Foreign investors dump ₹36,000cr in Indian equities, reaching 5-month high

31 Jan 2026

Foreign institutional investors (FIIs) have offloaded Indian equities worth ₹35,962 crore, the highest since August 2025.

The trend of foreign investors selling Indian equities has continued into the new calendar year.

In total, FIIs have sold ₹1,66,286 crore worth of Indian equities in Calendar Year (CY) 2025 so far.

The data was revealed by the National Securities and Depositories Limited (NSDL).

Foreigners net buyers through mutual fund route

Investment shift

Despite the selling spree in equities, foreign fund managers have been net buyers of Indian equity through the mutual fund route.

This trend has continued for about four months now with net purchases worth ₹312 crore during this period.

The contrast between equity selling and mutual fund buying indicates a cautious approach toward India from foreign investors.

Outflows from India-focused funds

Market impact

Sunil Jain, Vice-President at Elara Capital, noted a significant inflow into global emerging market funds with India being a beneficiary. This has improved the overall flow in the market.

However, selling by India-focused funds with a long-term view continues.

The current phase has entered its third consecutive week with $340 million withdrawn this week after outflows of $360 million and $320 million in the previous two weeks.

Q3 FY26 earnings so far slightly ahead of expectations

Market challenges

The main reason behind the foreign investor selling is weak earnings and rupee depreciation.

Shrikant Chouhan, Head of Equity Research at Kotak Securities, said that the Indian market witnessed a decent Q3 FY26 earnings season with aggregate earnings slightly ahead of expectations so far.

He added that beats were 1.3x of misses in the Kotak Institutional Equities coverage universe but FPI flows are likely to remain volatile going forward.

-

Ramiz Raja Shamelessly Defends Usman Tariq’s 'Chucking' Bowling Action On Live TV

-

Union Budget 2026: FM Nirmala Sitharaman Announces 'Khelo India Mission' To Transform Sports Sector Over Next Decade

-

Budget 2026: Indian Semiconductor Mission 2.0 Announced, Chemical Parks To Be Built For Mining Of 'Rare Earth Magnets'

-

Budget 2026: PLI Scheme May Be Extended, AI Push Likely, Smartphone Prices May Rise

-

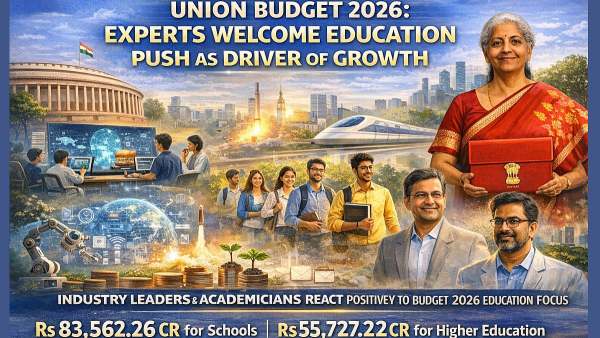

Union Budget 2026: Experts Welcome Rs 1.39 Lakh Crore Education Allocation, Call It Growth-Oriented