Mumbai: Home loan demand across urban and rural India is set to receive a renewed boost, with the Union Budget sharply increasing subsidy allocations for flagship housing schemes.

Budget 2026

Critics' choice rather than crowd-pleaser, Aiyar says

Sitharaman's Paisa Vasool Budget banks on what money can do for you best

Budget's clear signal to global investors: India means business

Budget 2026 Highlights: Here's the fine print

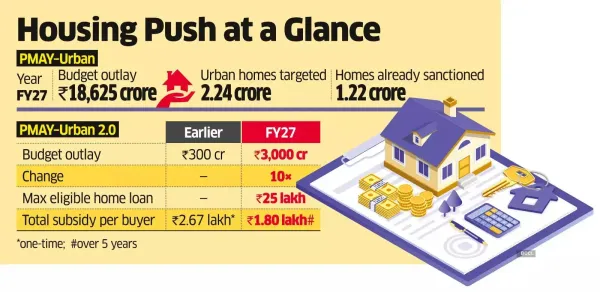

The outlay for PMAY-Urban has been more than doubled to Rs 18,625 crore for 2026-27 from Rs 7,500 crore, while PMAY-Urban 2.0 has been scaled up tenfold to Rs 3,000 crore from Rs 300 crore. The scheme targets the construction of 2.24 crore urban houses, of which 1.22 crore have already been sanctioned as of January 5.Subsidies for rural housing under PMAY-Gramin have also been raised by over 50% to Rs 54,917 crore from Rs 32,500 crore. The scheme aims to build 4.95 crore rural houses, with 3.97 crore beneficiaries already registered as of January 28. The budgeted allocations point to a renewed policy focus on rural demand and farm-linked incomes through high-impact welfare programmes.

Higher subsidy allocations to boost housing demand, more so in affordable segment

Housing finance companies said the higher subsidies will directly improve affordability and credit uptake, particularly in the affordable housing segment.

"The enhanced allocations under PMAY significantly improve affordability for first-time homebuyers and lower-income households," said Deo Shankar Tripathi, executive vice chairman, Aadhar Housing Finance. "This not only expands the addressable borrower base but also improves loan serviceability, which is positive for asset quality. For housing finance companies, especially those focused on Tier-II and Tier-III markets, this creates a more sustainable demand environment." The PMAY schemes are also expected to have broader economic spillovers. "The programmes will not only provide houses to those in need but also generate employment during the construction phase," CRISIL Ratings said in a note. PMAY accounts for nearly 10% of overall cement consumption in the country.

"Housing finance companies operating in affordable housing across tier 2 and 3 cities will continue to see steady demand," CARE Ratings said. "With the resolution of operational issues faced earlier in PMAY Urban 2.0, scheme mobilisation is expected to gain momentum in FY27." Under PMAY-Urban 2.0, the maximum eligible loan amount has been capped at Rs 25 lakh. Beneficiaries will receive the subsidy in five annual instalments totalling Rs 1.80 lakh, replacing the one-time subsidy of Rs 2.67 lakh. The amount is uniform across economically weaker section, lower and middle-income groups, with annual income caps of Rs 3 lakh, Rs 6 lakh and Rs 9 lakh respectively.