Systematic Investment Plan (SIP) has emerged as one of the most preferred ways of investing in mutual funds for millions of Indians. By investing a fixed amount every month, investors aim to build wealth gradually and achieve long-term goals such as retirement planning, children’s education, or buying a home. However, despite its growing popularity, SIP is often misunderstood.

Several myths around SIP investing create unrealistic expectations and, in some cases, lead to poor financial decisions. Understanding these misconceptions is essential to make informed choices and avoid potential losses. Let’s break down five major SIP myths and uncover the reality behind them.

Myth 1: SIP Guarantees Quick and Consistent High ReturnsMany first-time investors assume that starting a SIP automatically ensures high and steady returns every year. This belief is often fueled by social media posts and oversimplified success stories.

Reality: SIP is not a shortcut to instant wealth. Returns depend on multiple factors such as fund selection, investment duration, market cycles, and overall economic conditions. SIP’s real strength lies in discipline and long-term investing, not short-term gains. Meaningful growth typically becomes visible over 7–15 years, not within a few months.

Myth 2: Investing in Multiple Top-Rated Funds Means Higher ProfitsSome investors believe that investing in several popular or highly rated funds will maximize returns. As a result, they start SIPs in 8–10 different schemes without understanding them fully.

Reality: Too many funds can complicate your portfolio and lead to stock overlap, reducing actual diversification. A smarter approach is to choose 3–5 well-researched funds across categories such as large-cap, flexi-cap, mid-cap, or hybrid funds—aligned with your financial goals.

Myth 3: SIP Should Never Be Stopped or ModifiedThere is a common perception that pausing or stopping a SIP is a financial mistake.

Reality: SIPs are flexible. Life circumstances change—job switches, income fluctuations, emergencies, or shifting priorities. SIPs can be paused, modified, or even discontinued if needed. Many fund houses allow SIPs to be paused for a few months without penalties. Strategic changes can sometimes be beneficial.

Myth 4: SIP Must Be Stopped When Markets FallMarket downturns often trigger panic, prompting investors to stop their SIPs when portfolios turn red.

Reality: Market corrections are actually the best time for SIP investments. Lower NAVs allow investors to buy more units with the same amount, reducing average cost. When markets recover, these additional units significantly improve returns. Stopping SIPs during downturns often means missing valuable opportunities.

Myth 5: SIP Itself Is a Safe Investment Like FDMany people treat SIPs as low-risk products similar to fixed deposits.

Reality: SIP is not an investment product, but a method of investing. The risk and return depend entirely on the mutual fund chosen. Equity funds carry market risks, while debt and hybrid funds have different risk profiles. Proper fund evaluation and risk assessment are crucial before starting any SIP.

Final TakeawaySIP is a powerful wealth-building tool—but only when used with realistic expectations, patience, and proper planning. Understanding these myths helps investors stay disciplined, avoid emotional decisions, and maximize long-term returns. Always align SIP investments with your goals and risk appetite, and review your portfolio periodically.

-

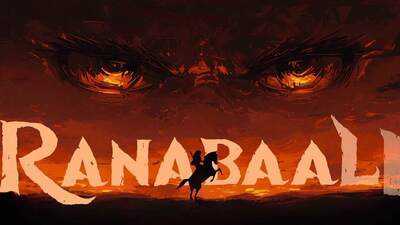

Vijay Deverakonda reveals upcoming movie title, drops RanaBaali AV

-

Sly Dunbar dead: Reggae legend and Rolling Stones collaborator found unresponsive by wife

-

Fresh alert issued in Channel migrant crisis - 'open season for illegal immigrants'

-

Keir Starmer faces another humiliating U-turn - argument has already been lost

-

Tottenham Hotspur star put on the spot over Arsenal Premier League title hopes