Samsung Electronics, South Korea’s flagship technology giant, has announced plans to distribute approximately $120 million worth of treasury shares to its executives as bonus incentives, highlighting its approach to performance-linked compensation amid a rebound in corporate earnings. The move, revealed on January 26, 2026, aims to motivate senior leaders and reinforce long-term performance, while reflecting broader trends in executive pay structures among global tech firms.

According to Samsung’s regulatory filing, the company will allocate a total of 175.2 billion Korean won (equivalent to about US$120 million) in treasury stock to 1,051 executives under its Over-achievement Performance Incentive (OPI) system. Importantly, these shares will be distributed directly from its treasury stock, meaning they are not being sold on the open market, thus reducing potential dilutive effects on existing shareholders.

The planned issuance comes after Samsung posted a strong rebound in earnings, with record operating profits in the fourth quarter of 2025, driven by a cyclical turnaround in the semiconductor segment and buoyed by gains in consumer electronics and premium devices. Samsung’s leadership has publicly urged executives to maintain focus and competitiveness, even as the company enjoys improved financial performance in a challenging global technology landscape.

Treasury Share Bonus Details and Incentive Structure:

The treasury share bonus is part of Samsung’s broader Excess Profit Incentive (OPI) framework, which rewards executives and senior leaders when their business units exceed predefined earnings targets. Under this system, eligible employees can receive up to 50 percent of their annual salary as a bonus, and a portion of this incentive is paid in Samsung’s stock rather than cash. The distribution pertains to performance metrics for the 2024 fiscal year.

Samsung will distribute 1.15 million treasury shares to eligible executives. Although large in dollar value, the shares represent only 0.019 percent of Samsung’s outstanding stock, a proportion that industry analysts say is unlikely to materially disrupt the company’s share price or significantly dilute existing shareholders.

Under the OPI scheme, part of the bonus is typically delivered in shares one year after the performance period ends. This deferred equity component is designed not only to reward past achievements but also to align executives’ interests with long-term value creation. A deferred delivery model also supports sustained executive commitment and continuity in strategic execution.

In addition to the equity portion tied to performance results, some restrictions on selling the granted shares may apply. In similar incentive arrangements, more senior executives often face extended lock-up periods, sometimes ranging from one to three years before they can sell allocated shares. This structure aims to reinforce long-term engagement and mitigate short-term trading incentives.

Earnings and Strategic Messaging:

Samsung’s decision to distribute treasury shares as executive bonuses comes against a backdrop of significantly improved financial results. For the fourth quarter of 2025, Samsung reported a record operating profit of 20 trillion won (around $13.8 billion), driven in part by strengthening demand in the semiconductor industry and improved pricing for memory and logic products.

Despite this strong performance, Samsung’s chairman, Lee Jae-yong, has cautioned executives against complacency. In a recent company seminar, he emphasised the importance of continued technological investment and strategic focus, framing the improved results as a critical opportunity for Samsung to rebuild competitiveness and maintain leadership in key markets such as memory chips, artificial intelligence (AI)- hardware, and advanced semiconductor production.

Lee’s message, described by industry analysts as a “last chance” call to action, is consistent with Samsung’s overall competitive pressures from rivals in the worldwide semiconductor and consumer electronics sectors. Despite huge advances, Samsung continues to spend heavily in next-generation technologies while dealing with cyclical demand fluctuations and macroeconomic uncertainty.

The OPI share bonus is therefore seen as both a reward for achievement and a strategic tool to retain top leadership talent who can drive sustained innovation and execution over the long term. Equity-based incentives have become common among leading technology firms globally, aligning executive compensation with shareholder interests and reinforcing performance accountability.

Broader Impacts and Industry Significance:

Samsung’s move reflects broader compensation trends in the technology sector, where equity-based incentives are increasingly used to attract, retain and motivate skilled executives amid intense global competition. By granting parts of performance bonuses in stock rather than cash, companies encourage ownership mentality and long-term thinking among leadership ranks.

Market analysts note that such equity awards typically have a limited immediate impact on share value, especially when the percentage of stock involved is minimal relative to total outstanding shares as is the case with Samsung’s 0.019 percent allocation. However, the perception around executive reward structures and their linkage to corporate performance can influence investor sentiment, particularly when tied to clear improvement in financial results. (

Samsung’s bonus announcement may potentially create a precedent for other South Korean and global businesses operating in comparable competitive and economic environments. As competition heats up in industries such as semiconductors and high-end consumer electronics, keeping top executives and aligning incentives with business performance become increasingly essential strategic issues.

The timing of the bonus issuance following record earnings may further highlight Samsung’s confidence in its operational recovery and future prospects. As the company continues to invest in emerging areas such as artificial intelligence hardware, advanced memory technologies and semiconductor fabrication, executive alignment through equity incentives could play a central role in executing long-term strategies.

Samsung’s plan to offer treasury shares worth roughly $120 million to executives highlights a performance-linked compensation approach that combines reward and long-term alignment with shareholder interests. As the corporation uses these incentives to improve leadership performance, industry observers will be watching for both internal effects on executive retention and external reactions from investors and market analysts.

-

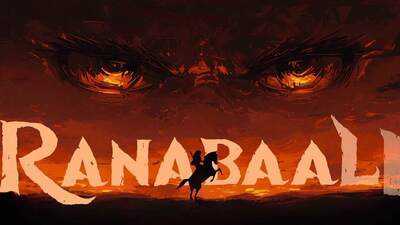

Vijay Deverakonda reveals upcoming movie title, drops RanaBaali AV

-

Sly Dunbar dead: Reggae legend and Rolling Stones collaborator found unresponsive by wife

-

Fresh alert issued in Channel migrant crisis - 'open season for illegal immigrants'

-

Keir Starmer faces another humiliating U-turn - argument has already been lost

-

Tottenham Hotspur star put on the spot over Arsenal Premier League title hopes