ATM Withdrawal Charges: The country’s largest bank, State Bank of India (SBI), has increased transaction charges at non-SBI ATMs. This change has come into effect from December 1, 2025. Cash withdrawals from non-SBI ATMs will now cost ₹23 plus GST after the free limit, compared to ₹21 plus GST previously.

Non-financial transactions, such as balance checks or mini statements, will now cost ₹11 plus GST, up from ₹10 plus GST previously.

The biggest change for salary account holders

Customers with salary packages and savings bank accounts are facing a significant change. Previously, they enjoyed unlimited free transactions at non-SBI ATMs, but now they will only be allowed 10 free transactions per month (both cash withdrawals and balance checks).

New charges will apply after the limit is reached. This change will affect millions of employees who frequently use ATMs at other banks.

How much difference will it make to regular savings accounts?

There is no change in the number of free transactions for regular savings account holders. Five free transactions (both financial and non-financial) will still be available per month at non-SBI ATMs, whether metro or non-metro.

The cash withdrawal charge after the free limit is exhausted has increased from ₹21 to ₹23 plus GST, and for non-financial ATMs from ₹10 to ₹11 plus GST.

Why were these charges increased? What did the bank say?

SBI stated that the price of ATM services was reviewed due to the increase in interchange fees. Interchange fees are the charges banks pay for using other banks’ ATMs.

This is the first such increase since February 2025. The bank also clarified that many categories will not be affected.

Which accounts remain unchanged?

- Basic Savings Bank Deposit (BSBD) account holders will continue to operate as usual.

- Kisan Credit Card (KCC) account holders will also be exempt from the revised fees.

- SBI debit card transactions at SBI ATMs will remain completely free.

- Cardless cash withdrawals (YONO Cash, etc.) will also remain unlimited and free at SBI ATMs.

Customer Tips: How to Save Charges

- Use SBI’s network of over 63,000 ATMs as much as possible, where transactions are free.

- Track your monthly free limit, especially mby minimisingbalance checks.

- Check and transfer balances through digital banking, such as the YONO app, net banking, or UPI, where no charges apply.

- Salary account holders will now need to plan if they frequently use non-SBI ATMs.

This change will impact the daily banking of millions of SBI customers, especially those living in smaller towns where SBI ATMs are scarce.

The bank has urged customers to check their account details and contact their branch if necessary.

-

Spain: High-speed train crash leaves at least 39 dead

-

The deserted UK 'ghost village' that was 'paused in time' for 35 years

-

Gurgaon Weather LATEST Update: Dense Fog or Sunny Relief? Check Forecast Here

-

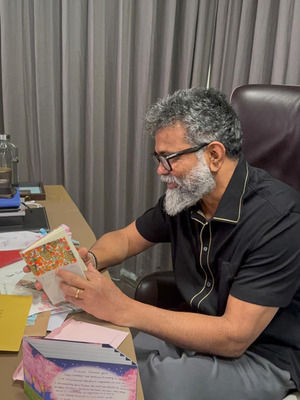

'Pushpa' director Sukumar on love from Japan: Cinema has no borders, only emotions!

-

Stop damp and mould on walls for good by wiping them with 1 natural item