While shares of 29 new-age tech companies gained in a range of 0.03% to over 15%, 21 companies declined in a range of 0.06% to close to 10%

With the addition of Shadowfax, the total market cap of 52 new-age tech companies stood at $131.06 Bn

Shares of 12 companies touched fresh lows this week

New-age tech stocks saw a mixed week amid the ongoing Q3 earnings session. While shares of 29 new-age tech companies gained in a range of 0.03% to over 15%, 21 companies declined in a range of 0.06% to close to 10%.

Shares of MobiKwik ended the week flat at INR 198. With this, the total market capitalisation of 51 new-age tech companies under Inc42’s coverage stood at $130.39 Bn at the end of the week, up $3 Bn from last week.

Logistics company Shadowfax became the latest new-age tech company to list on the bourses this week. After making its debut at a discount of 9% to the issue price, the stock further tumbled 5.75% to end the week at INR 106.5 on the BSE.

Investor interest was primarily driven by financial disclosures of companies this week. While CarTrade’s robust disclosure triggered a bull run, Paytm and Swiggy came under pressure after declaring their Q3 earnings.

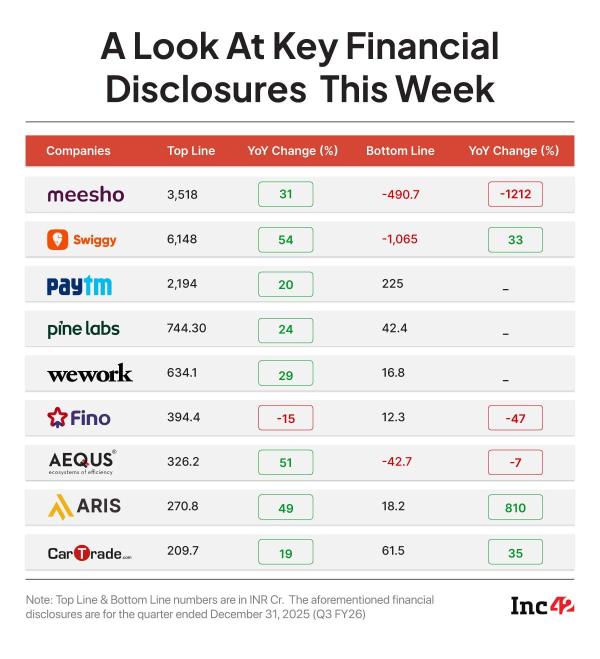

Here’s a look at the financial disclosures by new-age tech companies this week:

Dronetech company ideaForge emerged as the biggest gainer this week, surging 15.18% to end the week at INR 462.15. It is pertinent to note that the company’s shares plummeted last week after its net loss widened to INR 33.9 Cr.

EaseMyTrip, which has been under pressure for more than a year now on the bourses, was the biggest loser this week, with its shares crashing 9.42% to end at INR 6.28. The stock touched an all-time low at INR 6.11 during the intraday trading yesterday.

IndiQube (down 6.63%), Awfis (down 5.5%), BlueStone (down 4.36%), WeWork India (down 1.36%), Urban Company (down 0.88%), MobiKwik, MapmyIndia (up 1.12%), Ola Electric (up 1.19%), FirstCry (up 2.14%), ArisInfra (up 3.45%), Zaggle (up 3.81%), Tracxn (up 5.53%) and DevX (up 6.92%) were the other companies which touched an all-time low this week.

Here are some of the key developments at the new-age tech companies this week:

- Fintech major Pine Labs will invest about INR 129 Cr in merchant solutions platform subsidiary Mosambee to pursue “further growth opportunities” and further invest in step-down subsidiaries.

- Zappfresh founder Deepanshu Manchanda bought 10,800 shares, or 0.05% stake, via open market transactions between January 20 and 23. The promoter now holds 27.71% stake in the company.

- WeWork India plans to invest INR 100 Cr to expand its capacity by 3,300 desks to 1.22 Lakh. The company will raise the funds required for the expansion internally or via external debt.

- Dronetech startup APL International (AITMC Ventures) received SEBI’s approval for its confidential IPO papers this week. The company’s public issue is expected to comprise a fresh issue of INR 200 Cr as well as an offer-for-sale (OFS) component.

- In a bid to curtail its losses, Ola Electric is undertaking a restructuring exercise which will cut its workforce by 5%. The company said that the job cuts are part of its efforts for a business turnaround, under which it is focusing on building on early gains realised from its recently launched delivery service Hyperservice.

- Sports giant Nike is handing over its India ecommerce operations to BPC major Nykaa from February 2026. Once Nykaa takes charge, Nike said customers will get free shipping on all orders, free exchanges on the same product, and faster deliveries, ranging from two days for metro cities to up to four days for other parts of India.

- Insurtech startup Turtlemint filed its updated DRHP with the SEBI for its IPO, which will comprise a fresh issue of equity shares worth up to INR 660.7 Cr and an OFS component of up to 2.86 Cr shares.

- Menhood parent Macobs Technologies entered an agreement to buy over 50% stake in D2C protein brand Getmymettle for INR 10.5 Cr.

With that, let’s take a look at broader market trends this week.

Broader Market Gains On India-EU Deal

Benchmark indices Sensex and Nifty 50 ended the week in the green. While Sensex gained 0.9% to end the week at 82,269.78, Nifty 50 gained over 1% to end at 25,320.65.

Investor sentiment was supported by the conclusion of official-level negotiations on the India-EU Free Trade Agreement (FTA). Moody’s described the agreement as credit-positive due to its potential to boost investment, strengthen manufacturing, and enhance export competitiveness.

The India-EU FTA is one of India’s most consequential trade pacts, linking the world’s fastest-growing large economy with its largest trading bloc, which accounted for nearly $120 Bn in bilateral trade in FY24. Negotiated over more than a decade, the deal reflects India’s push to diversify export markets amid rising protectionism, while giving the EU deeper access to a fast-expanding consumer and digital economy.

Besides, domestic macro data remained supportive this week, with the index of industrial production (IIP) growth accelerating to a more than two-year high of 7.8% in December 2025. The Economic Survey’s projection of 6.8-7.2% GDP growth for FY27 reinforced confidence in India’s medium-term growth outlook.

However, intermittent profit-booking and persistent foreign institutional outflows kept volatility elevated through the week.

“Market sentiment improved mid-week following a favourable Economic Survey that reinforced expectations of robust FY27 growth and a benign inflation outlook. However, risk appetite weakened toward the end of the week ahead of the Union Budget, with volatility resurfacing amid FII outflows and rupee depreciation,” Geojit’s head of research Vinod Nair said.

The stock exchanges will remain open tomorrow for a special trading session, as finance minister Nirmala Sitharaman presents her ninth consecutive Union Budget. Investors will closely track fiscal discipline, capital expenditure priorities, and growth-oriented policy measures in the Budget.

The RBI’s monetary policy decision on February 6 will also be watched next week.

In addition, high-frequency indicators such as the HSBC Manufacturing PMI Final, followed by Services and Composite PMI Finals, will offer further clarity on economic momentum.

Now, let’s look at the developments at Paytm and CarTrade this week.

Paytm’s Shares Fall Post Q3 Results

Despite posting a more than 10X sequential jump in Q3 FY26 profit to INR 225 CrPaytm’s shares fell nearly 5% intraday to hit a low of INR 1,112.55 on the BSE yesterday, weighed down by investor concerns over the future of Payments Infrastructure Development Fund (PIDF).

The stock has been under pressure since a CNBC TV18 report flagged the potential financial impact of the scheme not being extended beyond December 2025. Paytm disclosed that PIDF incentives for H1 FY26 stood at INR 128 Cr, with brokerages estimating the figure at INR 220 Cr for 9M FY26.

Addressing the issue during Q3 earnings call, CEO Vijay Shekhar Sharma said PIDF was never core to Paytm’s business model, and stressed growing merchant willingness to pay. While Paytm reported operating revenue growth of 20% YoY to INR 2,194 Cr in Q3, brokerages remain divided, citing uncertainty over offsetting the loss of PIDF incentives.

Shares of Paytm ended the week 0.21% lower at INR 1,137.

CarTrade’s Strong Results Triggers Bull Run

It reported a 35% YoY rise in consolidated net profit to INR 61.5 Cr in Q3 FY26although profit declined 4.1% sequentially from INR 64.1 Cr. Revenue from operations grew 19% YoY to INR 209.7 Cr, with total revenue reaching INR 228.4 Cr.

EBITDA surged 56% YoY to INR 78.3 Cr, aided by operating leverage, while total expenses increased a modest 3% to INR 143.9 Cr. The quarter included an exceptional expense of INR 6.5 Cr linked to incremental labour code obligations.

Segment-wise, the consumer business posted a 27% revenue jump to INR 86.3 Cr, while the remarketing business saw its revenue rise 12% to INR 65.6 Cr. The classifieds segment, which includes OLX India, recorded an 18% increase in revenue to INR 58.7 Cr, underscoring broad-based growth across platforms.

CarTrade Profitability Spree

(Edited by: Vinaykumar Rai)

-

Bengal: Park Street restaurant tenders apology for serving beef to YouTuber (Lead)

-

Union Budget is people-centric, NE gets major push: Tripura CM

-

NCB secures 10-year jail term for truck driver, aide held in Gaya with opium, poppy straw

-

Liverpool defender leave club Arne Slot's transfer deadline day plan emerges

-

Arsenal get massive Premier League title boost after VAR cruelly denies Aston Villa