Have you ever faced a situation where you had only a ₹500 note in your wallet but struggled to buy tea, vegetables, or pay an auto-rickshaw fare because the shopkeeper had no change? While carrying high-value currency notes may seem convenient, it often creates problems for small daily transactions. To address this long-standing issue, the government is preparing a major initiative that will allow people to withdraw ₹10, ₹20, and ₹50 notes directly from ATMs.

The new system aims to make small-denomination currency easily accessible and improve cash circulation for everyday needs. These specially designed machines, known as hybrid ATMs, will not only dispense cash but will also allow users to exchange large-value notes for smaller ones.

Government’s Plan to Boost Availability of Small NotesThe central government is working on a technology-based solution to increase the supply of low-value currency notes in public circulation. The proposed hybrid ATMs will help citizens withdraw smaller denominations and also convert higher-value notes into multiple lower-value notes.

This move is expected to benefit millions of people who depend on cash for their daily activities. Even though digital payments have grown rapidly in India, cash transactions remain essential for many sections of society, especially in local markets and public transport systems.

Pilot Project Launched in MumbaiThe initiative has already entered the pilot phase in Mumbai, where these hybrid ATMs are being installed at locations with heavy cash usage. According to media reports, machines are being placed in:

-

Local markets

-

Railway stations

-

Bus terminals

-

Hospitals

-

Government offices

These are areas where people frequently need smaller denominations for routine purchases and services.

The pilot project will help authorities understand public response, technical challenges, and operational efficiency before expanding the model nationwide.

Why Small Denomination Notes Still MatterDespite the rapid growth of UPI and digital payment systems, a large part of India’s population continues to rely on cash. Daily wage workers, small shop owners, street vendors, auto drivers, and commuters often conduct transactions in amounts as low as ₹10 or ₹20.

For these groups, the shortage of small notes directly affects their earnings and daily business. When customers cannot provide exact change, transactions get delayed or canceled altogether. By making smaller currency notes available through ATMs, the government hopes to remove this bottleneck from the cash economy.

Role of the Reserve Bank of IndiaThe Reserve Bank of India (RBI) will play a crucial role in ensuring the success of this plan. The central bank is considering increasing the printing and supply of ₹10, ₹20, and ₹50 notes so that these hybrid ATMs do not face shortages.

Officials have clarified that the objective is not to reduce the use of digital payments but to ensure that cash remains easily accessible and better distributed. The initiative is part of a broader effort to modernize currency management while supporting citizens who still depend heavily on physical money.

Challenges and ConcernsWhile the proposal has been widely welcomed, it also raises some important questions:

-

Will banks be able to manage the installation and maintenance costs of these hybrid ATMs?

-

How will security be ensured for machines handling multiple denominations?

-

Can this system fully solve the long-standing shortage of small change?

Experts believe that ATMs alone may not completely eliminate the problem, but they can significantly reduce dependence on shopkeepers and transport workers for exchanging money.

A Relief for Cash-Dependent CitizensAlthough India has become one of the world’s leaders in digital payments, not everyone has equal access to smartphones or internet connectivity. For many households, cash is still the primary medium of exchange.

This initiative could bring much-needed relief to:

-

Daily commuters

-

Street vendors

-

Small traders

-

Senior citizens

-

Rural and semi-urban populations

By making lower-value notes available at ATMs, the government is trying to bridge the gap between digital growth and cash-based realities.

What Lies AheadIf the Mumbai pilot project proves successful, the government is expected to roll out hybrid ATMs in other major cities and eventually across the country. This would mark a significant upgrade in India’s ATM infrastructure and currency distribution system.

The move reflects a balanced approach—embracing digital innovation while strengthening cash accessibility for those who still depend on it.

ConclusionThe introduction of ATMs dispensing ₹10, ₹20, and ₹50 notes could solve one of the most common problems faced by ordinary citizens in daily life. By enabling people to withdraw small denominations and exchange large notes easily, the government hopes to make cash transactions smoother and more practical.

While challenges remain, this step could greatly improve convenience for millions of Indians and ensure that the country’s currency system remains inclusive, efficient, and responsive to real-world needs.

-

Renault Duster 2026 First Look: What Stands Out, What Falls Short

-

Lucknow University Students Welcome Supreme Court Stay on New UGC Equity Rules

-

SBI SCO 2026: Registration Process Starts At sbi.co.in; Check Eligibility Criteria Here

-

Kohrra Season 2 OTT Release Date: When & Where To Watch Mona Singh's Crime Drama Series?

-

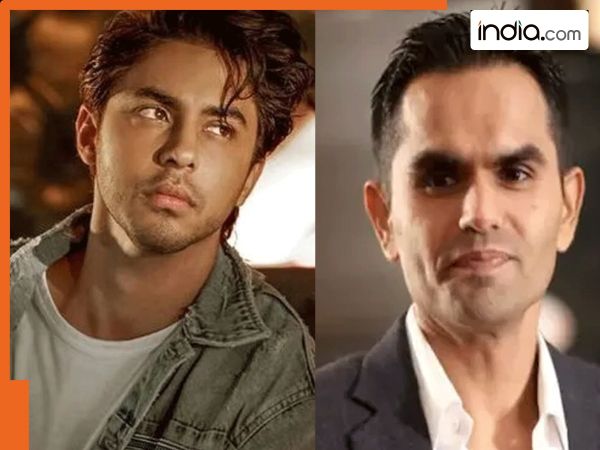

Big relief for Shah Rukh Khan, Aryan Khan as Delhi HC rejects Sameer Wankhede’s defamation suit on ‘The Ba***ds of Bollywood’ – Check details