Everyone dreams of having a secure income stream after retirement that provides sufficient monthly funds for household expenses and medical expenses. For the Indian middle class, the post office has always been synonymous with trust. If you're planning for your future and want a risk-free monthly pension of approximately ₹20,500, the Post Office's Senior Citizen Savings Scheme (SCSS) could be an excellent option.

Here we will understand in detail how this scheme works and how you can avail its benefits.

Senior Citizens' First Choice: What is SCSS?

After retirement, regular income sources diminish. Investing in volatile market options (such as mutual funds or the stock market) can be risky. This is where the government-guaranteed Senior Citizen Savings Scheme comes in. This scheme is specifically designed for individuals aged 60 and above to ensure safe and better returns on their savings.

Interest Rate 2026: How Much Will You Benefit?

The government is offering an excellent annual interest rate of 8.2 percent on this scheme for the current quarter ending January 2026. This rate is significantly higher than a typical bank fixed deposit (FD). The best part is that once you deposit, your interest rate remains the same for the next five years, even if market rates fall.

How to get a monthly income of more than Rs 20,000?

The maximum investment limit in this scheme is ₹30 lakh. Let's understand the math:

- Total Investment : Rs 30,00,000

- Interest rate : 8.2 percent per annum

- Annual interest : Rs 2,46,000

- Quarterly interest (every 3 months) : Rs 61,500

- Average monthly income : Around Rs 20,500

If you deposit a maximum of ₹30 lakh into this scheme, you'll earn ₹61,500 in interest every three months. This works out to around ₹20,500 per month, enough to live a comfortable life.

Who can invest?

60 years or older: Any Indian citizen who has attained the age of 60.

Retired employees: Those between the ages of 55 and 60 who have taken VRS (voluntary retirement) can open this account within one month of receiving their retirement benefits.

Defense personnel: Those who have retired from the defense services can invest even after the age of 50.

Key features and rules of the scheme

Time Limit: This account is opened for 5 years. If you wish to extend it further, it can be extended for another 3 years after maturity.

Minimum Investment: You can start with just ₹1,000.

Tax Benefits: Deposits in this scheme are exempt up to ₹1.5 lakh under Section 80C of the Income Tax Act. However, the interest earned is taxable.

Capital Protection: Since this is a Government of India scheme, your principal is completely protected.

Old age is about comfort and peace, not financial worries. This Post Office scheme provides senior citizens with the financial independence they need most at this age. If you have retirement funds, investing them in the right place is your best bet.

Before investing, visit your nearest post office or bank to obtain the forms and necessary documents (such as Aadhaar, PAN, and age proof).

Disclaimer: The information provided in this article is for educational and informational purposes only. We are not encouraging or advising on any type of investment. Readers should consult a certified financial advisor or investment specialist before making any financial decisions. Newscrab is not responsible for any profits, losses, or consequences resulting from investments made based on this information.

-

I sell meat and fish but do not eat, “Is this a sin? Premanand Maharaj gave this answer… – News Himachali News Himachali

-

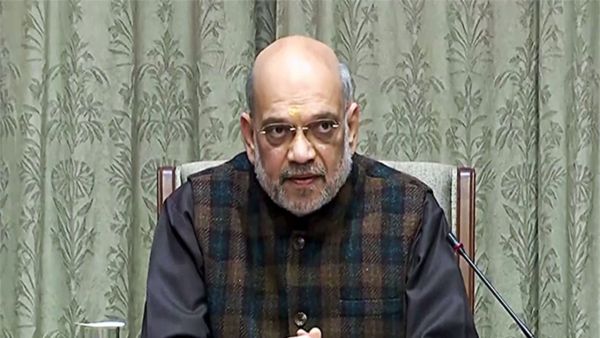

Amit Shah hails India-EU trade deal as a defining moment for nation

-

SIT report proves Gaurav Gogoi’s ‘direct link with Pakistan’: Assam CM

-

Scent of the Singularity “Blackyard Paris” Unveils GENTLEMAN perfumes by Manzil Pathan

-

Hollywood star died penniless after suffering horror accident