Budget 2026 Expectations: There will be change in income tax slab! What relief will salary earners and senior citizens get? Know interesting things about the budget here

Samira Vishwas | January 30, 2026 9:24 PM CST

Budget 2026 Expectations: The Union Budget 2026 will be presented in Parliament on Sunday, February 1. With this budget, the government’s focus is not only limited to providing tax relief, but also on increasing public consumption, simplifying tax compliance and speedy settlement of tax disputes. Through these reforms, it is expected to increase the tax base and give new impetus to the economy. Especially the eyes of salaried employees, middle class, senior citizens and manufacturing sector are fixed on this budget.

income tax slab

The possibility of any major relaxation in the Income Tax slab in Budget 2026 is considered to be less. A major reason for this is that important changes were made in the tax slabs last year. However, tax experts believe that it has become very important to link the tax slabs to inflation.

As salaries increase over time, taxpayers move into higher slabs, while their actual purchasing power (real income) does not increase as much. This condition is called “bracket creep”. Therefore, it is expected that even if the government does not make direct changes in the slab, it may make some adjustments keeping inflation in mind.

Strong expectation of increase in standard deduction

Standard deduction has always been a big relief point for salaried employees. The current standard deduction under the new tax system is Rs 75,000, the demand to increase it is gaining momentum.

The last increase in standard deduction was made in Budget 2024. After this, inflation, house rent, transport and daily expenses have increased significantly. In such a situation, it is expected to increase the disposable income of employees by further increasing it in Budget 2026, which will also boost public consumption.

Simplification of TDS system

The structure of TDS (Tax Deducted at Source) in India is considered quite complex. Different TDS rates apply to different transactions, making compliance difficult.

In Budget 2026, it is expected that the government can standardize TDS rates. It is possible that there may be 2–3 common TDS rates for most transactions. This will not only make it easier for taxpayers to understand the rules, but will also reduce mistakes and disputes.

old vs new tax system

In recent years, the government has continuously made the new tax system more attractive, while the relevance of the old system is gradually decreasing. Despite this, the possibility of completely abolishing the old tax system in Budget 2026 is considered less.

Many taxpayers still choose the old system because it offers more deductions like 80C, HRA, home loan interest. The government may aim to implement a single tax system in the long run, but for now both systems can co-exist.

Tax administrative reforms and faster dispute resolution

The big expectation from Budget 2026 is that tax laws should be further simplified and the process of resolving disputes should be faster. Over the years, assessment processes have been digitalised to a great extent, which has increased transparency.

However, delay in disposal of cases is still a big problem. If the government sets up a fast and efficient dispute-resolution mechanism, it will increase the confidence of taxpayers and compliance will automatically improve.

Section 24(b): Deduction on home loan interest

Deduction of up to Rs 2 lakh is available under Section 24(b) on home loan interest for a self-occupied house. This limit has not changed for almost a decade.

Given the rise in real estate prices and home loan amounts, this limit is now becoming less effective. There is a demand to increase this limit in Budget 2026, so that the middle class can get relief in buying a house.

Decriminalizing income tax provisions

In Budget 2025, the government had decriminalized some income tax provisions. Taking this thinking forward, more provisions are expected to be decriminalized in Budget 2026.

Its purpose is to reduce unnecessary fear and pressure on taxpayers, so that they can comply with taxes without hesitation.

Foreign Tax Credit and TDS

Taxpayers who pay tax on the same income in two countries get the benefit of Foreign Tax Credit. At present this credit can be claimed only at the time of filing ITR.

Because of this, taxpayers’ money remains stuck in the form of TDS for a long time. It is expected in Budget 2026 that the option to adjust the foreign tax credit can be given at the time of TDS deduction, which will reduce the cash flow problem.

Additional Depreciation for Manufacturing Sector

Under Section 32, manufacturing companies get the benefit of additional depreciation. This benefit is expected to be further increased in Budget 2026.

Considering the high wear and tear of machinery and the need for expansion of the sector, this step can boost indigenous production and strengthen the goal of ‘Self-reliant India’.

Capital gains taxation on contingent consideration

In cases like mergers and acquisitions (M&A), often a portion of the sale price depends on future performance. There is no clarity in the law regarding calculation of capital gains in such cases.

It is expected in Budget 2026 that clear rules will be brought regarding capital gains taxation on contingent consideration, which will reduce uncertainty in corporate transactions.

Perquisite valuation on EV cars

Perquisite valuation on cars offered by the company is currently based on engine capacity, which is not applicable to electric vehicles.

It is expected in Budget 2026 that separate perquisite valuation rules will be made for EV cars, which will further promote electric mobility.

Section 80JJAA: Focus on employment generation

Under section 80JJAA, tax deduction is available on the cost of new employees. There is a possibility of increasing the limit of this deduction in Budget 2026.

Its purpose is to encourage companies to create more jobs, which is very important in the current economic environment.

Joint income tax return option

There is also talk of giving married couples the option to file joint income tax returns in Budget 2026. This will make compliance easier and in some cases may also reduce the tax burden.

The post Budget 2026 Expectations: There will be changes in income tax slabs! What relief will salary earners and senior citizens get? Know interesting things about the budget here appeared first on Latest.

READ NEXT

-

Union Budget 2026 live: Proposal to extend deadline for revised I-T returns

-

Budget 2026–27: Key announcements for education, youth

-

Grammy Awards 2026: Star nominees, power-packed performances & more

-

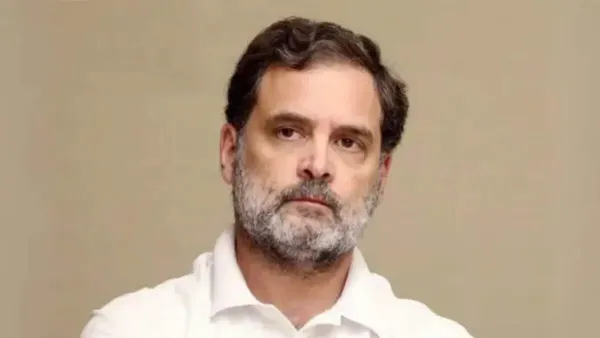

Pollution now a national health emergency, govt must act: Rahul

-

Welcome February 2026! Fresh wishes, quotes, and beautiful images to start new month