As the Union Budget 2026 approaches, the annual exercise of preparing India’s financial roadmap moves into its final stages. The process is led by Finance Minister Nirmala Sitharaman, under whose supervision the Ministry of Finance coordinates inputs from across the government to frame policy priorities, spending plans, and revenue measures for the coming financial year.

Budget preparation typically begins six to eight months ahead of presentation, long before the Finance Minister rises in Parliament on Budget Day.

Union Ministries Submit Spending Demand

A key part of the process involves Union ministries and departments submitting their budget estimates and demands for grants. These proposals outline funding needs for existing schemes, new initiatives, and sector-specific priorities.

Under the guidance of Finance Minister Nirmala Sitharaman, the Finance Ministry examines these demands to ensure they align with fiscal targets, policy objectives, and overall economic conditions.

States and Stakeholders Are Consulted

State governments are consulted on matters related to taxation, devolution of funds, and centrally sponsored schemes. These discussions help the Finance Ministry assess regional priorities and ensure coordination between the Centre and states ahead of final allocations.

In parallel, the government holds consultations with industry bodies, economists, and other stakeholders, whose feedback is factored into policy planning.

CEA and Economic Survey Set The Macroeconomic Tone

The Chief Economic Adviser (CEA) plays a crucial role in shaping the macroeconomic framework of the Budget. The CEA’s office prepares the Economic Survey, which analyses economic growth, inflation trends, fiscal health, employment, and global risks.

The Economic Survey, tabled in Parliament just before the Budget by Finance Minister Nirmala Sitharaman, provides the analytical foundation on which Budget assumptions, such as growth projections and fiscal deficit targets, are based.

Revenue Planning and Fiscal Balancing

Alongside expenditure planning, the Finance Ministry works closely with revenue departments to project tax collections, non-tax revenue, and disinvestment receipts. Inputs from the Central Board of Direct Taxes (CBDT) and the Central Board of Indirect Taxes and Customs (CBIC) inform decisions on tax policy and compliance measures.

Balancing revenue expectations with expenditure commitments remains a key challenge in Budget formulation.

While multiple institutions contribute to the drafting process, final decisions rest with Finance Minister Nirmala Sitharaman, in consultation with senior officials and the Prime Minister’s Office. These decisions determine tax proposals, welfare allocations, capital expenditure, and reform announcements.

Once finalised, the Budget documents are prepared under strict confidentiality before being presented in Parliament.

-

Pakistan PM's Instructions To PCB Revealed After Mohsin Naqvi Meeting

-

T20 World Cup 2026: ICC Set To Announce Warm-Up Match Schedule As India A, USA Set For Games

-

India At ICC T20 World Cup 2026: Washington Sundar In Doubt, Riyan Parag In Contention As Bishnoi Makes Claim With IND Vs NZ 3rd T20I Show

-

MP Police Constable Result 2025 Declared At esb.mp.gov.in, Over 59,000 Candidates Qualify For PET, PST

-

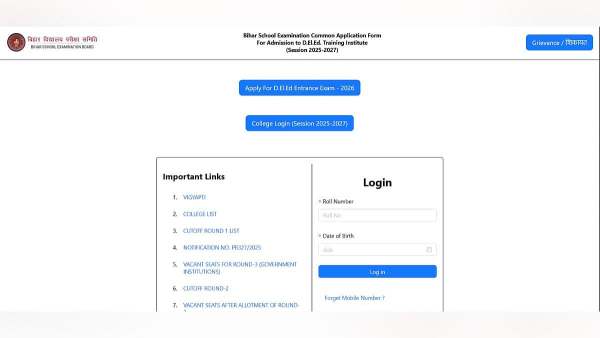

BSEB Releases D.El.Ed JEE 2026 Dummy Admit Cards At bsebdeled.com; Correction Window Open Till Feb 2