Budget 2026 Income Tax Announcements: The 2026 budget did not introduce any changes to income tax rates, but Finance Minister Nirmala Sitharaman made several announcements to provide relief to taxpayers. The Finance Minister stated that the new income tax law will come into effect from April 1st, while its rules and Income Tax Return (ITR) forms will be notified soon.

No Jail Time, Only Fines

This budget brings several major reliefs for taxpayers. The most significant change is that the government has decided to move away from the approach of linking income tax law to criminal offenses. The Finance Minister clarified that if any discrepancy is found in a taxpayer's income or a case of tax evasion is detected, there will no longer be immediate imprisonment. Such cases can now be settled by paying a fine. This system will be part of the new Income Tax Act, which will come into effect from April 1, 2026. The Finance Minister announced a 30% tax. This means that those who conceal their income will not be punished with imprisonment, but will instead be charged a 30% tax.

Relief for Those with Assets Abroad

Relief has also been provided to those holding undeclared assets abroad. They can disclose their assets under a disclosure scheme within the next six months. The budget also brings good news for those dreaming of foreign travel or their children's education abroad. Previously, the TCS (Tax Collected at Source) on foreign tour packages, education, and medical treatment ranged from 5% to 20%, significantly increasing the cost. Now, the government has reduced it to a flat 2%. This means that whether it's for education, medical treatment, or a foreign trip, the burden on your wallet will be significantly less than before.

Easy Opportunity to Correct ITR Filing Errors

Making a small mistake while filing returns is common. Earlier, correcting it was a difficult and lengthy process. Now, the Finance Minister has announced that taxpayers will get more time to file revised returns. A nominal fee will be charged for this.

Return Filing Dates

The government has also clarified the return filing dates. Taxpayers filing ITR-1 and ITR-2 will be able to file their returns by July 31st. The deadline for non-audited businesses and trusts will be August 31st. In addition, the process for obtaining lower or nil TDS certificates for small taxpayers has now been completely automated, eliminating the need to visit tax offices.

Buying property from NRIs is now easier.

Until now, when buying property from an NRI, the buyer had to obtain a TAN number to deduct TDS, which was cumbersome for ordinary people. This hassle has been eliminated in the budget. Now, buyers can deduct TDS directly without needing a TAN.

Investing is also easier

Furthermore, the process for Form 15G and 15H has also been simplified for investors who have invested in multiple companies. Now, depositories will accept these forms and send them directly to the relevant companies, allowing investors to complete the process from the comfort of their homes.

Disclaimer: This content has been sourced and edited from TV9. While we have made modifications for clarity and presentation, the original content belongs to its respective authors and website. We do not claim ownership of the content.

-

Four-member gang from Odisha arrested for selling ganja in Hyderabad

-

Air India launches Shanghai-Delhi flight after gap of about six years

-

Budget 2026 draws praise from farm sector, edible oil industry unhappy

-

You won’t believe where this iconic Tere Naam scene was actually shot

-

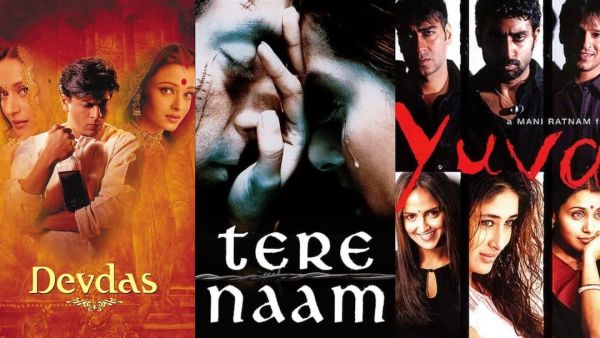

Bollywood Classics 'Devdas', 'Tere Naam' And 'Yuva' Return To Theatres This February