In today’s digital age, mobile notifications have become a powerful marketing tool for banks and financial apps. Many people regularly receive messages or alerts offering pre-approved personal loans with tempting promises like “instant approval,” “no paperwork,” and “money credited within minutes.” At first glance, such offers can look extremely attractive—especially if you are facing an urgent financial need.

However, before clicking on that notification and accepting the offer, it is important to pause and evaluate the details carefully. A pre-approved loan may be convenient, but making a rushed decision can turn an easy loan into an expensive mistake. Here’s a detailed guide on what you should check before moving forward.

What Is a Pre-Approved Personal Loan?

A pre-approved personal loan is an offer extended by a bank or financial institution after reviewing your financial profile. This usually includes factors such as:

-

Your credit score

-

Income stability

-

Past relationship with the bank

-

Repayment history

Because the lender has already assessed your profile, the loan approval process is faster and often requires minimal documentation. However, pre-approved does not mean automatic. You still need to accept the terms and conditions, and the loan will be disbursed only after that.

Such offers are generally made to existing customers with a good credit record.

Always Check the Interest Rate Carefully

The most important factor to review is the interest rate. While the loan amount highlighted in the notification may look impressive, the interest rate is often mentioned in fine print.

In many cases:

-

Pre-approved personal loans carry higher interest rates than regular personal loans

-

Convenience and speed come at a cost

Even a small difference in interest rate can significantly increase the total amount you repay over time. Make sure you compare the offered rate with other loan options before accepting it.

Understand Processing Fees and Hidden Charges

Another critical step is to check all additional charges, including:

-

Processing fee

-

GST on processing fee

-

Administrative or service charges

These fees are often deducted upfront from the loan amount. For example, if you accept a loan of ₹2 lakh, you might actually receive less after charges are deducted. Always read the fee structure carefully so there are no surprises later.

Review the Loan Tenure and EMI Impact

Loan tenure plays a major role in determining your monthly EMI:

-

A shorter tenure means higher EMIs but lower total interest

-

A longer tenure reduces EMI but increases overall interest outgo

Some pre-approved loan offers come with shorter repayment periods, which can lead to heavy monthly EMIs and strain your budget. Make sure the EMI fits comfortably within your monthly income and does not disrupt your essential expenses.

Assess Whether You Really Need the Loan

Instant loan offers can encourage impulsive borrowing. Before proceeding, ask yourself:

-

Is this loan truly necessary?

-

Can the expense be postponed or managed through savings?

-

Will repayment affect my financial stability?

Personal loans are unsecured and flexible, but they should ideally be used for genuine needs, not convenience-driven spending.

Verify the Credibility of the App or Bank

With the rise of digital lending, fraudulent loan apps and fake offers have also increased. Some red flags to watch out for include:

-

Requests for excessive permissions

-

Pressure to act immediately

-

Lack of clear contact details

Always ensure that:

-

The lender is a bank or RBI-registered NBFC

-

The app is downloaded from an official app store

-

The offer is visible on the bank’s official website or app

Never share sensitive details like OTPs, PINs, or passwords with unverified platforms.

Check the Impact on Your Credit Score

Every loan you take adds to your credit profile. While timely repayments improve your credit score, missed EMIs can harm it significantly. Multiple loans at once can also increase your credit burden, making future borrowing more difficult.

Final Takeaway

A pre-approved personal loan offer on your phone may feel like an easy solution, but smart borrowing requires careful evaluation. Interest rates, fees, tenure, lender credibility, and your own repayment capacity should all be reviewed before accepting the offer.

Convenience should never come at the cost of long-term financial stress. Take a few extra minutes to read the fine print—because when it comes to loans, being informed is always better than being quick.

-

IND vs NZ 2026: Why is Prasidh Krishna not playing in India vs New Zealand 3rd ODI?

-

Bangladesh says most incidents involving minorities in 2025 were non-communal

-

Bail before conviction is a right: Chandrachud on Umar Khalid’s bail denial

-

Tech Mahindra on WEF list of organisations making AI work in real world

-

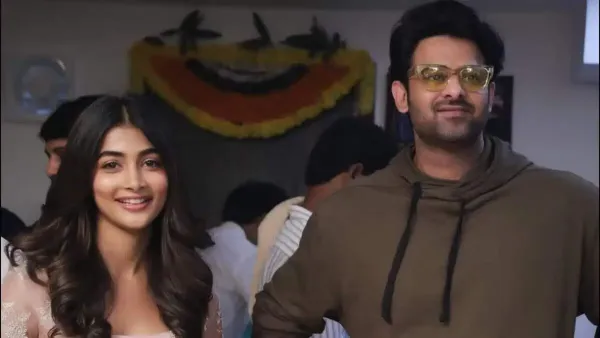

Unverified, viral: Reports claim Pooja Hegde slapped co-star, Prabhas trends