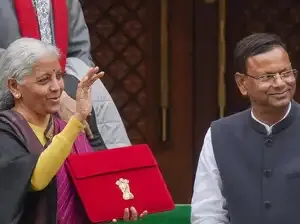

Finance Minister Nirmala Sitharaman on Sunday, in the Union Budget 2026-27, proposed several key measures aimed at strengthening India’s clean energy, industrial, and regional development initiatives.

Sitharaman proposed extending the basic customs duty exemption on capital goods used for manufacturing lithium-ion cells for battery storage, as well as granting the same exemption on imports of sodium anti-monot for solar glass production. In addition, she announced customs duty relief for capital goods required to process critical minerals in India.

On the energy front, the Finance Minister said the government would exclude the entire value of biogas when calculating excise duty on biogas-blended CNG, further promoting cleaner fuels.

Focusing on regional development, Sitharaman proposed the creation of an integrated East Coast Industrial Corridor with a key node at Durgapur. The Budget also earmarks investments for the Northeastern region, including 4,000 e-buses and the development of Buddhist sites, while five new tourism destinations will be established across the Poorvodaya states.

In line with rationalising the customs structure, the Budget also proposes removal of exemptions on items manufactured domestically or with minimal imports, signalling a shift toward encouraging local production.

Budget 2026 Live

Budget 2026: Catch all the live action here

Income Tax Budget 2026 Live Updates

Stock Market Live Updates

On the energy front, the Finance Minister said the government would exclude the entire value of biogas when calculating excise duty on biogas-blended CNG, further promoting cleaner fuels.

Focusing on regional development, Sitharaman proposed the creation of an integrated East Coast Industrial Corridor with a key node at Durgapur. The Budget also earmarks investments for the Northeastern region, including 4,000 e-buses and the development of Buddhist sites, while five new tourism destinations will be established across the Poorvodaya states.

In line with rationalising the customs structure, the Budget also proposes removal of exemptions on items manufactured domestically or with minimal imports, signalling a shift toward encouraging local production.