Prime Minister Modi launched the PM Svanidhi credit card from Kerala, a major gift for the poor. He ...read more

Prime Minister Narendra Modi delivered a significant gift to the poor on Friday. He launched the PM Svanidhi credit card from Kerala. He also launched several development projects and flagged off new train services in Kerala.

During an event in Thiruvananthapuram, the Prime Minister flagged off three Amrit Bharat Express trains and a Thrissur-Guruvayur passenger train, aimed at improving regional rail connectivity between Kerala and neighbouring states like Tamil Nadu, Karnataka, Telangana and Andhra Pradesh.

PM SVANidhi Credit Card can be linked with UPI

The PM Svanidhi Credit Card, launched by the Prime Minister, can also be linked to UPI. This card is a UPI-linked, interest-free revolving credit facility designed to benefit street vendors, street cart operators, and pavement vendors across the country.

PM Modi described the launch of the PM SVANidhi Credit Card as an initiative originating from Kerala that will help in the welfare of the poor across the country, and strengthen the government's emphasis on inclusive growth and financial empowerment.

What is PM SVANidhi Credit Card?

The PM SVANidhi Credit Card is a credit card available to eligible street vendors who have successfully repaid their first two PM SVANidhi loans. It provides on-demand, flexible credit for daily expenses, with an initial limit of ₹10,000 (later increasing to ₹30,000) and a validity of 5 years. It supports the main micro-credit scheme by providing revolving credit.

This credit card is issued by banks. If you are a street vendor, you can also take advantage of this credit card.

What is PM SVANidhi Scheme?

PM SVANidhi (Pradhan Mantri Street Vendor's AtmaNirbhar Nidhi) is a central-sector micro-credit scheme launched on 1 June 2020 by the Ministry of Housing and Urban Affairs to support street vendors.

The scheme offers a working capital unsecured loan of ₹10,000, followed by a 7% interest subsidy on loans of ₹20,000 and ₹50,000.

This scheme focuses on increasing digital penetration in India by promoting digital transactions among street vendors. Street vendors are given a cashback of up to ₹100 per month for adopting digital transactions.

PC:Jagran

-

IND Vs NZ 2nd T20I: Suryakumar Yadav Scores Half-Century After 468 Days, Returns To Form Ahead Of ICC T20 World Cup 2026

-

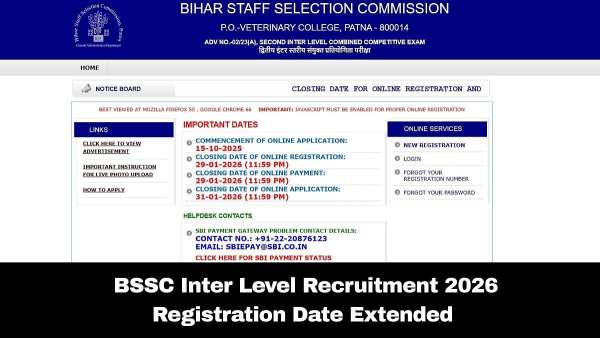

BSSC Inter Level Recruitment 2026: Last Date Extended Till January 29; Check Application Fees & Other Details Here

-

'She Left A Sinking Ship' Fans React As Janhvi Kapoor Exits Karan Johar's Dharma Productions

-

'She Left A Sinking Ship' Fans React As Janhvi Kapoor Exits Karan Johar's Dharma Productions

-

Gujarat Forest dept gears up for tiger conservation after tiger sighted in Ratanmahal wildlife sanctuary