The Union Budget 2026 is expected to mark an important turning point in India’s fiscal framework, as it will incorporate the recommendations of the 16th Finance Commission for the financial year 2027 and beyond. The Finance Commission plays a crucial constitutional role by determining how tax revenues are shared between the Centre and the states, making its recommendations highly significant for both governance and development.

Although the report of the 16th Finance Commission has not yet been made public, it has already been submitted to President Droupadi Murmu and shared with the Prime Minister and the Union Finance Minister. Historically, the central government has largely accepted the recommendations of previous Finance Commissions, indicating that the upcoming budget is likely to reflect the commission’s guidance on fiscal distribution and financial relations between the Centre and the states.

Role of the Finance Commission in India’s Fiscal System

The Finance Commission is a constitutional body formed periodically to advise on the distribution of tax revenues between the Union and the states. It also provides recommendations on grants-in-aid and measures to strengthen state finances. Importantly, cess and surcharges imposed by the Centre are not included in the divisible tax pool shared with states.

Through its framework, the Finance Commission ensures balanced development and financial stability across the country. Its work directly influences how much funding states receive for public services, infrastructure, and welfare programs.

Formation and Leadership of the 16th Finance Commission

The 16th Finance Commission was constituted on December 31, 2023, under the chairmanship of former NITI Aayog Vice Chairman Arvind Panagariya. The commission included several prominent members from economic and administrative backgrounds.

The panel consisted of retired bureaucrat Annie George Mathew, economist Manoj Panda, SBI Group Chief Economic Advisor Saumya Kanti Ghosh, RBI Deputy Governor T. Rabi Shankar, and Commission Secretary Ritvik Pandey. Together, the team conducted extensive consultations with states and stakeholders before finalizing their report.

On November 17, 2025, the commission formally submitted its report to President Droupadi Murmu. Copies of the report were also handed over to Prime Minister Narendra Modi and Finance Minister Nirmala Sitharaman.

Under its terms of reference, the commission was tasked with providing recommendations for a five-year period beginning April 1, 2026. These recommendations will directly guide the fiscal structure of the Union Budget for FY2027 and the years ahead.

Why the Report Matters for Budget 2026

Even though the full details of the 16th Finance Commission report have not yet been released publicly, its influence on Budget 2026 is expected to be substantial. The government generally follows the commission’s proposals when framing policies related to tax sharing, grants to states, and fiscal responsibility.

This means that allocations in the upcoming budget will reflect a new formula for revenue distribution, potentially reshaping financial relations between the Centre and the states. The decisions taken will have long-term consequences for state budgets, development programs, and overall economic planning.

Lessons from the 15th Finance Commission

The 15th Finance Commission, chaired by N.K. Singh, recommended that states receive 41 percent of the Centre’s divisible tax pool for the six-year period from 2020–21 to 2025–26. This was the same level suggested earlier by the 14th Finance Commission.

The distribution formula was based on several weighted criteria, including population, geographical area, demographic performance, forest cover and ecology, income distance, and fiscal discipline. These parameters were designed to ensure fairness while encouraging states to improve governance and economic efficiency.

Specifically, the 15th Commission assigned weights such as:

-

Population: 15 percent

-

Area: 15 percent

-

Demographic performance: 12.5 percent

-

Forest cover and ecology: 10 percent

-

Tax and fiscal effort: 2.5 percent

These recommendations, however, have remained a point of debate between the Centre and several states, especially those governed by opposition parties. Many states have argued that they did not receive their fair share under the existing framework.

Ongoing Centre-State Debate

Revenue sharing has long been a sensitive issue in India’s federal structure. Some states believe that the increasing use of cess and surcharges by the Centre reduces the pool of funds available for distribution. Since these levies are not shared with states, they have become a major point of contention in fiscal discussions.

The 16th Finance Commission’s recommendations are expected to address some of these concerns by revisiting allocation criteria and proposing a more balanced approach for the coming years.

What Lies Ahead

As Budget 2026 approaches, attention will remain focused on how the government incorporates the 16th Finance Commission’s proposals. The new fiscal roadmap will influence development spending, welfare schemes, and financial planning at both central and state levels.

With global economic challenges and domestic development priorities in play, the upcoming budget is likely to reflect a careful balance between fiscal discipline and growth-oriented policies.

Conclusion

The inclusion of the 16th Finance Commission’s recommendations in Budget 2026 makes it a significant event in India’s financial history. These proposals will redefine the framework of tax sharing and Centre-state financial relations for the next five years. While the report itself remains confidential for now, its impact will be visible in the structure and priorities of the Union Budget for FY2027 and beyond.

-

Martin Lewis speaks about 'particularly good' bank account for couples

-

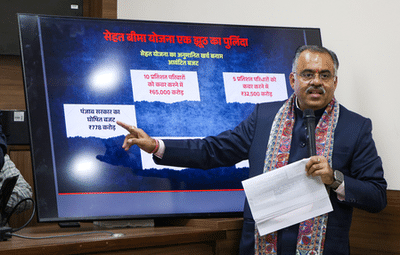

Punjab's health insurance scheme impractical, publicity-driven: BJP

-

Himachal secures first place for average response time in distress, says CM Sukhu

-

Nitish Kumar launches, inaugurates projects worth Rs 136 crore in Darbhanga

-

Tragic Warehouse Fire in Kolkata Claims Lives and Sparks Rescue Efforts