With the Union Budget 2026–27 just days away, taxpayers across income groups are hoping for practical relief measures rather than major changes in tax slabs. Over the past few budgets, Finance Minister Nirmala Sitharaman has introduced several reforms aimed at simplifying taxation. In the previous budget, annual income up to ₹12 lakh was made tax-free under the new tax regime, providing major relief to salaried individuals.

Now, taxpayers are looking for improvements that directly affect their cash flow and reduce administrative burdens. Among the key expectations are lower Tax Deducted at Source (TDS), faster tax refunds, a clearer tax framework, and fewer disputes with tax authorities.

Demand for Lower TDS for Low and Middle-Income Groups

One of the strongest expectations from Budget 2026–27 is a reduction in TDS rates for low and middle-income earners. Current TDS rates range from 10 percent to 30 percent depending on income and transaction type. According to tax experts, these rates often reduce monthly cash flow for salaried employees and small entrepreneurs.

Karthik Narayanan, Vice President (Tax and Transition) at Stellar Innovations, explained that high TDS deductions create unnecessary paperwork for taxpayers. Many individuals are forced to claim refunds later, which delays access to their own money for months. A lower TDS structure would ease financial pressure and simplify compliance for millions of taxpayers.

Faster Refund Processing Is a Major Priority

Another major concern among taxpayers is the long waiting period for income tax refunds. At present, refunds often take between six and twelve months to be processed. This delay locks up large amounts of personal savings that families could otherwise use for essential expenses such as education, housing EMIs, or investments.

Experts believe the refund process should be completed within 30 days by using artificial intelligence and advanced automation systems. Faster verification of returns and fewer manual checks could significantly improve efficiency. They have also suggested increasing the TDS exemption threshold to ₹5 lakh to reduce the number of refund claims and administrative load.

Rather than focusing only on tax rate cuts, analysts expect the government to introduce smaller but impactful reforms that make the system more taxpayer-friendly.

Need for a Stable and Transparent Tax Framework

Legal and financial experts emphasize that stability in tax rules is more important than frequent changes in slabs and rates. Ankit Rajgarhia of Bahuguna Law Associates said that India needs a tax framework with lower rates, simpler compliance, and clearer guidelines.

He also highlighted the importance of resolving tax disputes quickly. Thousands of cases remain pending for years, creating stress for taxpayers and burdening the legal system. A faster dispute resolution mechanism would improve trust and reduce pressure on courts and tax departments alike.

Additionally, experts have suggested increasing the standard deduction under the new tax regime. This step would directly benefit salaried individuals and make the new regime more attractive compared to the old system.

Refund Delays Create Financial Stress for Families

Despite increased automation in income tax processing, many refunds get stuck due to small mismatches between employer filings and Annual Information Statements (AIS). Even when such mismatches have little impact on actual tax liability, they trigger verification checks and slow down the refund process.

This delay can seriously affect household budgeting. Many families depend on refunds to meet routine financial commitments such as school fees, insurance premiums, and loan repayments. When refunds are delayed, it disrupts their financial planning and increases dependence on borrowing.

Tax professionals believe that minor discrepancies should be resolved automatically without requiring lengthy verification, especially when the tax impact is minimal.

Investors Want Stability in Capital Gains Rules

Investors are also watching Budget 2026–27 closely but expect fewer changes in capital gains tax rules. Ravi Singh, Chief Research Officer at Master Capital Services, said that long-term investors have already adjusted to recent changes in taxation policies.

He added that the market is looking for stability rather than new rules. Predictable tax policies encourage long-term investment and help build confidence among retail and institutional investors.

Key Expectations from Budget 2026–27

Taxpayers and experts broadly agree on the following priorities:

-

Reduction in TDS rates for low and middle-income groups

-

Faster processing of income tax refunds within 30 days

-

Higher TDS exemption limits

-

Increase in standard deduction under the new tax regime

-

Stable and transparent tax rules

-

Faster resolution of pending tax disputes

Conclusion

As the Union Budget 2026–27 approaches, expectations are centered on practical reforms that improve cash flow and reduce compliance hurdles. Rather than major structural changes, taxpayers are hoping for small but meaningful steps that make the tax system simpler, faster, and more reliable.

Lower TDS, quicker refunds, and a stable tax framework could go a long way in easing financial pressure on households and strengthening confidence in India’s tax administration. The upcoming budget will reveal whether these expectations translate into concrete policy decisions for millions of taxpayers under the new tax regime.

-

Martin Lewis speaks about 'particularly good' bank account for couples

-

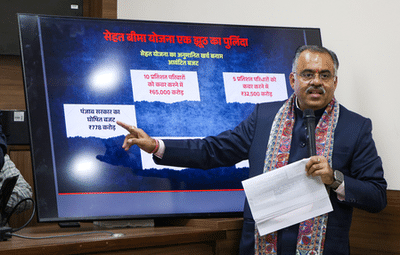

Punjab's health insurance scheme impractical, publicity-driven: BJP

-

Himachal secures first place for average response time in distress, says CM Sukhu

-

Nitish Kumar launches, inaugurates projects worth Rs 136 crore in Darbhanga

-

Tragic Warehouse Fire in Kolkata Claims Lives and Sparks Rescue Efforts