeptech investing, where startups are no longer building in anticipation of demand but into a pre-defined market.

Drawing upon this, many investors agree that defence tech is probably going to lead the overall deeptech funding. However, Suyash Singh, founder and CEO of GalaxEye believes that every trend has a cycle.

“Cleantech was the primary investment magnet in deeptech before defence tech took over. Investor interest has now decisively moved toward defence tech, and we expect this cycle to sustain for a few years before normalising,” he said.

Still, defence tech startups are operating in an environment where the buyer, the budget and the procurement intent is only deepening.

With long-term defence allocations locked into national budgets and indigenisation now a strategic imperative rather than a policy experiment, the sector offers revenue visibility, a key factor that continues to attract both early-stage and growth capital.

As a result, the coming years are likely to see a steady increase not just in funding volumes, but also in the number and maturity of defence tech startups.

What began with drones is now expanding into electronic warfare systems, secure communications, AI-led surveillance, space-based defence assets and advanced materials.

As these startups move from prototyping to repeat orders and multi-year contracts, defence tech is set to become one of the most durable pillars of India’s deeptech ecosystem, one where capital follows capability, and scale follows sovereignty.

Edited by Akshit Pushkarna

The post Why Defence Tech Is Becoming India’s Next Big Deeptech Bet? appeared first on Inc42 Media.

-

Government Jobs 2026: Bumper government recruitment for 10th and 12th pass candidates, over 2900 posts to be filled in Assam Police, Forest and Fire departments..

-

IIT Kharagpur Vacancy: IIT is recruiting for professor positions; learn about all the necessary application requirements..

-

APS Haryana Vacancy: Army Public School is recruiting for teaching and non-teaching positions; apply by this date..

-

DMSRDE: A great opportunity to get a two-year research fellowship in Kanpur; selection will be through a walk-in interview..

-

If you've booked a ticket, hold on! Have railways canceled these trains? Is your train among them?