India's transition to a new labour law framework has triggered one of the biggest shifts in how salaries are paid and how statutory benefits are calculated. With the four labour codes coming into force on Nov 21, 2025, India has moved to a unified labour framework, and at the heart of this reform is a single, standardised definition of "wages," which now applies for all statutory benefits governed by these codes.

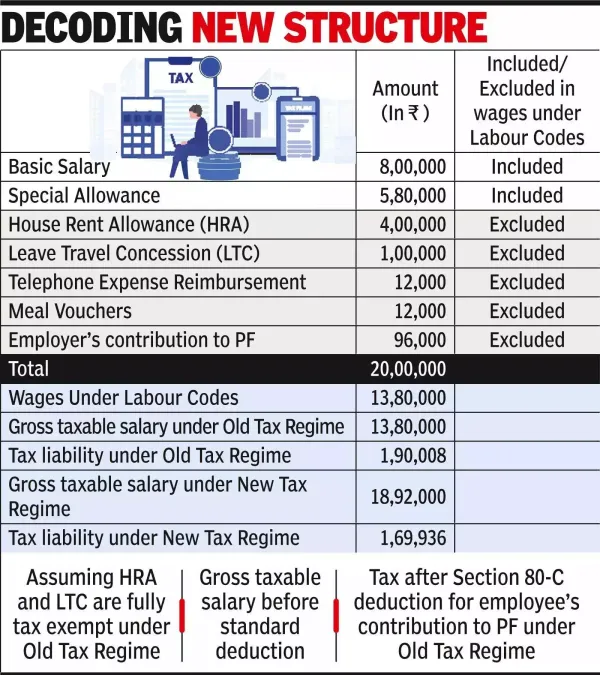

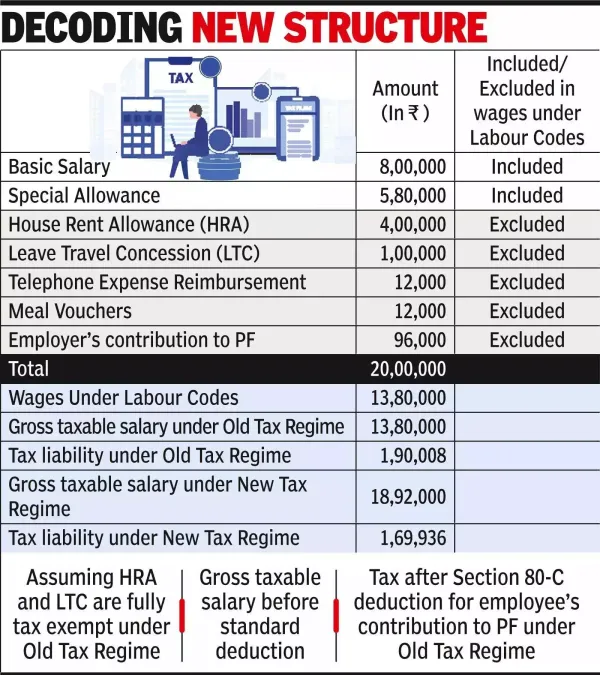

To understand why this matters, it helps to look at how salaries are typically paid in India. Most employers follow a Cost-to-Company (CTC) structure, where salary is distributed across basic salary, various allowances along with the option for employees to opt for tax-efficient reimbursements for travel expenses, telephone and internet expenses, fuel expenses and similar items.

The new labour codes reshape this structure by clearly defining what counts as "wages" for the purpose of various statutory benefits. Under the codes, wages cover all salary components (including basic pay, dearness allowance and retaining allowance) excluding specific components listed in the definition of wages. If excluded components exceed 50% of total pay, the excess must be added back to wages for statutory calculations.

The excluded list in the definition of wages covers items such as house rent allowance, conveyance allowance, the employer's share of provident fund contributions, housing accommodation, utilities such as light and water, medical attendance provided by the employer, and other specific components. The definition also empowers the appropriate govt to specify additional amenities or services to be excluded from wages through general or special orders.

The new wage definition has major implications for social security. Key benefits such as gratuity and leave encashment are now to be calculated based on the revised wage definition. However, employees and employers may continue contributing PF at 12% of basic salary so long as the basic salary exceeds Rs 15,000 (wage ceiling under the PF Scheme), even if the wages under the labour codes are higher.

The new wage definition also interacts closely with India's two income tax regimes. Since wages exclude specific allowances, employees may continue receiving components such as house rent allowance (HRA) and leave travel concession (LTC) without these forming part of wages, and such allowances may continue to offer tax benefits under the old tax regime, subject to the relevant eligibility rules. Similarly, the revised draft central rules confirm that telephone and internet reimbursements and the value of meal vouchers remain excluded from wages. These may continue to offer tax exemptions under the old tax regime, while telephone and internet reimbursements remain eligible for exemption under the new tax regime as well. This provides employees with some relief, because although the wage definition tightens the structure of compensation, several tax-efficient allowances remain available.

An important safeguard in the transition to the new system is Section 124 of the Code on Social Security (COSS). This provision states that no employer shall, solely because of its liability to make contributions under the Code, reduce an employee's wages or the total quantum of benefits to which the employee is entitled under the terms of employment, whether express or implied.

Taken together, the new wage definition in the labour codes represents a significant reorganisation of India's compensation system. Employers may now need to frame salary packages so that at least half of an employee's gross salary falls within the wage definition. The CTC framework will continue, but the internal mix of basic pay, allowances and reimbursements will become more regulated and transparent.

(The writer is tax partner, EY India. Views expressed are personal)

To understand why this matters, it helps to look at how salaries are typically paid in India. Most employers follow a Cost-to-Company (CTC) structure, where salary is distributed across basic salary, various allowances along with the option for employees to opt for tax-efficient reimbursements for travel expenses, telephone and internet expenses, fuel expenses and similar items.

.

The new labour codes reshape this structure by clearly defining what counts as "wages" for the purpose of various statutory benefits. Under the codes, wages cover all salary components (including basic pay, dearness allowance and retaining allowance) excluding specific components listed in the definition of wages. If excluded components exceed 50% of total pay, the excess must be added back to wages for statutory calculations.

The excluded list in the definition of wages covers items such as house rent allowance, conveyance allowance, the employer's share of provident fund contributions, housing accommodation, utilities such as light and water, medical attendance provided by the employer, and other specific components. The definition also empowers the appropriate govt to specify additional amenities or services to be excluded from wages through general or special orders.

The new wage definition has major implications for social security. Key benefits such as gratuity and leave encashment are now to be calculated based on the revised wage definition. However, employees and employers may continue contributing PF at 12% of basic salary so long as the basic salary exceeds Rs 15,000 (wage ceiling under the PF Scheme), even if the wages under the labour codes are higher.

The new wage definition also interacts closely with India's two income tax regimes. Since wages exclude specific allowances, employees may continue receiving components such as house rent allowance (HRA) and leave travel concession (LTC) without these forming part of wages, and such allowances may continue to offer tax benefits under the old tax regime, subject to the relevant eligibility rules. Similarly, the revised draft central rules confirm that telephone and internet reimbursements and the value of meal vouchers remain excluded from wages. These may continue to offer tax exemptions under the old tax regime, while telephone and internet reimbursements remain eligible for exemption under the new tax regime as well. This provides employees with some relief, because although the wage definition tightens the structure of compensation, several tax-efficient allowances remain available.

An important safeguard in the transition to the new system is Section 124 of the Code on Social Security (COSS). This provision states that no employer shall, solely because of its liability to make contributions under the Code, reduce an employee's wages or the total quantum of benefits to which the employee is entitled under the terms of employment, whether express or implied.

Taken together, the new wage definition in the labour codes represents a significant reorganisation of India's compensation system. Employers may now need to frame salary packages so that at least half of an employee's gross salary falls within the wage definition. The CTC framework will continue, but the internal mix of basic pay, allowances and reimbursements will become more regulated and transparent.

(The writer is tax partner, EY India. Views expressed are personal)