Guwahati, Jan 29: According to a report from the Reserve Bank of India, Assam's total liabilities are expected to reach ₹2,06,608.30 crore by the conclusion of this financial year.

The state's internal debt has surged to ₹1,46,758.7 crore, with ₹1.28 lakh crore attributed to state government securities.

At the end of March 2024, Assam's liabilities stood at ₹1,50,901.8 crore, which increased to ₹1,78,058.9 crore the subsequent year. The ratio of these liabilities to the Gross State Domestic Product (GSDP) rose from 21.2% in 2020 to 27.9% by 2026.

Gross market borrowings for the state escalated from ₹17,100 crore in 2022-23 to ₹18,500 crore in 2023-24, and are projected to reach ₹19,000 crore in 2024-25. This financial year alone, borrowings have surpassed ₹9,204 crore.

By the end of March 2025, a significant 82.4% of the outstanding state government securities will mature in less than ten years.

The report indicates a decline in state government finances compared to the previous year, citing geopolitical uncertainties, high debt levels, and increasing contingent liabilities from guarantees and cash transfer schemes as potential risks to financial stability.

It noted that several states have implemented measures in their 2025-26 budgets, including farm loan waivers, free electricity for agriculture and households, subsidized transport, allowances for unemployed youth, and direct cash transfers to women. While these social welfare initiatives are crucial in a nation with significant economic disparities, they may hinder essential investments in physical and social infrastructure. Therefore, conducting impact assessments to evaluate the effectiveness of these welfare schemes is vital.

The report also suggested that states with high fiscal deficits should consider reviewing their market borrowings through fiscal consolidation, exploring alternative financing methods, and improving cash management practices.

Furthermore, the net market borrowing of states and Union Territories rose by 5.0% to ₹7.53 lakh crore in 2024-25, up from ₹7.17 lakh crore in 2023-24.

Highlighting climate vulnerability, the report identified nine Indian states, including Assam, as among the top 50 regions globally at risk of climate change-related damages. Assam, Bihar, and Kerala are expected to face the most significant increases in damage from 1990 to 2050.

In light of these challenges, the report advocates for states to prioritize climate budgeting to align fiscal strategies with climate action. By implementing coherent policies and strategic investments, Indian states can enhance their climate resilience and contribute to national and global climate objectives.

-

Renault Duster 2026 First Look: What Stands Out, What Falls Short

-

Lucknow University Students Welcome Supreme Court Stay on New UGC Equity Rules

-

SBI SCO 2026: Registration Process Starts At sbi.co.in; Check Eligibility Criteria Here

-

Kohrra Season 2 OTT Release Date: When & Where To Watch Mona Singh's Crime Drama Series?

-

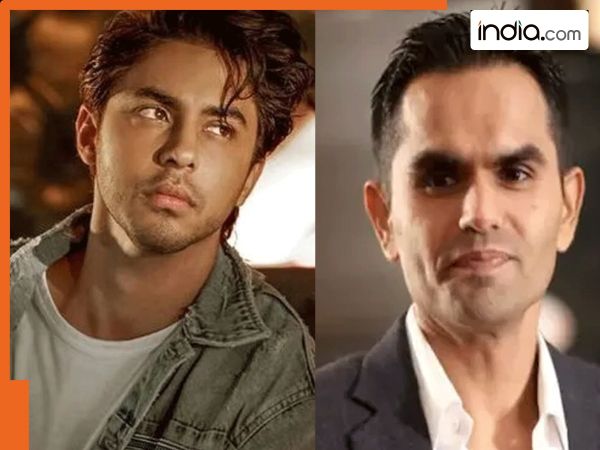

Big relief for Shah Rukh Khan, Aryan Khan as Delhi HC rejects Sameer Wankhede’s defamation suit on ‘The Ba***ds of Bollywood’ – Check details