On Sunday, Union Finance Minister Nirmala Sitharaman revealed that there would be no alterations to the income tax rates or slabs in the Union Budget for the fiscal year 2026-27. However, she confirmed that the new Income Tax Act of 2025 will come into effect starting April 1.

Sitharaman informed Parliament that updated income tax regulations and forms will be announced soon, allowing taxpayers sufficient time to adjust to the new guidelines.

The recently enacted Income Tax law, which supersedes the 1961 Income Tax Act, received parliamentary approval in August.

Revised Deadlines for Tax Returns Extended Timeline for Filing Returns

The Finance Minister also stated that the timelines for tax payments will be staggered. The deadline for revising submitted income tax returns has been extended from December 31 to March 31, subject to a nominal fee.

For those filing ITR-1, which is designated for salaried individuals and pensioners earning up to Rs 50 lakh, and ITR-2, applicable to individuals and Hindu Undivided Families outside the ITR-1 category, the deadline remains July 31.

In the previous year's Budget, Sitharaman announced that individuals with an income of up to Rs 12 lakh annually would not be liable for income tax under the new regime. This regime, introduced in February 2023, allows salaried employees with a gross income of up to Rs 12.75 lakh to have no tax obligations, factoring in a standard deduction of Rs 75,000.

Previously, income up to Rs 7 lakh per year was exempt from taxation.

-

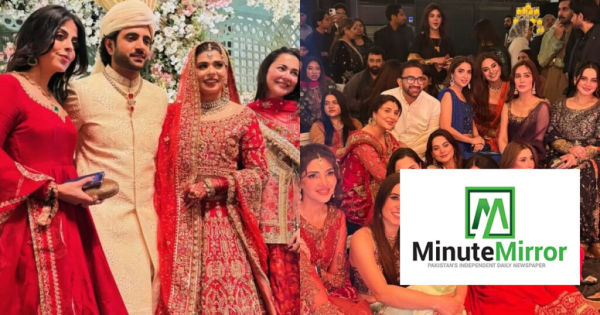

Umer Aalam’s star-studded wedding sparks internet frenzy

-

Lemon leaves are a treasure of health, know the tremendous benefits of their consumption.

-

5 Rare Traits Of People Who Don’t Commit To One Job

-

3 Chinese Zodiac Signs Attract Luck & Good Fortune From February 2 – 8, 2026

-

Parlors are not expensive, spa at home! Here are some tips to get your hair back quickly