Many middle-class families make common money mistakes like prioritizing spending over saving, getting caught in the EMI trap, and avoiding insurance.

For many middle-class families, expenses are ready as soon as the salary comes. But saving is often an afterthought, which is a huge mistake. Savings should be a priority, not a leftover.

Life without EMIs is unimaginable now. Thinking "it's just a small amount per month," many get trapped. These EMIs add up, eating a huge part of the salary and reducing financial freedom.

Many think keeping money in a bank makes it grow. But savings are just for safety; inflation lowers its value. Investing puts your money to work. Not knowing this is a big mistake.

Thinking "nothing will happen to me" is common, but life is unpredictable. Health and term insurance are seen as needless costs, but they're a safety net. One emergency can wipe out years of savings.

Many focus on cutting costs, but that has limits. The long-term solution is increasing income by learning new skills or finding side hustles, which is often overlooked by families.

-

Budget: Auto cos seek EV duty rationalisation, support for multiple green energy pathways

-

ASK Property Fund pours Rs 260 cr in Kreeva’s south Delhi luxury housing project

-

A 200-year quest for a lost portrait

-

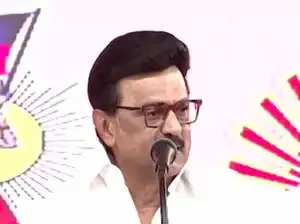

Stalin hails UGC’s equity regulations as long-overdue reform amid backlash

-

'TMC-sponsored Bangla Pakkho claimed 50 deaths': Amit Malviya targets Mamata govt over Kolkata fire, demands SIT probe