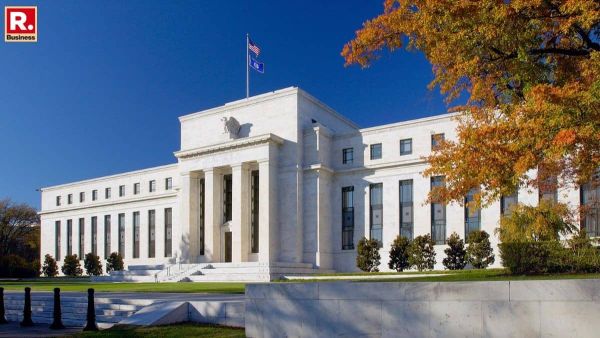

US President Donald Trump is expected to announce his choice for the next Chair of the Federal Reserve in the coming hours, a decision closely watched by global markets for signals on the future direction of US monetary policy. Three names are currently in focus: Kevin Warsh, Rick Rieder, and Kevin Hassett, each representing a distinct policy and institutional background.

Kevin Warsh: The Central Banking Insider

Kevin Warsh is widely viewed as the most traditional central banking candidate among the contenders. He served as a Federal Reserve Governor from 2006 to 2011, a period that included the global financial crisis, and worked closely with then-Fed Chair Ben Bernanke.

Warsh has since been a critic of prolonged ultra-accommodative monetary policy, arguing that extended stimulus can fuel asset price distortions and weaken financial discipline. He has also questioned the expansion of the Fed’s role beyond its core mandates of price stability and employment.

His prior experience inside the Federal Reserve makes him a familiar figure for markets seeking predictability, with a policy stance generally seen as more hawkish.

Rick Rieder: The Market-Focused Contender

Rick Rieder is Chief Investment Officer for Global Fixed Income at BlackRock, overseeing investment strategies across global bond markets. He is widely followed for his views on inflation trends, interest rates and financial market liquidity.

Unlike Warsh, Rieder has not served within the Federal Reserve system. His candidacy would mark a rare move to appoint a Fed Chair directly from Wall Street, bringing deep exposure to real-time market dynamics and capital flows.

Supporters argue this could strengthen policy responsiveness, while critics may raise concerns about regulatory distance between the central bank and financial markets.

Kevin Hassett: The Policy Strategist

Kevin Hassett currently serves as Director of the National Economic Council, making him the most politically embedded of the three contenders. An economist by training, Hassett has played a key role in shaping the administration’s economic strategy, including growth projections, tax policy and inflation assessments.

Hassett has consistently emphasised supply-side reforms and productivity-led growth. While he lacks direct central banking experience, his appointment would signal closer coordination between fiscal policy and monetary decision-making.

The Fed Chair appointment will be scrutinised for its implications on:

• The Federal Reserve’s independence

• The trajectory of interest rates and inflation control

• Market confidence in US monetary governance

With global markets sensitive to shifts in US policy signals, the announcement is expected to trigger immediate reactions across bonds, equities, and currencies.

-

Designer sarees-blouses are rocking the market, this time Saraswati Puja wear a special touch.

-

Sanju Samson: Sanju Samson got such punishment, Team India snatched this responsibility

-

Gold and Silver Prices in Focus as Budget 2026 Signals Possible Duty Reduction

-

The height of atrocities! 600 needle marks on the body of a 10 month old baby – News Himachali News Himachali

-

Story of Confident Group, without loan, 159 projects from India to America