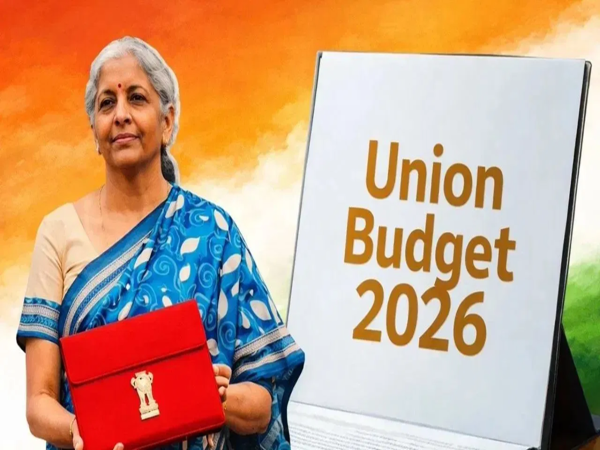

The Union Budget 2026 will be presented tomorrow, and expectations are running high. This will be the first full budget since Finance Minister Nirmala Sitharaman delivered the biggest personal tax relief in recent years. Through revised tax slabs and rebates, income up to ₹12 lakh was made almost tax-free. This decision put more money in the hands of the middle class and eased the pressure on household budgets. Now, taxpayers hope that Budget 2026 will address the finer points of the tax system that, despite last year's significant relief, still pinch families, senior citizens, and small investors.

According to CA Dr. Suresh Surana, the Union Budget is the most significant tool for influencing people's spending power and financial decisions, especially as more people are brought into the tax net. He believes that Budget 2026 should move beyond grand announcements and focus on targeted and structural reforms to make the tax system more practical and equitable.

Why Discuss Joint Taxation for Married Couples?

India's tax system is entirely individual-based, while in reality, household expenses and savings are often managed jointly by spouses. Dr. Surana says this leads to a higher tax burden on families with single incomes or unequal incomes. He suggests that introducing an optional joint taxation system, while retaining separate filing as the default, would simplify tax planning for married couples and better reflect economic realities. Many countries treat the family as an economic unit, and such an option could be beneficial in India as well.

Relief for Senior Citizens, But Incomplete

Last year, the limit for TDS not being deducted on interest income for senior citizens was increased to ₹1 lakh, but the deduction under Section 80TTB remains capped at ₹50,000. Dr. Surana says this discrepancy leads to unnecessary tax and paperwork burdens for senior citizens. He advocates for increasing the 80TTB limit to ₹1 lakh as well.

Medical Expenses Rise, Tax Exemptions Lag Behind

The cost of medical treatment has increased rapidly, but the tax exemptions have not kept pace. Currently, only senior citizens without health insurance can claim medical expenses up to Rs 50,000 under Section 80D. Dr. Surana suggests that this benefit should be extended to all taxpayers, the limit should be increased to Rs 1 lakh, and the benefit of Section 80D should also be available under the new tax regime.

Gift Tax Limit Outdated

The tax exemption limit for gifts received from non-relatives is still Rs 50,000, unchanged since 2006. Considering inflation, there is a demand to increase this limit to Rs 1.5 lakh so that small and genuine gifts are not taxed.

Family Settlements and Capital Gains

The courts have repeatedly stated that capital gains tax should not apply to the division of property within a family, but this is not clearly defined in the law. There is a demand to explicitly include this in Section 47 to reduce disputes.

Extension of Deadline for Belated Returns

Currently, late returns can only be filed until December 31st. Extending this deadline to March 31st would provide relief to taxpayers and increase voluntary compliance.

Rs 12 Lakh Tax-Free, Yet Capital Gains Remain a Hurdle

Although income up to Rs 12 lakh is tax-free, the rebate under Section 87A does not apply to equity capital gains. This forces small investors to pay tax. There is a demand to include capital gains up to a certain limit in the rebate.

Expectations from Budget 2026

After significant tax cuts last year, this year's focus may be on making the system simpler, clearer, and fairer. As Dr. Suresh Surana says, after providing major relief, the next step is to address the shortcomings. This will benefit taxpayers and increase confidence in the system.

Disclaimer: This content has been sourced and edited from TV9. While we have made modifications for clarity and presentation, the original content belongs to its respective authors and website. We do not claim ownership of the content.

-

Union Budget 2026 live: Proposal to extend deadline for revised I-T returns

-

Budget 2026–27: Key announcements for education, youth

-

Grammy Awards 2026: Star nominees, power-packed performances & more

-

Pollution now a national health emergency, govt must act: Rahul

-

Welcome February 2026! Fresh wishes, quotes, and beautiful images to start new month