Luxury housing market in India to cool down in FY27

25 Jan 2026

The demand and prices for luxury homes in major Indian cities are likely to cool down in the next fiscal year, a survey by property consultant India Sotheby's International Realty (ISIR) has revealed.

The survey, which was conducted among nearly 700 high-net-worth individuals (HNIs) and ultra HNIs, found that 56% of respondents expect a moderation in the luxury real estate market's outlook for FY27.

Survey respondents optimistic about India's economic growth

Economic outlook

Despite the anticipated cooling of the luxury housing market, a majority of survey respondents remain optimistic about India's economic growth.

The ISIR report, 'The India Luxury Residential Outlook 2026,' found that 67% of HNIs and UHNIs are bullish on India's growth story despite global headwinds.

Furthermore, 72% of these wealthy individuals expect GDP growth to remain in the 6-7% range for FY27.

Luxury housing market's performance in 2025

Market performance

Amit Goyal, the Managing Director of ISIR, noted that India's luxury housing market performed well in 2025 across major cities like Delhi-NCR, Mumbai, Goa, and Alibaug.

He said the year 2026 started with a sense of quiet confidence after a defining year for India's luxury real estate market.

Goyal also highlighted how buyer composition has changed significantly with established business families being joined by start-up founders and next-generation entrepreneurs.

ISIR CEO on luxury real estate demand

Demand dynamics

ISIR CEO Ashwin Chadha said India's growth and wealth creation have gone hand in hand, fueling a sustained boom in luxury real estate.

He noted that with over 350 billionaires holding nearly $2 trillion in wealth, the demand for bespoke residential assets is structural rather than cyclical.

"Momentum continues but with moderation," Chadha added, reflecting the nuanced view of the luxury housing market's future trajectory.

Wealthy investors expect high returns

Investment expectations

The ISIR survey also found that 67% of wealthy investors expect annualized real estate returns of up to 15%.

Of the respondents, 53% said they invested in luxury real estate for capital appreciation while 47% bought it for self-use.

Aakash Ohri, MD and CBO at DLF Home Developers, noted how the concept of luxury real estate in India has changed dramatically with lifestyle and amenities becoming central to residential experiences.

-

Common viruses can lead to severe brain infections, says AIIMS Bhopal

-

Videos of deadly Minneapolis shooting contradict government statements

-

Three killed in fire at furniture shop building in Hyderabad

-

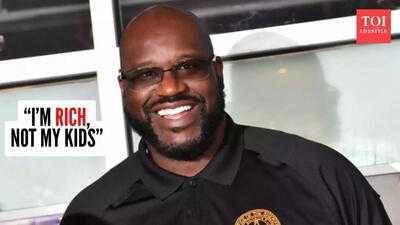

How Shaquille O'Neal told his kids, 'We're not rich, I'm rich'

-

Procurement of 3.37 lakh metric tonnes of Tur approved in Maharashtra for Rs 2,696 crore