As Budget 2026 approaches, expectations are growing among taxpayers regarding further improvements to the income tax new regime. Introduced in Union Budget 2020 by Finance Minister Nirmala Sitharaman, the new tax regime was designed to offer lower tax rates with fewer exemptions and deductions. Since then, the government has taken multiple steps to make it more attractive, including a major relief announced in the previous budget that made annual income up to ₹12 lakh tax-free under the new structure.

Tax experts believe that if a few additional measures are announced in Budget 2026, the new tax regime could become significantly more appealing to a wider section of taxpayers, especially salaried individuals and the middle class. Here are five key changes that experts say could provide substantial relief and boost the popularity of the new tax regime.

1. Increase in Standard Deduction LimitCurrently, salaried taxpayers opting for the new tax regime are allowed a standard deduction of ₹75,000. However, industry bodies such as the American Chambers of Commerce in India (AMCHAM) have recommended that this limit be increased to ₹1.5 lakh.

The standard deduction directly reduces taxable income and is available only to salaried individuals. Its biggest advantage is simplicity—employees do not need to make any specific investments or submit proof to claim this benefit. An increase in the standard deduction would immediately lower tax liability and improve take-home income for millions of salaried taxpayers.

2. Allowing Health Insurance Premium DeductionAt present, tax deductions on health insurance premiums are available only under the old tax regime. However, with medical costs rising rapidly, health insurance has become a necessity for almost every household.

Tax experts suggest that allowing deductions for health insurance premiums under the new tax regime would offer meaningful relief. Such a move would encourage wider health insurance coverage, reduce financial stress during medical emergencies, and align tax policy with real-life household expenses.

3. Deduction for Term Life Insurance PremiumsAnother major suggestion is to permit tax deductions on term life insurance premiums under the new regime. Unlike traditional insurance plans, term life insurance does not include a savings component and is purely focused on financial protection.

In the event of an untimely death, term insurance provides financial security to the policyholder’s family. Experts argue that encouraging term insurance through tax incentives would help strengthen financial safety nets for middle-income households without compromising the simplicity of the new regime.

4. Home Loan Interest Deduction Under New RegimeCurrently, the benefit of claiming a deduction on home loan interest—up to ₹2 lakh per year under Section 24(b)—is available only under the old tax regime. Many taxpayers factor in this benefit when deciding to purchase a home.

Experts believe that extending this deduction to taxpayers under the new tax regime could significantly boost homeownership and support the housing sector. With property prices and EMIs rising, allowing home loan interest deductions could make the new regime more balanced and practical for aspiring homeowners.

5. Higher Income Threshold for SurchargeUnder the new tax regime, a surcharge applies when an individual’s annual income exceeds ₹50 lakh. Depending on income levels, surcharge rates range from 10 percent to 25 percent.

Tax professionals have suggested that the income threshold for surcharge should be increased. One proposal is to raise the limit from ₹50 lakh to at least ₹75 lakh. This would reduce the tax burden on high-income professionals and entrepreneurs who are increasingly opting for the new tax regime due to its simpler structure.

Why These Changes MatterThe government’s long-term objective is to make the new tax regime the default choice for most taxpayers. While lower tax rates and reduced compliance are attractive features, the absence of key deductions still discourages many individuals from switching.

If Budget 2026 incorporates some of these measures, it could strike a better balance between simplicity and financial relief. Such reforms would not only increase adoption of the new tax regime but also improve taxpayer satisfaction and voluntary compliance.

All Eyes on Budget 2026With Finance Minister Nirmala Sitharaman set to present her ninth Union Budget, taxpayers are keenly watching whether these expectations translate into announcements. Any move to expand benefits under the new tax regime could mark a significant shift in India’s personal taxation landscape.

For now, taxpayers can only wait and see whether Budget 2026 delivers the promised big relief under the new income tax regime.

-

IND Vs NZ 4th T20I: India Aim To Continue Dominance As New Zealand Search For 1st Win In Vishakhapatnam

-

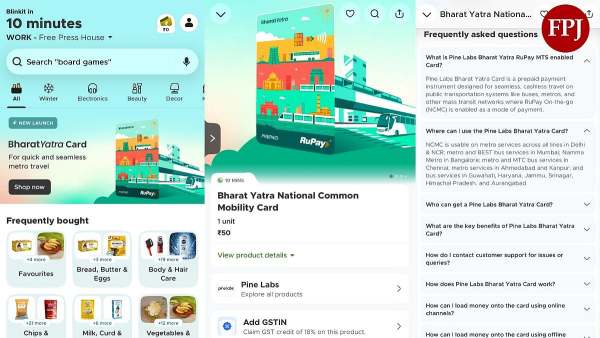

Blinkit Launches New Bharat Yatra Card For Public Transport Users In Mumbai, Delhi, Few Other Cities In India: All You Need To Know

-

'Chennai Employees Will Face Immediate & Devastating Impact': IT Industry Strongly Condemns Amazon's Upcoming Layoffs In India

-

Vivo X200T With Triple 50-Megapixel Cameras Launched In India: Price, Specifications, Launch Offers

-

NEP 2020 & Research: We Need To Move Faster