Post Office Scheme: Have you retired and are looking for a steady monthly income to ensure a comfortable and peaceful life after retirement? Then let us tell you about a government scheme offered by the Post Office, specifically designed for senior citizens. Under this scheme, they can earn a substantial monthly income from the comfort of their homes. It's called the Post Office Senior Citizen Savings Scheme (SCSS). Let's learn more about this scheme.

Post Office SCSS Scheme

The Post Office Senior Citizen Savings Scheme is considered highly reliable because the investment made in it is completely safe and risk-free. The government itself guarantees this scheme, and the interest rate offered is higher than that of bank fixed deposits (FDs). Currently, this scheme offers an annual interest rate of 8.02%, which is considered quite good for senior citizens.

Who can invest in this scheme?

Any person aged 60 years or older can invest in this Post Office scheme. A joint account can be opened in the name of a husband and wife. Those who have taken VRS (Voluntary Retirement Scheme) from government service should be between 55 and 60 years of age, and retired defense personnel should be between 50 and 60 years of age. The maturity period of this scheme is 5 years. After 5 years, you can either withdraw the entire amount or extend it for another 3 years. If you close the account before maturity, you may have to pay a small penalty.

How to invest in this scheme?

You can start investing in the Post Office Senior Citizen Savings Scheme with a minimum of Rs. 1,000, and the maximum limit is Rs. 30 lakhs. If a senior citizen deposits Rs. 30 lakhs in this scheme, they will receive an annual interest of Rs. 240,000, which means they will receive Rs. 20,500 per month – equivalent to a job salary. Thus, you can earn more than Rs. 20,500 per month from home without any effort. Another special feature of this scheme is that it also offers tax benefits. Under Section 80C of the Income Tax Act, you can avail tax exemption benefits up to Rs. 1.5 lakh.

Disclaimer: This content has been sourced and edited from NDTV India. While we have made modifications for clarity and presentation, the original content belongs to its respective authors and website. We do not claim ownership of the content.

-

Renault Duster 2026 First Look: What Stands Out, What Falls Short

-

Lucknow University Students Welcome Supreme Court Stay on New UGC Equity Rules

-

SBI SCO 2026: Registration Process Starts At sbi.co.in; Check Eligibility Criteria Here

-

Kohrra Season 2 OTT Release Date: When & Where To Watch Mona Singh's Crime Drama Series?

-

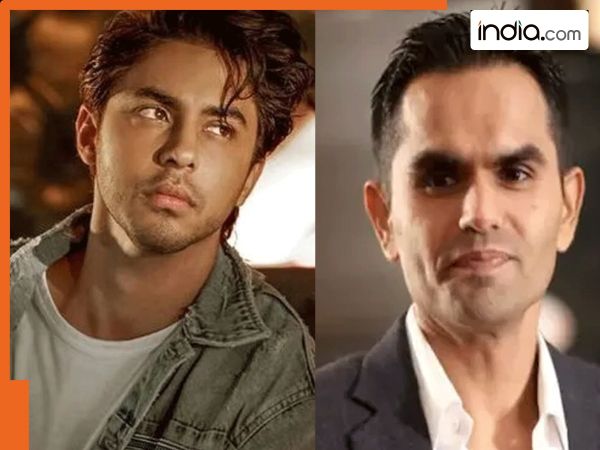

Big relief for Shah Rukh Khan, Aryan Khan as Delhi HC rejects Sameer Wankhede’s defamation suit on ‘The Ba***ds of Bollywood’ – Check details