Silver prices witnessed slight cooling on Wednesday, January 28, but they continue to hover close to historic highs, keeping investor attention firmly fixed on the precious metal. Despite minor fluctuations, silver has emerged as one of the strongest-performing commodities this year, supported by global uncertainty, rising safe-haven demand, and strong technical momentum.

In the international market, spot silver rose by nearly 0.6 percent to trade around $113.63 per ounce. Earlier this week, on January 26, silver touched an all-time high of $117.69 per ounce, marking a remarkable milestone in its price journey. Since the beginning of the year, silver has gained close to 60 percent, outperforming most other commodities.

Rapid Price Rally Signals Strong Buying Interest

The pace of silver’s rally has been exceptionally fast. Prices climbed from the $80 level to $90 within just 15 days. Soon after, silver crossed the $100 mark in only 10 days. What surprised markets the most was that silver moved from $100 to $110 in a single trading session, highlighting intense buying pressure and strong investor confidence.

Such swift movement suggests that both retail and institutional investors are actively positioning themselves in precious metals amid rising uncertainty in global markets.

Safe-Haven Demand Fuels the Momentum

Market experts believe the primary driver behind silver’s rally is growing demand for safe-haven assets. With geopolitical tensions, trade disputes, and tariff-related concerns creating instability across global markets, investors are increasingly shifting their funds toward precious metals like gold and silver.

According to commodity analysts, silver is benefiting from the same factors that are pushing gold prices higher. Concerns over global economic growth and unpredictable policy decisions have strengthened silver’s appeal as a hedge against risk and inflation.

Aamir Makda, Commodity and Currency Analyst at Choice Broking, noted that rising geopolitical risks and tariff-related worries have triggered aggressive buying in silver. He added that domestic silver prices are still trading above key moving averages, which indicates a strong upward trend in the market.

Technical Indicators Suggest Caution Ahead

While the overall trend remains bullish, experts are advising investors to remain cautious in the short term. Technical indicators such as the Relative Strength Index (RSI) show that silver is currently in an overbought zone. This suggests that prices may pause for some time or witness a mild correction after the sharp rally.

Such corrections are considered healthy for the market, as they allow prices to stabilize before the next possible upward move. Analysts believe that volatility is likely to remain high in the coming sessions.

Exchanges Take Action to Control Volatility

Due to the sudden surge and sharp price swings, exchanges have stepped in to manage risk. The CME Group has decided to increase margin requirements on COMEX silver futures contracts. This move aims to curb excessive speculation and control rising volatility in silver trading.

Higher margins mean traders will need to deposit more funds to hold their positions, which can help reduce extreme price fluctuations and ensure market stability.

Impact on India’s Jewellery Industry

In India, rising silver prices are beginning to affect the gems and jewellery sector. Manufacturers and exporters are facing cost pressures due to higher raw material prices. However, industry leaders believe that international trade agreements could offer some relief.

Colin Shah, Managing Director of Kama Jewellery, stated that the proposed India–European Union Free Trade Agreement (FTA) could support exporters during this period of elevated prices. The agreement may help boost exports and provide stability to the jewellery industry amid increasing costs.

Outlook for Silver Prices

Looking ahead, analysts expect silver to remain in focus as long as global uncertainties persist. Factors such as geopolitical developments, inflation trends, and central bank policies will continue to influence price movements. While short-term corrections cannot be ruled out, the long-term outlook remains positive if safe-haven demand stays strong.

Investors are advised to track international cues closely and avoid rushing into positions at peak levels. A balanced approach with proper risk management may help navigate the current volatility.

Conclusion

Silver’s strong performance in 2026 reflects a mix of global instability, rising investor interest, and technical momentum. Even after a slight dip, prices remain near record highs, signaling sustained confidence in the metal. However, with signs of overbought conditions and rising volatility, cautious optimism appears to be the best strategy for investors in the days ahead.

-

Martin Lewis speaks about 'particularly good' bank account for couples

-

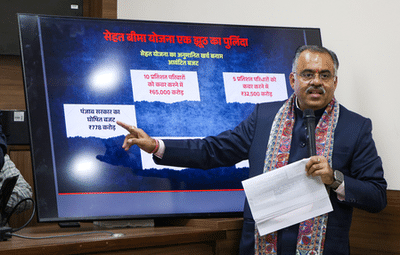

Punjab's health insurance scheme impractical, publicity-driven: BJP

-

Himachal secures first place for average response time in distress, says CM Sukhu

-

Nitish Kumar launches, inaugurates projects worth Rs 136 crore in Darbhanga

-

Tragic Warehouse Fire in Kolkata Claims Lives and Sparks Rescue Efforts