Texas Instruments forecast first-quarter revenue and profit above Wall Street estimates on Tuesday, betting on robust demand for its analog chips from booming AI data center expansions, sending its shares up nearly 9% in extended trading.

Tech companies have doubled down on expanding data center capacity to develop artificial intelligence technology, boosting demand for chipmakers across the board.

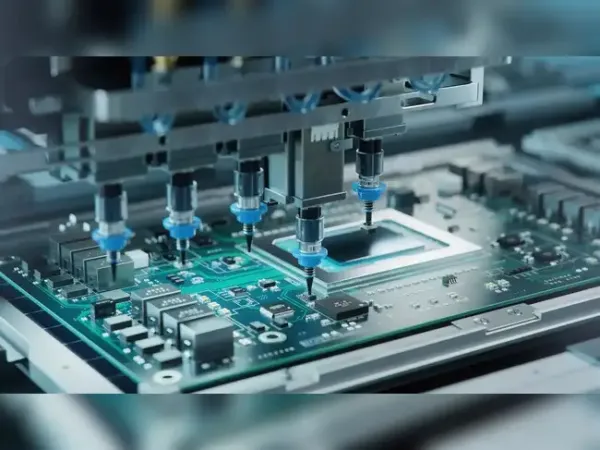

TI does not make speedy, expensive graphics processors powering AI such as those sold by Nvidia; its analog chips perform a range of functions including converting signals into those better understood by computers and perform power management for systems, making them an important fixture in data centers.

Underscoring the growing importance of AI-driven demand to TI's finances, CEO Haviv Ilan said in a post-earnings call on Tuesday that the company would now begin breaking out sales to the data center end-market in its results.

Revenue in the data center segment grew 70% in the December quarter, Ilan said, adding that the segment constituted 9% of total sales in 2025.

TI expects revenue between $4.32 billion and $4.68 billion for the first quarter, compared with an estimate of $4.42 billion, according to data compiled by LSEG. It expects earnings between $1.22 and $1.48 per share in the first quarter, compared with a profit estimate of $1.26 per share.

Analog market recovery

The company's strong forecast is also being driven by a general industrial recovery, Summit Insights analyst Kinngai Chan said.

Revenue from the industrial end-market, where TI's chips are used across factories for various purposes including automation, was up in the "high tens" percentage, Ilan said, adding that a recovery is continuing broadly across sectors.

After a more than 7% drop in 2025, TI's shares have risen more than 13% so far this year as investors hoped for signs of a years-long analog supply glut ending after excessive buying during the pandemic resulted in elevated inventory levels.

"With the inventory correction that has plagued the industry during the last two years essentially complete, we believe the company is well positioned to see acceleration of growth as we move throughout 2026," Stifel analyst Tore Svanberg said.

Texas Instruments reported fourth-quarter revenue of $4.42 billion, missing an estimate of $4.44 billion, according to data compiled by LSEG.

Revenue from the personal electronics segment declined in the "upper tens" percentage, Ilan said.

A global shortage of memory chips has cast a shadow over end-market demand in the personal electronics space, with researchers expecting sales of smartphones and personal computers - a key market for TI - to be impacted.

Tech companies have doubled down on expanding data center capacity to develop artificial intelligence technology, boosting demand for chipmakers across the board.

TI does not make speedy, expensive graphics processors powering AI such as those sold by Nvidia; its analog chips perform a range of functions including converting signals into those better understood by computers and perform power management for systems, making them an important fixture in data centers.

Underscoring the growing importance of AI-driven demand to TI's finances, CEO Haviv Ilan said in a post-earnings call on Tuesday that the company would now begin breaking out sales to the data center end-market in its results.

Revenue in the data center segment grew 70% in the December quarter, Ilan said, adding that the segment constituted 9% of total sales in 2025.

TI expects revenue between $4.32 billion and $4.68 billion for the first quarter, compared with an estimate of $4.42 billion, according to data compiled by LSEG. It expects earnings between $1.22 and $1.48 per share in the first quarter, compared with a profit estimate of $1.26 per share.

Analog market recovery

The company's strong forecast is also being driven by a general industrial recovery, Summit Insights analyst Kinngai Chan said.

Revenue from the industrial end-market, where TI's chips are used across factories for various purposes including automation, was up in the "high tens" percentage, Ilan said, adding that a recovery is continuing broadly across sectors.

After a more than 7% drop in 2025, TI's shares have risen more than 13% so far this year as investors hoped for signs of a years-long analog supply glut ending after excessive buying during the pandemic resulted in elevated inventory levels.

"With the inventory correction that has plagued the industry during the last two years essentially complete, we believe the company is well positioned to see acceleration of growth as we move throughout 2026," Stifel analyst Tore Svanberg said.

Texas Instruments reported fourth-quarter revenue of $4.42 billion, missing an estimate of $4.44 billion, according to data compiled by LSEG.

Revenue from the personal electronics segment declined in the "upper tens" percentage, Ilan said.

A global shortage of memory chips has cast a shadow over end-market demand in the personal electronics space, with researchers expecting sales of smartphones and personal computers - a key market for TI - to be impacted.